We are committed to serving the institutional marketplace by offering fixed-income investment solutions with client-focused services.

These solutions are accessible through separate accounts, sub-advisory relationships and various commingled vehicles.

With over $41 billion in assets under management as of July 31, 2025, we are dedicated to creating value through a prudent, thoughtful and rigorous investment decision-making process.

Our tailored investment strategies incorporate a unified investment philosophy and process across the fixed income risk spectrum.

Experience, Performance and Stability

31

Investment Specialists & Professionals

36

Year Track Record as an Independent Business

$41.1B

Assets Under Management

- $31.3B Insurance

- $1.7B Separately Managed Accounts and Pooled Vehicles

- $8.1B Manager of Managers

As of July 31, 2025

Thought Leadership & Market Insights

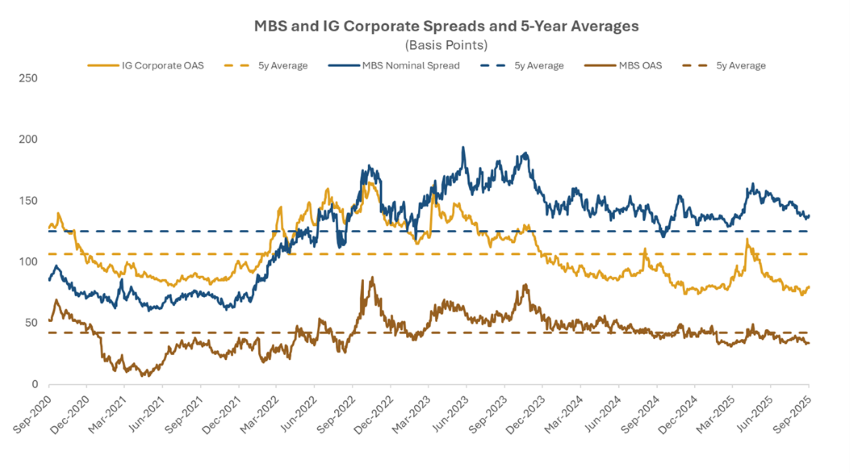

Nominal Spreads on Mortgage-Backed Securities Remain Wide Relative to Investment-Grade Corporates

By John Swarr | September 11, 2025

The nominal spread for an agency mortgage-backed security (MBS) is the difference between the MBS yield and a Treasury security with a comparable maturity. It measures the extra yield the MBS earns over benchmark Treasuries, typically a …

- September 8, 2025 This Week’s Inflation Data Unlikely to Derail a September Fed Rate Cut

- September 4, 2025 Hedging Always Comes at a Price

- September 2, 2025 The Sun Sets on Summer

- August 28, 2025 TL;DR: How AI Summaries Are Impacting Traditional Website Usage

- August 25, 2025 Powell Pivot

- August 21, 2025 Continuation Vehicles and Their Derivations Add Flexibility (And Complexity) in a Stagnant Exit Environment

- August 18, 2025 Jackson Hole Summit Takes Center Stage this Week