Retail Sector Mid-Year Check-In

July 20, 2023

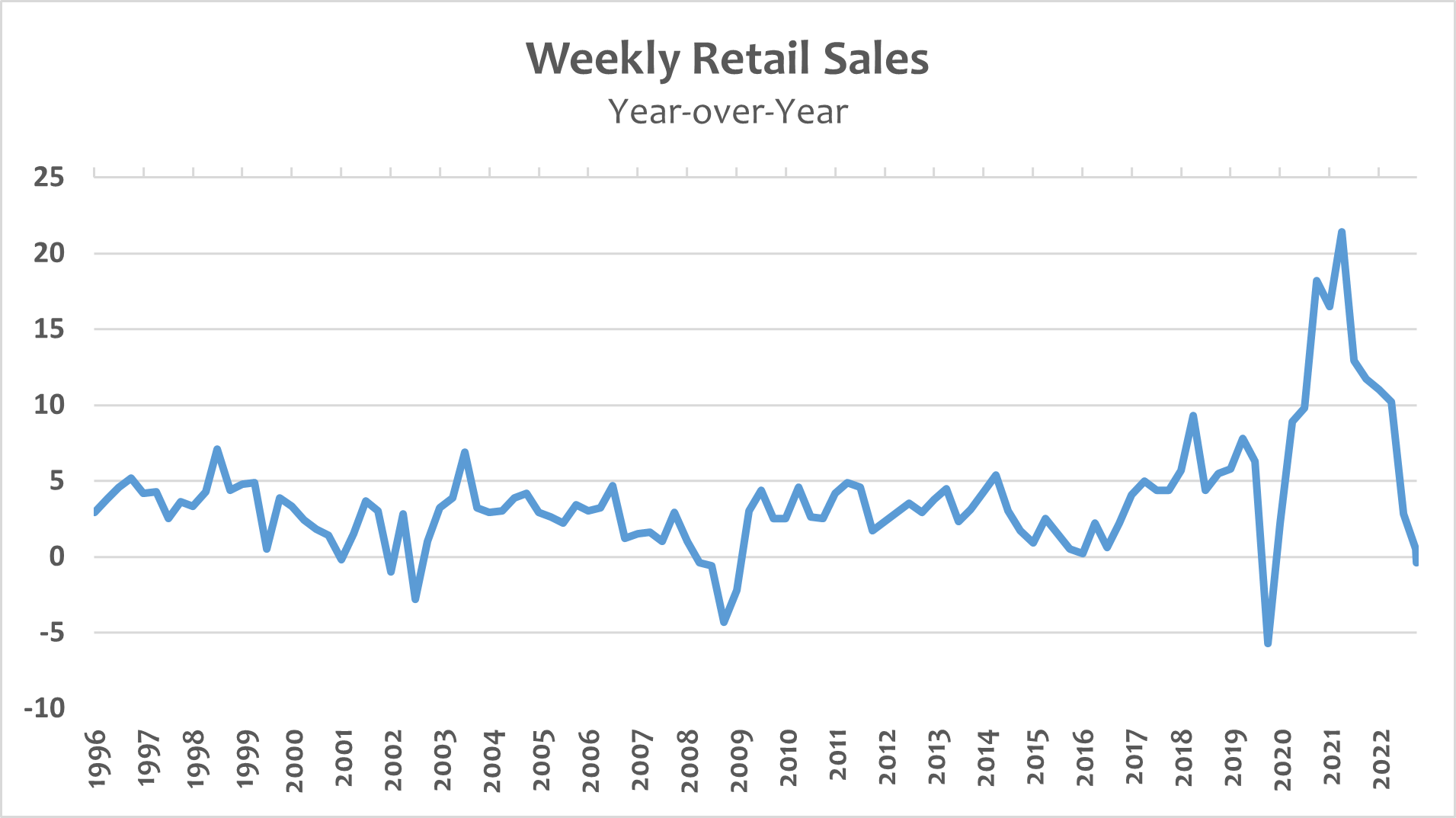

Today’s Chart of the Week highlights the importance of last week's negative change in the Johnson Redbook Index. This index tracks the year-over-year same-store sales growth in a sample of approximately 9,000 stores of large U.S. general merchandise retailers. As such, it provides an advance reading of trends in retail sales ahead of official releases and company reports. Last week's reading showed that the Johnson Redbook Index decreased by 0.40% for the week ending July 8, 2023 compared to the same week last year.1 As shown in the chart, the index has been decelerating, and this is the first time the index has gone negative since March 2020. It's nearly impossible to forget the previous environment of negative readings when COVID-19 lockdowns were in full swing and the economy spiraled into a quick recession. Understandably, this was a very difficult time period for retailers and the fact that the Johnson Redbook Index has fallen negative again is telling.

This could be a troubling sign as we head into second quarter earnings reporting for retail companies. So far we have seen a few cracks in retail earnings. For example, Levi Strauss & Co. lowered revenue and earnings per share guidance earlier in July.2 Their Chief Executive Officer Chip Bergh said, “The macro effects of higher inflation and a slowing U.S. economy has put increased pressure on the price-sensitive consumer."3 The company noted that low- and middle-income shoppers were feeling the most pressured. On the other hand, an example of slowing sales from a luxury company is Richemont, the owner of Cartier and Van Cleef & Arpels jewelry. They reported a surprise lower-than-expected revenue increase on July 17 from the Americas for the quarter ending June 30, 2023.4

Key Takeaway

The Johnson Redbook Index is one of the weaker data points I have seen amongst other retail sales numbers in the U.S. that have signaled consumer spending remains resilient despite higher inflation and interest rates. As is always the case, this earnings season will be very important to see if some retailers have run out of steam and post weaker earnings.

Sources:

1Trading Economics – United States Redbook Index; 7/9/2023

2Levi Strauss & Co – Levi Strauss & Co. Reports Second-Quarter 2023 Financial Results; 7/6/2023

3Yahoo! Finance – Levi Strauss cuts outlook, warns of 'price-sensitive consumer'; 7/7/2023

4Reuters – Luxury group Richemont boosted by Asia recovery but Americas weigh; 7/17/2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.