What are interest rates? Warren Buffett referred to interest rates as the “gravity” in the financial market. When the force of gravity increases (interest rates up), the prices of all other assets must adjust downward to the level that matches the lower rate of return. When gravity decreases (interest rates down), asset prices will inflate like a balloon.

To visualize the impact of increasing interest rates even further, let’s take a look at the past. Between 1964 and 1981, U.S. gross domestic product (GDP) increased 373%; however, the Dow Jones Industrial Average closed at 874 on 12/31/1964 and opened at 875 on 12/31/1981 — a one point gain in 17 years as a result of interest rates increasing from 4% to 15%. Asset prices, however, are not only affected by interest rates, but also by fundamentals, forecasting and the economy. I believe fundamentals decide the direction of asset prices and interest rates determine their magnitude.

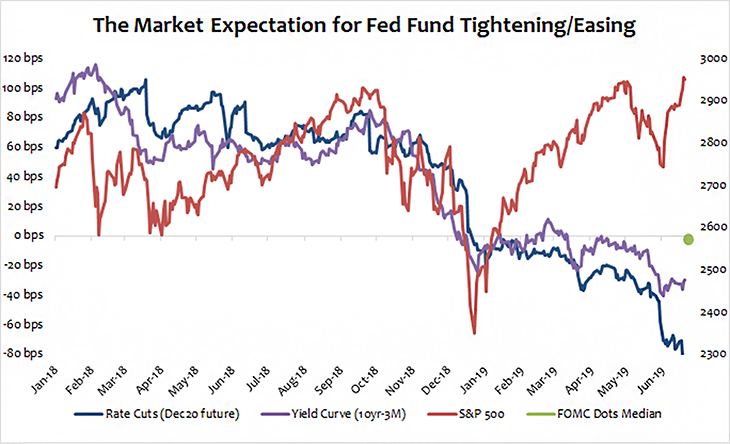

When deciding the path of interest rates, monetary policy is a critical tool for the Federal Reserve (Fed) — most often utilized to help stimulate the economy during a recession and provide a cooling effect when it is overheating. As seen in this week’s chart, Fed fund futures (blue line) represent the market’s prediction for where the Fed Fund will land. The futures market indicates a likelihood of 85 basis points of expected easing during 2019.

Ironically, the Federal Open Market Committee (FOMC) came to the conclusion last week that the sustained expansion of economic activity, a strong labor market, moderate inflation and the dot plot’s median (green dot) signaled zero rate cuts before the end of 2019. While markets aggressively priced in three rate cuts this year and one more next year, I believe Chair Powell’s statement that the Fed will “act as appropriate to sustain the expansion” is not guaranteeing rate cuts. Rather, it is simply meant to provide reassurance that the FOMC is well aware of the risks, leaving room for markets to be disappointed.

Key Takeaway

Late in the cycle, a yield curve inversion can be viewed as a flashing red light for the future state of the economy as investors price in lower growth and inflation. Rising equity valuations since the beginning of the year are pricing a more positive outlook with the Fed’s dovish insurance cut being the main driver. When the stock market is close to all-time highs, but the economy is slowing, profit margins are squeezed, and companies are often forced to lower profit guidance.

The stock market is deviating from its fundamentals and forward outlook, which implies the “Powell Put” will prolong the market expansion when stimulus is necessary. The easy monetary policy will lift asset prices, but how much will flow to the real economy? I believe the Fed will ignore pressure from the market and the president and will make policy decisions independently based on the real economy.

This week’s meeting between Presidents Trump and Xi could be another factor impacting the Fed’s decision. Due to lack of communication, I don’t expect there will be a formal agreement between the two leaders, but they will most likely resume negotiations and pause on escalations. Consequently, the Fed may maintain this holding pattern despite the market having priced in 100% that there will be one rate cut during the July FOMC meeting.

Moreover, the Fed is still under quantitative tightening (QT) until September, so it doesn’t make sense to continue QT and simultaneously cut rates. Ultimately, investors should be conscious of a possible Fed surprise and switch focus back to fundamentals and forward-looking guidance.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.