A Tradition for Which I Am Always Thankful!

December 11, 2025

There is something magical about Thanksgiving. It is a holiday steeped in American traditions, such as gathering with family and friends, turkey, the Macy’s Day Parade and the anticipation of Black Friday sales. Black Friday is the gateway to the holiday season that is now unfolding.

As retail has evolved, Black Friday shopping now spans several different platforms. More consumers placed orders online this year than tailgated brick-and-mortar stores for the iconic early-morning doorbusters.1 However, the more things change, the more they stay the same, and Black Friday continues to be one of the highest-grossing retail spending days of the year.2

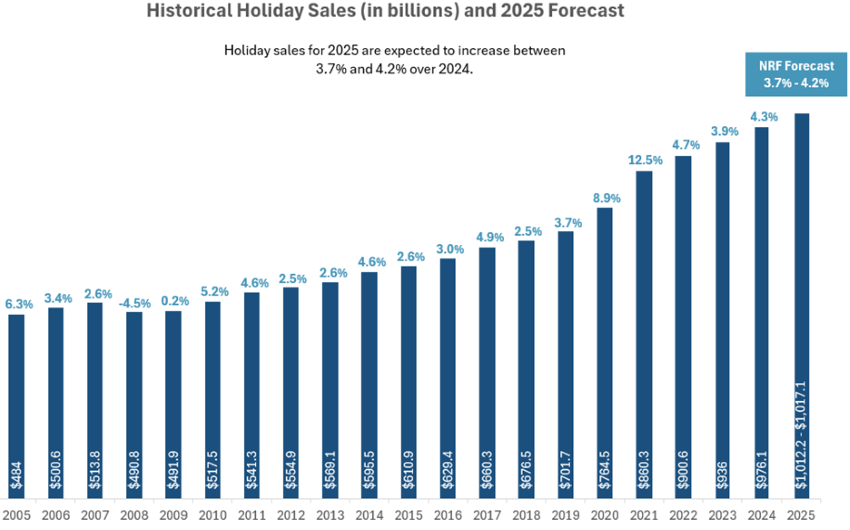

Early signs indicate that holiday spending will meet expectations. According to the National Retail Federation (NRF), 2025 marked a record turnout for shoppers.3 202.9 million consumers shopped during the holiday weekend (Thanksgiving Day through Monday), up from 197 million in 2024.4 Mastercard cited a 4.1% year-over-year (YOY) increase in Black Friday sales—inclusive of in-store and online transactions.5 So far, consumers have demonstrated a willingness to spend, despite cautious comments from management teams at Walmart and Procter & Gamble,6,7 as well as lower consumer confidence readings reflecting concerns about job security and inflation.8 The NRF is forecasting total sales during the holiday period—which it defines as the months of November and December—to increase approximately 4% YOY and surpass the $1 trillion mark for the first time.9

Key Takeaway

Black Friday set the tone for increased holiday spending in 2025. Consumers are spending despite inflation concerns and cautious corporate outlooks. With a few weeks left in the crucial season for many consumer and retail companies, we will soon learn if 2025 will live up to the expectations.

Sources:

1-4National Retail Federation – Thanksgiving Holiday Weekend Draws a Record 203 Million Shoppers; 12/2/2025

5Mastercard Spending Pulse – U.S. Black Friday retail sales up +4.1% year over year as holiday momentum builds; 11/29/2025

6Bloomberg

7Barron’s – P&G Stock Drops. Its CFO Says Consumers Are Nervous; 12/2/25

8The Conference Board – US Consumer Confidence Fell Sharply in November; 11/25/25

9National Retail Federation – NRF Expects Holiday Sales to Surpass $1 Trillion for the First Time in 2025; 11/6/2025

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.