High-Yield Market Lends a Helping Hand

June 22, 2023

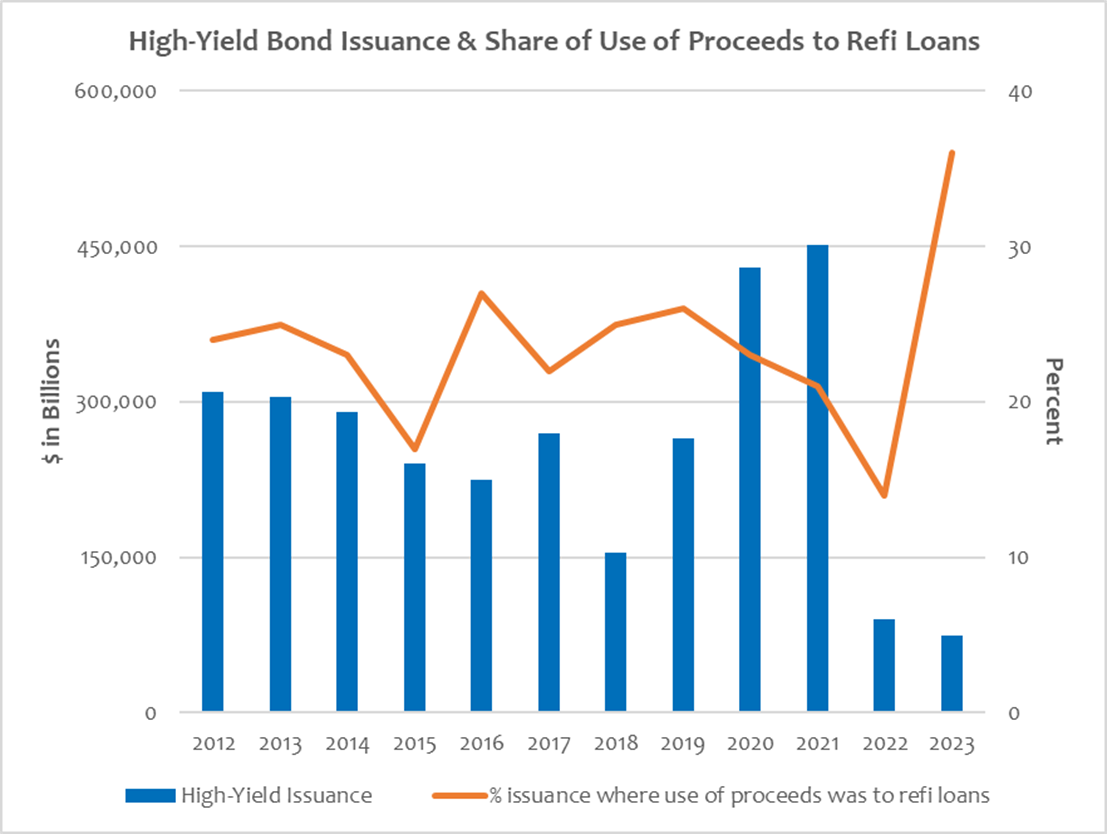

New issuance in the high-yield market has rebounded from a dismal showing in 2022. Per J.P. Morgan research, year-to-date issuance is up over 30% year-over-year, and the current backdrop indicates that the market remains wide open for issuers across the quality spectrum. This is in contrast to the leveraged loan market, which has contracted in 2023. The issues plaguing the loan market have been driven in part by its rapid growth over the prior decade, which was fueled by the low-interest-rate environment, strong collateralized loan obligation (CLO) creation, a heavy proportion of leveraged buyout funding and attractive covenant-lite terms for issuers.

Unlike the high-yield market, the loan market has a more material maturity wall in the 2024-2026 timeframe, and overall credit quality is weaker. The appetite for refinancing in the loan market is currently diminished, particularly for lower-quality credit, and will be problematic if we enter a recession or significant growth slowdown. Fortunately, the secured-debt portion of the high-yield market has been — and can continue to be — an important safety valve for loan market refinancing.

Loan market demand is driven largely by CLOs, and there are a couple of issues creating headwinds. Namely, a large share of CLOs are exiting their reinvestment period and the potential exists for many CLOs to be unable to consent to amend-and-extend agreements if their deals fail certain covenant tests. As such, issuers with bank-heavy capital structures have looked to access the high-yield market.

This week’s chart shows that one of the primary market trends among high-yield issuance is the high percentage of use of proceeds dedicated toward loan refinancing. Much of the refinancing has come in the form of the secured or guaranteed debt portion of the high-yield market, which has grown considerably. Refinancing, as opposed to mergers & acquisitions and other leveraging activity, is a positive dynamic for the market and helps support current valuations, despite the higher interest burden incurred and subsequent diminished free cash flow.

Key Takeaway

Risk markets are often subject to feedback loops — positive or negative — and if either condition lasts for an extended period of time, it can change the broad market narrative. Currently, there is the potential for a positive feedback loop in which struggling loan issuers can tap the high-yield market to extend maturities, alleviate covenant pressure and improve liquidity.

Cumulatively, this would ease downgrade pressure and default risk, reduce loan supply and, ultimately, improve demand for the asset class. The window is open, given the recent rally in spreads, and proactive management teams are likely to take advantage — which could lead to a surge in secured high-debt issuance in the coming months.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.