Big Tech Comes Roaring Back in the First Half of 2023

July 6, 2023

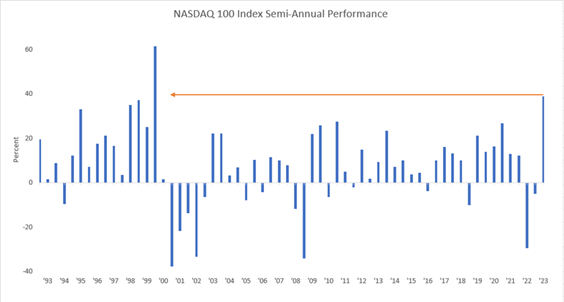

Amid sticky inflation, higher interest rates and calls for a recession, the Nasdaq 100 Index (NDX) just experienced its best semi-annual performance dating back to the 1999 dot-com bubble, as seen in the chart above. Mega-cap stocks (defined as market capitalizations greater than $200 billion) have added roughly $5 trillion in value over the first half of 2023 and continue to move higher as we head into the back half of the year.1

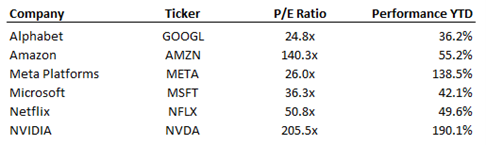

Amazingly, these stocks continue to increase in value even though they trade at expensive valuations. The table below shows the price-to-earnings (P/E) ratios for several of the highest-performing mega-cap companies in the NDX as of June 30. While other valuation metrics may be more appropriate for companies with higher growth rates, the numbers below are still impressive.

Source: Bloomberg

As a whole, the NDX trades at roughly 26 times estimated earnings, significantly above its 10-year average of 21 times. At some point, investors may deem these stocks to be too expensive. But in a market with so many uncertainties, earnings estimates moving lower, and bearish sentiment across Wall Street from many economists and market participants, both retail and institutional investors have flocked to these “safe haven” technology stocks regardless of how expensively they trade.

Although expensive, many of these businesses have unique competitive advantages, consistent top-line growth, durable margins, and operate in end markets that will continue to see strong demand for years to come. So I can see the appeal of owning many of these stocks even if investors have to pay up for them.

Furthermore, one of the biggest reasons why many investors have bought some of the names mentioned above can be attributed to the role that artificial intelligence (AI) will play in the years ahead. Following the release of ChatGPT in November 2022, investors have sought out businesses that could benefit from this emerging technology, such as these mega-cap tech companies as well as chip manufacturers, which have seen overwhelming demand for their products.

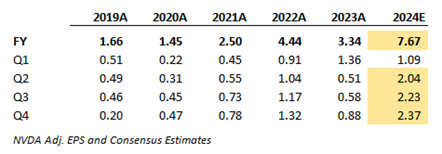

It would be difficult to talk about AI without mentioning NVIDIA, which is up almost 200% year-to-date. NVIDIA designs, develops and markets graphics processors and related software, which have wide-reaching implications across scientific computing, autonomous vehicles, robotics, internet applications and, of course, AI. One example of the type of demand NVIDIA has seen and expects to see ahead is the company’s forward earnings estimates, as seen below.

Source: Bloomberg

In terms of adjusted earnings per share (EPS), NVIDIA has never made more than $1.36 in a quarter prior to 2024. But as seen in the table above, consensus estimates now expect NVIDIA to earn more than $2.00 per share for Q2, Q3 and Q4 2024E in addition to growing its fiscal year EPS by more than 100% year-over-year.

The market is obviously expecting demand to persist, and some investors believe that these estimates may still be somewhat conservative based on the wide-ranging implications AI could have across other industries such as healthcare, supply-chain manufacturing, cybersecurity and logistics. In addition, AI could turn out to be a boon to margins moving forward as it proves effective at eliminating various costs and making many of these companies more fiscally efficient.

Management teams across almost all sectors have started to incorporate AI into how they communicate with the market and investors as well. Through May 4, there had been 1,072 mentions of AI in earnings calls from companies in the S&P 500, including Expedia Group, Moderna and Kraft Heinz, with roughly 20% of the index still left to report at that time.2

Many of these companies and management teams are exploring how they can utilize AI and take advantage of the many different use cases it presents. According to Goldman Sachs strategists, AI has the potential to boost net margins by roughly 400 basis points over the next decade, although there is still a high amount of uncertainty around the overall impact that AI could have broadly.3

So what can we expect for the latter half of 2023? Given that there is widespread uncertainty regarding inflation expectations, limited line of sight to improvements in earnings forecasts in some sectors, and generally a more difficult economic environment for businesses and consumers due to higher rates, I expect these mega-cap stocks to continue to perform well and see a consistent bid given their size and positioning in their respective markets.

Furthermore, I expect AI to act as a catalyst that will drive incremental growth and margin expansion moving forward. However, it will be interesting to see how the market comes around to more thoughtfully considering valuation versus buying some of these names based purely on momentum.

Key Takeaway

In a market with so many unknowns, investors have flocked to mega-cap technology stocks as a “safe haven,” with little regard for price or valuation. In addition, there is significant investor interest in the role that AI is playing in the world today, and how this technology could positively impact the profits and business models of these large tech companies.

While it is difficult to predict how the market will perform over the next six months, we intend to focus on finding situations that provide value while minimizing risk. Continuing to look for businesses with strong balance sheets, defensible moats, skilled management teams and healthy margins of safety will be top of mind as we navigate this volatile market in search of consistent and relative outperformance.

1 Tech Stocks on Fire: Apple Is Worth $3 Trillion - Bloomberg

2 AI Is the Hot Topic on Earnings Calls This Quarter - Bloomberg

3 Goldman Strategists See Potential Profit Boom From AI - Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.