GLP-1 Drugs Drop More Than Just Weight

October 19, 2023

The S&P 500 Index (+13.9% year-to-date) and the Nasdaq Composite (+29.7% year-to-date) have performed well so far in 2023, fueled by optimism surrounding artificial intelligence (AI), declining inflation and the economy’s resilience in the face of rising interest rates. However, a deeper look under the hood will show that a majority of these returns have been driven by only a few stocks, including Microsoft (+39.5% year-to-date), Nvidia (+214.9% year-to-date) and Alphabet (+57.5% year-to-date). One story that perhaps flew under the radar heading into the year was the impact that injectable drugs, known as GLP-1s, could potentially have on various sectors of the stock market.

GLP-1s are a class of medications used to help manage glucose levels in individuals with Type 2 diabetes.1 These medications are often injectable and relatively new, as the U.S. Food and Drug Administration approved the first GLP-1 medications in 2005. In general, GLP-1 is a hormone that the body produces and helps the pancreas release insulin, blocks glucagon secretion, slows stomach emptying and increases how full one feels after eating. GLP-1 drugs aim to mimic how this hormone works, ultimately helping those with Type 2 diabetes manage blood sugar more efficiently.

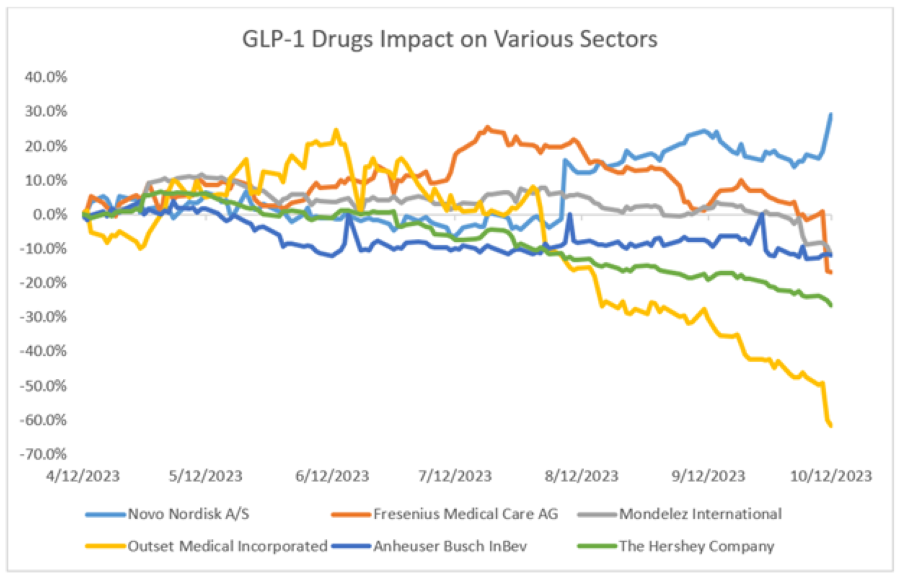

Novo Nordisk A/S, now Europe’s most valuable company with a market capitalization of roughly $454.5 billion as of Oct. 13, 2023, manufactures two GLP-1 drugs known as Wegovy and Ozempic, two well-known therapeutics in the space.2 The success of these drugs and their potential widespread applications have helped wreaked havoc on various areas of the stock market so far. As seen in today’s Chart of the Week, as more positive news about the effectiveness of Wegovy and Ozempic has been released, the stocks of companies that may potentially be negatively affected by the success of these drugs have started to fall.

For instance, Fresenius Medical Care AG & Co. and Outset Medical Incorporated, two businesses that provide medical care and device technology to patients in the dialysis space, have seen their shares decline as Novo Nordisk A/S’ Ozempic drug showed effectiveness in patients with kidney failure. In the consumer staples sector, Anheuser Busch InBev and The Hershey Company have seen their stocks decline as investors start to ponder what demand could look like for their various products over the long term as these companies market products that are generally unhealthy for consumption. Mondelez International, which produces packaged food products, has seen its stock price fall as comments from Walmart indicated that individuals taking GLP-1 drugs have reduced the amount of food they purchase.3

Given it is still in the early days regarding the success and second-order effects of these drugs, it’s difficult to determine if the impact on various areas of the stock market is short-lived. Through the pandemic, many consumer staples companies raised prices to combat inflation and elevated supply chain expenses. Now that consumer purchasing power has started to become a little less certain, consumers may be pulling back as a result of the current economic backdrop. With regard to companies in the healthcare and medical device sectors, many management teams have stated the long-term impact of GLP-1 drugs is difficult to predict, and they are not seeing immediate impacts to the financial results of their respective businesses.

Overall, investing in this year’s theme of GLP-1’s disruption of various sectors of the economy has been profitable. Just as many investors purchased technology stocks based on the commentary around AI, there are certainly some investors playing the theme of weight loss as well. What will the ultimate impact of these drugs be? No one has a magic eight ball, but management teams and investors are thinking long and hard about the impacts these drugs could have worldwide.

Key Takeaway

GLP-1 drugs, such as Wegovy and Ozempic, could potentially disrupt various areas of the economy. Potential winners include drug makers, suppliers and consumer-focused businesses that manufacture healthy foods. Potential losers include medical device companies focused on diabetes care and hip and knee replacements, packaged food companies that sell candy or other unhealthy snacks and companies that sell beer and other alcoholic beverages. In my opinion, it’s too early to determine what the long-term impacts of these drugs will be. It will be important not to get too caught up in the short-term view and news around the effectiveness of these drugs but rather focus on the long-term earnings power of each business and how each management team reacts to the ever-changing conditions in the broader market today.

Source:

1Cleveland Clinic – GLP-1 Agonists; 7/3/23

2Yahoo Finance! – Weight-Loss Drug Frenzy Cements Novo Nordisk as Europe’s Most Valuable Company; 10/13/23

3Nasdaq – Snack Maker Mondelez Int'l Is Down but Not Out; 10/16/23

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.