We are committed to serving the institutional marketplace by offering fixed-income investment solutions with client-focused services.

These solutions are accessible through separate accounts, sub-advisory relationships and various commingled vehicles.

With over $43 billion in assets under management as of January 31, 2026, we are dedicated to creating value through a prudent, thoughtful and rigorous investment decision-making process.

Our tailored investment strategies incorporate a unified investment philosophy and process across the fixed income risk spectrum.

Experience, Performance and Stability

31

Investment Specialists & Professionals

37

Year Track Record as an Independent Business

$43.5B

Assets Under Management

- $34.2B Insurance

- $1.3B Separately Managed Accounts and Pooled Vehicles

- $8.0B Manager of Managers

As of January 31, 2026

Thought Leadership & Market Insights

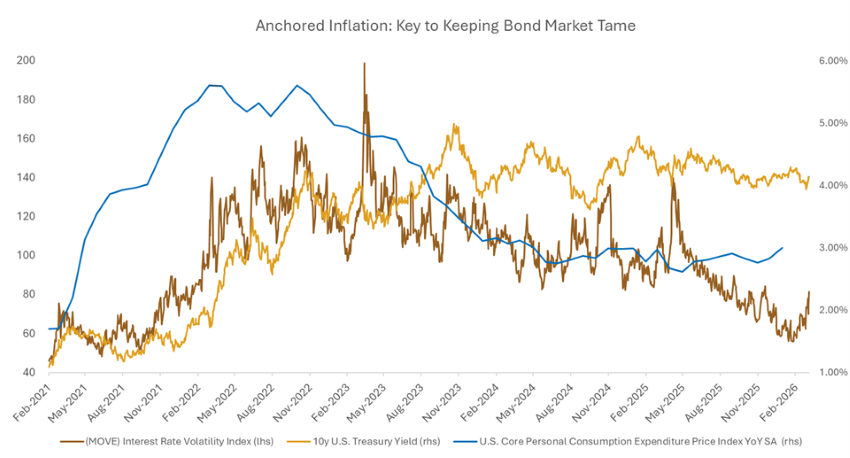

Anchored Inflation: Key to Keeping Bond Market Tame

By John Swarr | March 12, 2026

Inflation has cooled from its peak in 2022;1 however, it remains too high for the Federal Reserve (Fed) to declare victory. Currently, the Fed is less concerned about runaway inflation and more focused on ensuring inflation co…

- March 9, 2026 Oil Rising

- March 5, 2026 The Mortgage “Mendoza Line”

- March 2, 2026 Jobs, Tech Earnings and Iran to Set the Week’s Tone

- February 26, 2026 When AI Became a Headwind: Dispersion and Rotation in Early 2026

- February 23, 2026 Economic Surprises, Hawkish Fed and Resilient Equities in a Volatile Week

- February 19, 2026 Sell-Offs Powered by AI

- February 17, 2026 Treasury Yields Move Lower as AI Concerns Continue