March Madness

March 23, 2023

March Madness tipped off this past weekend, and we got to see some pretty historic upsets including No. 16 seed Fairleigh Dickinson’s win over No. 1 seed Purdue. Only one other time has a 16 seed defeated a 1 seed, when UMBC triumphed over Virginia in the first round of the 2018 NCAA Tournament.

Outside of basketball, March has been historic in a few other ways. For example, Silicon Valley Bank and Signature Bank were put into receivership by the Federal Deposit Insurance Corporation (FDIC) over the weekend of March 10, becoming the second- and third-largest bank failures in United States history behind the collapse of Washington Mutual in 2008. And just this past weekend, UBS acquired Credit Suisse in a transaction valued close to $3.2 billion, in an attempt to shore up the global banking system.1

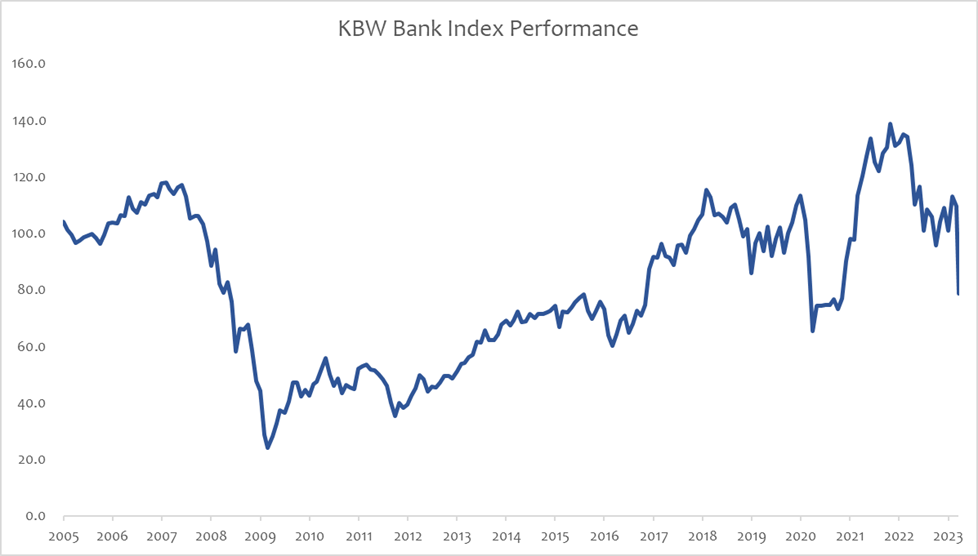

As shown in this week’s chart, the KBW Bank Index has fallen dramatically over the past few weeks, down 27% since the beginning of March. This index consists of 24 stocks representing the largest national money centers, regional banks and thrifts in the country, such as J.P. Morgan, Bank of America, First Republic, PNC Financial and Capital One Financial.

Banks are subject to a number of different risks including credit risk, or counterparty risk, as well as interest rate risk. One real-world example of interest rate risk at play is a situation banks find themselves in today. Over the past few years, banks have been investing customer deposits in U.S. Treasuries and mortgage-backed securities. But as the Federal Reserve (Fed) began to raise rates last year, prices of these securities have started to decrease in value. Theoretically, if a bank holds said securities to maturity, the institution does not lose anything. However, some banks have been forced to sell portions of their portfolios at a loss, which has caused concern among depositors.

The real trouble in the sector commenced a few weeks ago when Silicon Valley Bank sold a significant amount of its “available-for-sale” securities at a loss in order to shore up its balance sheet, while simultaneously looking to raise equity financing from a few different parties. As depositors became concerned about the liquidity and solvency of the bank, as well as whether they might be unable to retrieve their deposits, clients of Silicon Valley Bank rushed to withdraw their capital.

Consequently, the institution experienced roughly $42 billion of deposit withdrawals over a span of two days. Silicon Valley Bank, as the name suggests, mainly served venture-capital and technology-focused clients.

Just a few days later, Signature Bank, which catered to a similar client base, was seized by regulators on March 12. Signature Bank was also struggling given the company’s bet on cryptocurrency banking, which imploded as banking regulators began to take a closer look at lenders’ exposure to digital assets and the crypto ecosystem as a whole.2

This past weekend, Credit Suisse, a Zurich-based bank created in 1856 to finance Switzerland’s rail network, was acquired by UBS for less than half of Credit Suisse’s market cap as of market close on March 17. FINMA, the Swiss financial regulator, undertook several significant steps to facilitate the acquisition, including wiping out $17 billion worth of Credit Suisse’s bonds.3

Akin to depositors rushing to withdraw money at Silicon Valley Bank and Signature Bank, Credit Suisse depositors withdrew billions of dollars over the past week, causing concern that Credit Suisse would be unable to resume operations come Monday without intervention from the government or another large banking institution.

In addition, amidst the turmoil in the banking sector and the state of the global economy, the Fed decided at its March 22 meeting to continue on its path of monetary tightening with a 25-basis-point increase in the Fed Funds Rate in order to further curb inflation. In its statement released yesterday, the Fed noted that “the U.S. banking system is sound and resilient, but recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation.”4

Post the Fed’s decision to raise rates by 25 basis points, the FOMC dot projections show expectations for the terminal rate of 5.125% for year-end 2023, unchanged from December and only implying one more 25-basis-point hike this year. However, the median dot for 2024 interest rate expectations was raised to 4.375% from 4.125%, implying rate cuts starting in 2024.

Key Takeaway

The KBW Bank Index is down nearly 30% month-to-date, with a few different banks having been seized by the FDIC or acquired by a competitor. It will be interesting to observe the performance of bank stocks throughout the balance of the year, given concerns around liquidity, securities portfolios, net interest margins and the profitability of banks moving forward if the Fed decides to start cutting rates in the back half of the year. It will be key to continue performing fundamental investment analysis and focusing on businesses that have strong cash balances and defensible balance sheets with the ability to drive earnings growth and free cash flow.

Finally, I’ll be watching the rest of the NCAA Tournament closely, as my pick to win it all made it through to the Sweet 16 — go UCLA Bruins!

Sources:

1Source: AP News- UBS to Buy Credit Suisse For Nearly $3.25B to Calm Turmoil; 3/20/23

2Source: The Wall Street Journal- What Happened With Silicon Valley Bank?; 3/14/23

3Source: AP News- UBS to Buy Credit Suisse For Nearly $3.25B to Calm Turmoil; 3/20/23

4Source: Board of Governors of the Federal Reserve System- Press Release; 3/22/23

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.