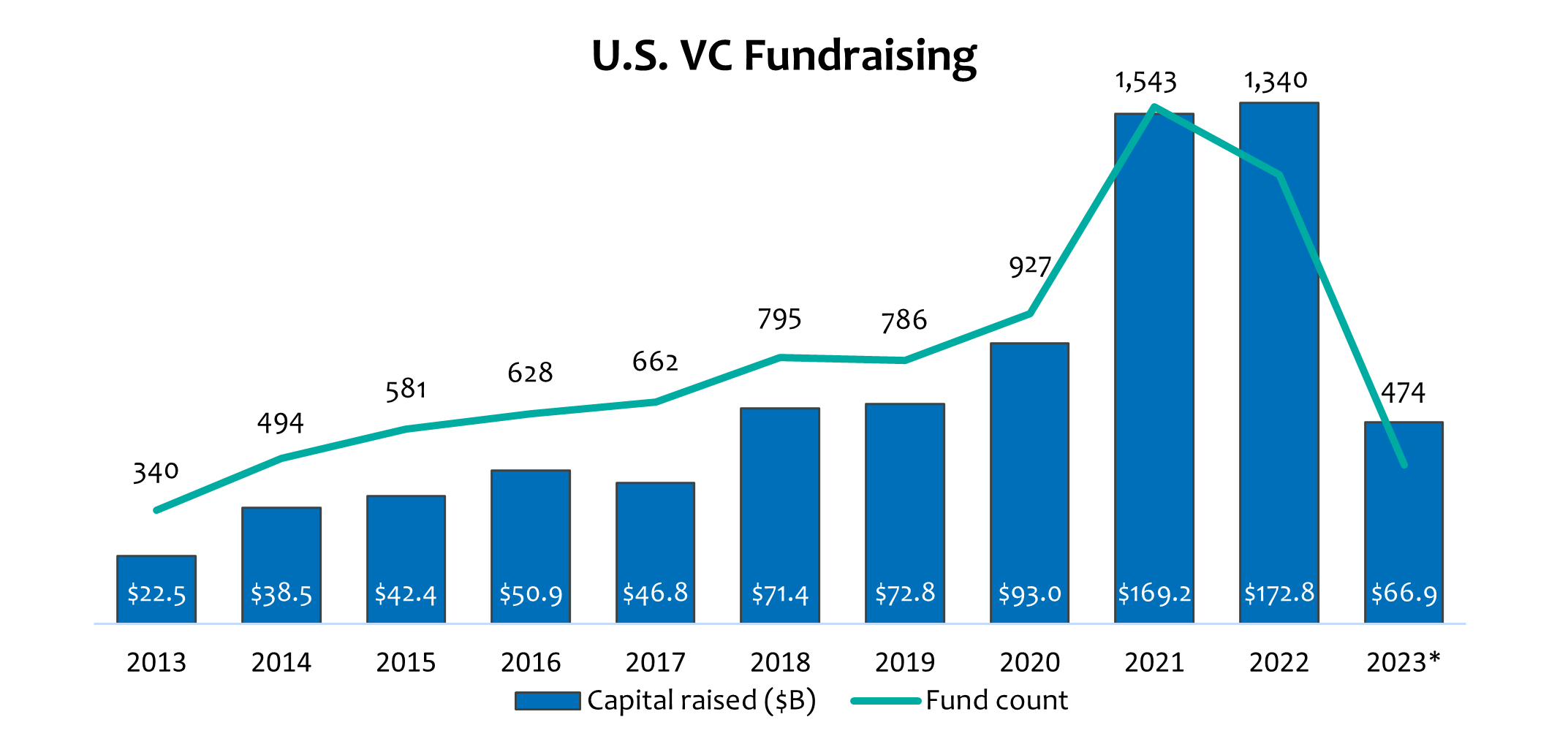

The venture capital (VC) fundraising environment is currently experiencing a significant slowdown after back-to-back record-breaking years. According to PitchBook Data, Inc., VC funds raised just under $70 billion in 2023, a staggering 60% decline from the previous year. Although this contraction has been felt across the industry, many established fund managers, despite garnering 75% of the capital raised, have encountered significant hurdles in meeting their fundraising objectives. High-profile VC firms such as Insight Partners and Tiger Global are examples of this trend, having had to prolong fundraising efforts or lower target fund size.

The decline in available funds not only reduces the investment capital pool, affecting VC firms' potential earnings from management fees, but it also impacts the more lucrative revenue stream from carried interest — where partners earn a percentage of the profits from successful investments. The twin challenges of down rounds (declining valuations) and a tightening liquidity market have directly impacted the earnings of venture capitalists, particularly those who have not recently realized gains from their investments. Consequently, these adverse conditions have led to a reshuffling within the industry. A number of professionals left to join competitors, some established their own funds, while others have exited the sector altogether.

In 2020 and 2021, limited partners (LPs) flush with cash were attracted to the venture asset class given its strong performance, including many who historically had limited exposure and experience investing in the asset class. As a result, many established VCs raised larger funds, a record number of first-time funds were launched and many “tourists,” like hedge funds, entered the scene. This influx led to substantial deal volume and skyrocketing valuations — a classic case of excess capital chasing a limited number of opportunities. However, in 2022, this exuberance was tempered by rising interest rates, economic uncertainties, geopolitical tensions and a regional banking sector crisis, which collectively exerted downward pressure on valuations and constricted the initial public offerings (IPO) market — a critical liquidity pathway for VCs.

The recent downturn has also disillusioned less experienced LPs, leading many to reduce their venture capital exposure and reassess their commitment to this asset class. This recalibration, however, may ultimately foster a healthier ecosystem, aligning the interests of LPs and VC firms more closely, especially those optimistic about the long-term growth prospects of VC and emerging technologies like AI and blockchain. In addition to less competition, the improved entry point from a valuation perspective and recovering capital markets could position 2024 vintages for impressive returns.

Key Takeaway

While the current fundraising environment poses challenges, it may also create opportunities. VCs are refocusing their investments in startups led by seasoned founders with large addressable target markets, financial viability and sustainability — all at more realistic valuations. At Penn Mutual Asset Management, our strategy doesn't involve timing the markets. Instead, we consistently seek out and back venture capital firms with steadfast, disciplined investment teams, delivering top-tier performance. Given the aforementioned challenges, I believe that venture is experiencing a generational shift, which may lead to many emerging managers generating top-quartile returns. We continue to opportunistically source for, what we believe to be, the best of this incoming class of investors.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.