Sell-Offs Powered by AI

February 19, 2026

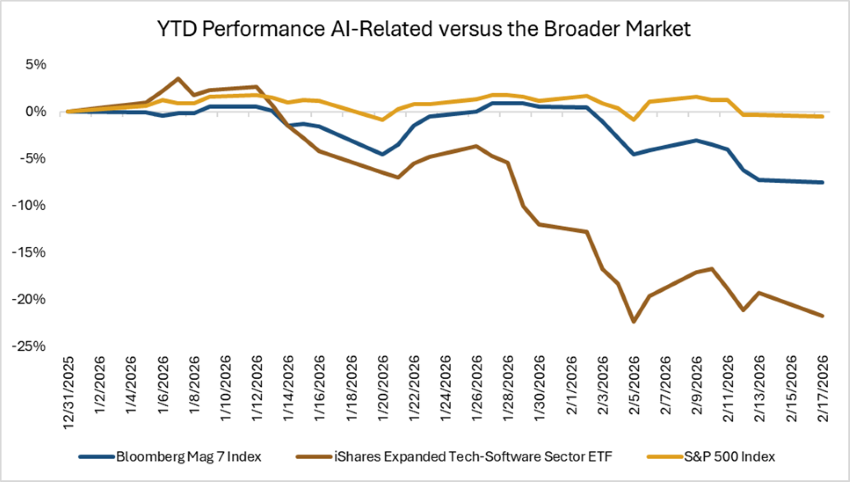

Artificial intelligence (AI) continues to dominate the news cycle and drive markets, but sentiment has shifted. Instead of feeling bullish on AI’s potential to drive growth, efficiency and earnings, investors are increasingly concerned about the implications for companies that could become obsolete due to AI and growing wary of increased AI capital expenditure (capex) spending by technology firms. As companies have reported earnings this quarter, market pullbacks broadened beyond software into transportation, commercial real estate and other areas of the market, even as earnings and forward estimates remained intact.1 Companies are also acknowledging the concern, with management mentions of AI disruption on earnings calls surging well beyond levels seen in past quarters.2

However, technology companies are also experiencing volatility and investor offloading. Post-earnings, many technology stocks declined, as investors grew concerned about ballooning capex, with company capex guidance far exceeding market expectations. Capex spending by five of the largest technology companies is expected to exceed $700 billion this year, up from around $150 billion in 2022.3 To fund this spending, Big Tech has, in part, turned to the bond market, issuing some of its largest-ever deals amid record investor demand.4 As capex for Big Tech climbs to over 20% of revenues to fund massive projected spending on AI, chips and data center infrastructure, the actual return this spending will deliver remains uncertain.5 Traditionally, these companies have operated on more asset-light models, which have allowed for greater returns and valuations compared to more capital-intensive businesses, with Big Tech return on invested capital exceeding 20-25% in recent years.6 Big Tech will need to demonstrate it can adopt a capital-intensive, asset-heavy model while continuing to generate similar returns for investors and keep debt loads manageable.

Key Takeaway

As investors weigh the disruptive impact of AI, uncertainty regarding industry displacement and doubts over whether Big Tech’s unprecedented AI investments will ultimately deliver returns are driving recent sell-offs across industries. While much is still unknown about how AI will develop and what effect it will have on each industry, non-AI companies will need to demonstrate that they can evolve and adapt the use of AI to remain competitive, while Big Tech will need to deliver on the lofty expectations for transformative AI that have fueled such ambitious spending.

Sources:

1,2Bloomberg – S&P 500 Erases Nearly 1% Drop Amid AI Volatility: Markets Wrap; 2/17/26

3The Wall Street Journal – Picks and Shovels Still Rule the AI Tech Trade; 2/9/26

4Bloomberg – Alphabet Embarks on Global Bond Spree to Fund Record Spending; 2/9/26

5,6RBC Wealth Management – Big Tech’s AI expansion: From investment to scalable returns; 2/3/26

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.