Is Office Real Estate the Next Shoe To Drop for Small and Midsize Banks?

April 13, 2023

The recent failure of Silicon Valley Bank (SVB), which was caused by its asset/liability duration mismatch and rapidly rising interest rates, has sparked a public conversation about the role that small and midsize banks play in our economy. Now that a degree of calm has returned to the markets, a lot of thought is being given to the “next shoe to drop.” Many believe that shoe, which will again impact smaller banks disproportionately, is commercial real estate (CRE).

CRE is property used exclusively for income-generating (commercial) purposes and comes in a variety of forms such as retail, industrial, multifamily rental and office, to name a few. Some areas of CRE, including industrial and multifamily rental, continue to benefit from structural shifts in the economy. But office, which accounts for approximately 6.5% of the CRE market,1 has faced high vacancy rates since the onset of the pandemic, and this weakness is expected to continue.

In addition to lower revenues caused by high vacancy rates, owners of office space face the pressure of rising borrowing costs, as the Federal Open Market Committee has raised the federal funds rate from near zero in the first quarter of 2022 to nearly 5% today, and tightening credit conditions, as lenders look to reduce the amount of risk on their balance sheets.

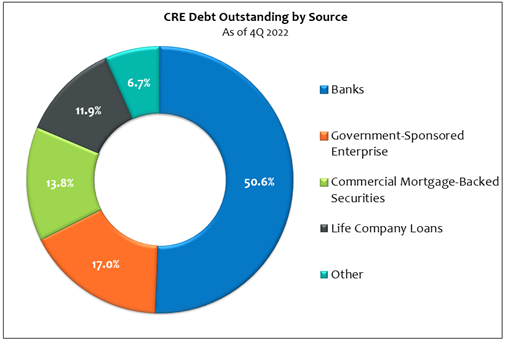

According to Trepp Inc., a provider of data and insights to the real estate market, $448 billion in CRE loans will mature in 2023. Banks hold $227 billion — or just over 50% — of those loans. Over the next five years, $2.56 trillion in CRE loans will mature, with $1.4 trillion held by banks.2 Much of this debt was financed when interest rates were at or near zero. According to Goldman Sachs, banks with less than $250 billion in assets hold more than 80% of CRE loans in the U.S.3 To provide a size comparison, JP Morgan Chase, the largest bank in the U.S., had $3.7 trillion in total assets for the quarter ending Dec. 31, 2022.4

The less-than-rosy picture for office space has led to an uptick in delinquencies and defaults. For example, Brookfield Asset Management — the largest office owner in downtown Los Angeles — defaulted in mid-February on two of its trophy office towers worth a combined $784 million.

Shortly thereafter, two other well-respected and well-capitalized names in CRE also announced defaults. Blackstone Group defaulted on around €300 million of remaining principal of a €531 million bond backed by a portfolio of offices and stores owned by Finnish company Sponda Oy, while PIMCO’s Columbia Property Trust defaulted on $1.7 billion in loans tied to seven office buildings across the country. Given that many of the current headwinds are not likely to subside in the near term, it isn’t difficult to imagine delinquencies and defaults continuing into the future.

Key Takeaway

In light of the SVB failure, many small and midsize banks continue to address their own asset/liability duration mismatches. While they address this issue, the next shoe to drop may well be their CRE exposure, as the office sector faces the headwinds of high vacancy rates and refinancing costs, tighter credit conditions and falling property values. Not only are small banks the biggest holders of CRE debt, but they’re much less diversified than their larger bank peers from a business-line perspective. While CRE is not likely to break the banking sector, it is likely to cause pain for those banks that have a high proportion of their assets tied up in the space.

Sources:

1Nareit – Estimating the Size of the Commercial Real Estate Market in the U.S.; 6/30/2021

2Trepp – CRE Loan Origination Volume Grew 15% in 2022: What This Means in Face of Bank Failures & Recessionary Signs; 3/21/2023

3Goldman Sachs – Stress among small banks is likely to slow the US economy; 3/16/2023

4MarketWatch – JPMorgan Chase & Co. Balance Sheet; as of 4/10/2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.