A Suspenseful Hurdle

August 17, 2023

I love a great, suspenseful movie — especially a nail-biter. However, I definitely do not like too much anxiety when it comes to money. I tend to be pretty risk averse in general, so when I can earn a reasonable return on cash with taking what I believe to be minimal risk, I’m all for it. Now, today is very different from any point in my adult life in that we have this pesky thing called inflation insidiously eating into our purchasing power. For now, let’s leave that conversation for another day and focus on what a high cash/hurdle rate has done in relation to markets over the past few decades.

If ultra-low rates spur wild speculation, financial irresponsibility and bubbles (tech in the late 1990s; housing/mortgage in the mid-2000s; everything in the post-COVID boom), then logically speaking, a solid, sturdy rate of interest on our cash should eventually result in the exact opposite — investment rationality, responsible behavior and sanity. Today, some will say that this basic concept is outdated or even wrong. High cash rates have not (yet) deterred the S&P 500 Index from approaching near all-time highs again, for example. Credit spreads on corporate bonds are still grinding near their tightest levels. And those observations would be absolutely correct, so far.

Market volatility has plummeted and until this recent earnings season, most days have been boring. Demand for credit remains extremely strong, almost insatiable at times. However, the historical evidence is overwhelming in that what happens from here has the potential to be anything but boring.

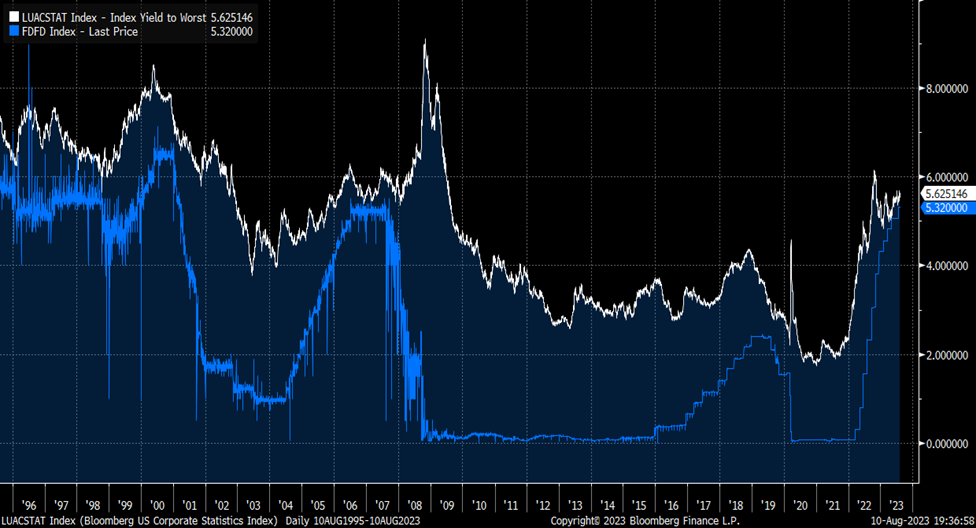

Today’s Chart of the Week displays the current federal funds rate and the yield (to worst) for the Bloomberg U.S. Corporate Bond Index. In a normal environment, we should earn some additional level of yield or spread above U.S. Treasuries specifically, and even more so versus the risk-free rate we can earn on cash.

But today, as you can see — consistent with other extreme Federal Reserve (Fed) hiking cycles (2000/2001; 2006/2007; 2018/2019; today) — investors are earning very little in extra yield to assume risk. When cash rates are high, a “hurdle” is created for investment in any security that requires the assumption of risk. How much incremental yield should we expect to receive for a given unit of (higher) risk? As we have witnessed recently, with money market rates hovering over 5%, investors have flooded money market funds with $5.9 trillion, which is an all-time record by far.1

This movement of cash away from lower-yielding bank deposits can create ripple effects throughout the world of finance. The competition for deposits certainly created a stir in March with the subsequently called “Banking Tremors.” In the past, this exodus from riskier assets also led to spikes in credit spreads and higher jolts of stock market volatility as financial conditions tightened and default rates increased. The current argument is that the Fed will engineer a soft landing and avoid the worst of outcomes. Maybe this will be the case and Fed Chair Jerome Powell and the gang will prove to be superheroes; but, maybe not.

Key Takeaway:

The ending to this most recent Fed hiking cycle has yet to be written. Just like sitting down to watch the final scenes of a great movie, we eagerly await the conclusion. Historically, a high hurdle rate for investment created competition for funds, movement away from risk assets and some big time market volatility. Will this time turn out to be another sequel or its own story? As an income investor, keeping our portfolios positioned to potentially deal with just about any adverse outcome will hopefully help us all to rest easy. I will try my best to leave any scary, surprise endings for the silver screen.

Source:

1The Wall Street Journal - Money-Market Fund Yields Soar to 16-Year High; 8/8/23

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.