Downside Protection, But at What Cost?

July 13, 2023

The start of a busy July also marked the beginning of the third quarter of 2023. In the short time since, we have already witnessed several important data points — including the ADP National Employment Report, initial and continuing jobless claims, the unemployment rate and the change in payroll numbers, among others.

Many of these data points are crucial to the Federal Reserve (Fed). In its last meeting, the Fed decided to pause its rate hikes, opting instead to observe how the economy would evolve. If it decides to hike again in the coming months, rates could reach their highest levels in 22 years.

Last week demonstrated the continued resilience of the U.S. economy, particularly in the labor market. By historical standards, the labor market remains exceptionally tight. Sectors experiencing significant growth included leisure and hospitality, indicating an increase in demand for services and contributing to inflation being stickier than expected. Additionally, the unemployment rate decreased slightly in June.1

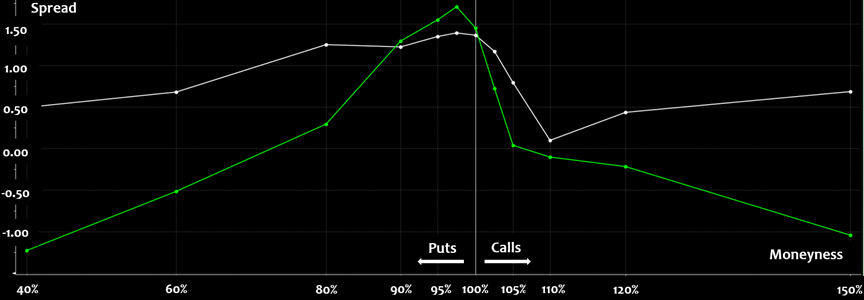

These developments not only support continued rate hikes by the Fed but also have implications for market volatility. In today's Chart of the Week, we can observe the change in the S&P 500 Index volatility skew from June 30 to July 7 for the 1-month (green line) and 3-month (white line) tenors. The best way to interpret this chart is by starting from the line traced at 100% moneyness, or at-the-money. As we move farther away in either direction, we see the weekly change for puts/calls respectively as we get farther out of the money. It provides insights into how the market absorbed the data released this week, including the resulting volatility and influence on the pricing of derivatives.

On one hand, we notice that the volatility for put options near at-the-money strikes increased more significantly compared to those further out of the money, for both the 1-month and 3-month tenors. The change in the 1-month tenor is particularly noticeable, resulting in a flattening of the put skew. This increase in volatility leads to higher prices for derivatives. Investors may be rushing to seek downside protection, as the data remains strong and shows little signs of deceleration.

Meanwhile, we observe the opposite trend for call options. The volatility increased at a slower pace for calls near the at-the-money level, compared to the at-the-money strikes for both tenors. It is worth noting that the volatility for 5% out-of-the-money calls remained relatively unchanged (with a spread of 0.0361) compared to the same tenor, as of last week.

Key Takeaway

The market seems to be resilient to anything the Fed throws its way and there are many theories about what might happen next. But one thing is certain: The Fed has more reasons to continue hiking rates. While the Fed continues with its hawkish narrative, downside protection has become more expensive as the economy continues to prove strong.

This week’s chart shows the volatility skew changes for calls and puts with 1- and 3-month maturities within a week, reflecting the effects of what a continuing tight labor market, among other data points, might have on the market. These changes demonstrate the expectations about what could happen in these time horizons.

Source:

1U.S. Bureau of Labor Statistics – The Employment Situation; June 2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.