Gaming Margins Are Post-COVID Winners

March 9, 2023

Operating margins have been front and center over the last two years, as companies grappled initially with supply chain issues stemming from the pandemic, and then accelerating inflationary pressures due to the war in Ukraine. There were numerous moving parts in 2021 and 2022 but the overriding theme was reasonable revenue growth alongside persistent margin pressure.

Dispersion among companies has been evident in terms of their ability to control costs and inventory levels, pass on price increases and adapt business models to the new remote workforce. One sector on the plus-side of the ledger has been the casino gaming industry.

Gaming was one of the industries that completely shut down for a few months in 2020 at the height of the pandemic, and then it only gradually began to entertain a limited number of visitors amid strict social distancing requirements. As vaccines rolled out and the economy opened up, casino executives reexamined their businesses and experimented with new practices. Among the most significant changes was the elimination of “loss leaders” — offerings such as huge buffets and other money-losing and/or low-margin marketing tools that used to be necessary to drive foot traffic.

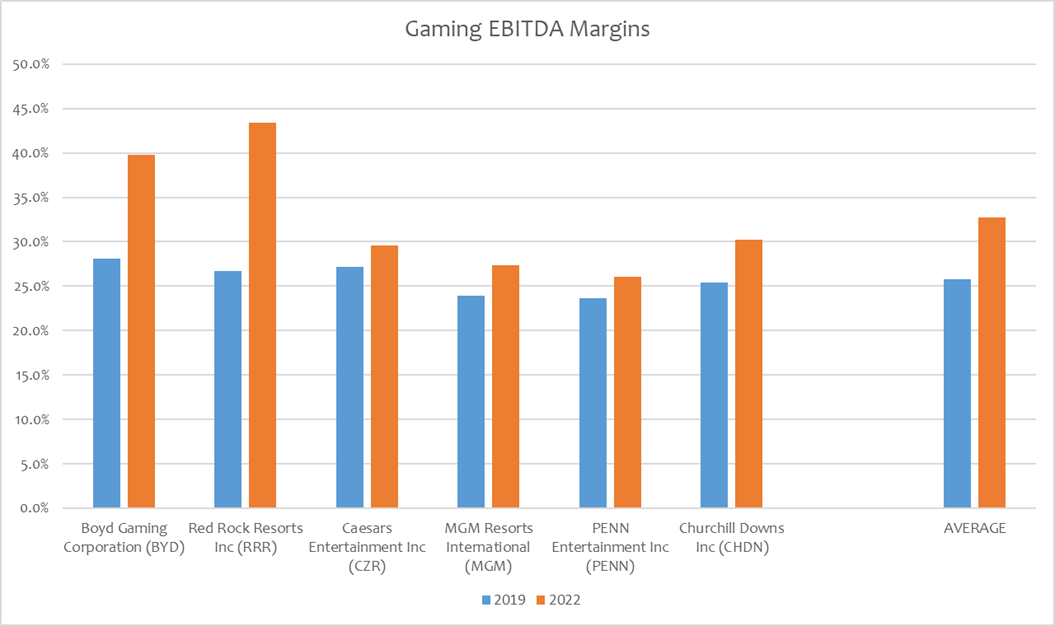

As seen in this week’s chart, EBITDA margins for a cross section of public casino companies averaged a healthy 26% in 2019 — the last full year prior to pandemic-related shutdowns in the U.S. Despite elevated labor and other cost pressures in 2022, average EBITDA margins for these companies improved to 33%. It’s worth noting that the comparable set excludes Macau-exposed operators. The 700 basis-point margin improvement is an impressive outperformance compared to other industry sectors.

Key Takeaway

When playing games of chance, luck is just as important as skill. Similarly, while casino executives were proactive in dealing with the new operating environment, they clearly benefited from changing consumer preferences and the need for less marginal promotional spending in the post-COVID-19 period. The structural margin improvement appears permanent, which could enhance profitability and free-cash-flow profiles, boost valuation multiples and make the sector more defensive over the course of a business cycle.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.