The Energy Transition is Happening, But We’re Not There Yet

November 9, 2023

While the energy transition is well underway, global energy demand continues to grow (16% since 2010), and is expected to grow approximately an additional 7% through 2030 and 17% through 2050 — corresponding with the increase in global population. According to The United Nations World Population Prospects 2022 Report, the current global population of 7.9 billion is expected to grow to 8.5 billion by 2030 and 9.7 billion by 2050.1 Meeting the call for addressing worldwide energy needs will be an exceptional challenge.

According to the International Energy Agency (IEA), the number of global light-duty electric vehicles is expected to grow at 40% annually between 2021 and 2030 — from 17 million to 350 million. The number of internal combustion engine vehicles is expected to increase from roughly 1.1 billion to 1.4 billion over the same period.2 While the growth in electric vehicles is an integral part of de-carbonization efforts, the increase of combustion engines during that same period must be met with the requisite fuel supply.

One of the challenges facing the world’s current energy scenario is that shale wells have a much higher decline rate than conventional alternatives. Given this accelerated rate of decline, barring any new investment, the current oil supply is projected to only represent about 25% of projected demand by 2035. This supply and demand mismatch highlights the need for continued development as the energy transition occurs.

Long-term oil demand forecasts through 2035 generally agree that oil will remain a significant part of the global energy mix, with 2035 demand forecasted to be approximately 111% of 2021 demand. The energy transition will continue to demand a considerable amount of time and capital, creating a sustained near- and medium-term need for oil. In addition to oil’s dominance as the world’s main transportation fuel source — it is also feedstock for plastics, chemicals and other manufacturing products. According to the IEA, at least $7 trillion of oil and gas capital investment will be required to reach its net zero 2050 scenario.

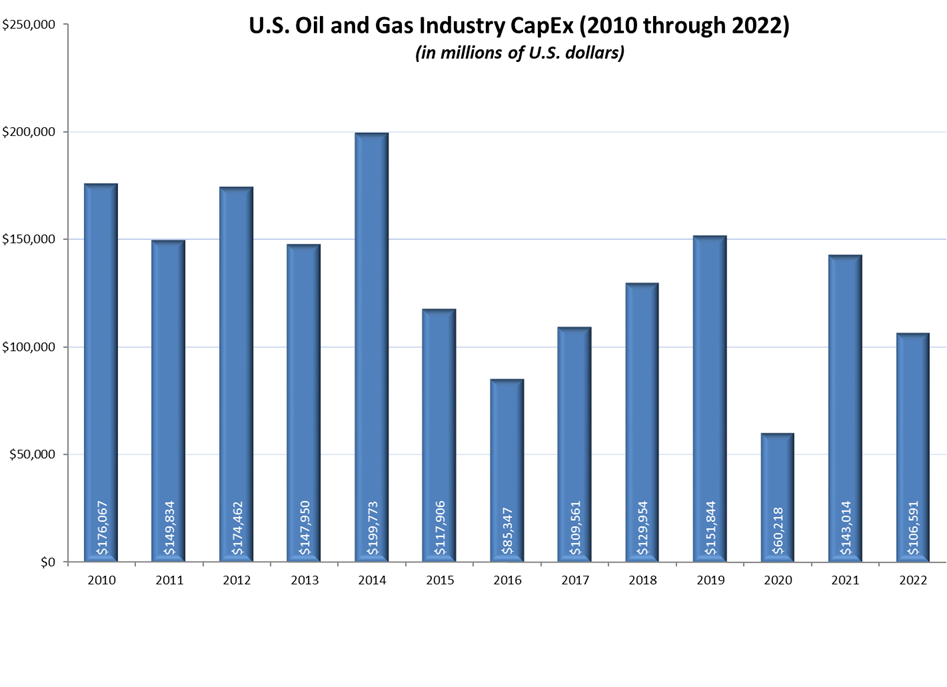

However, domestic investment in the space has slowed considerably, as environmental, social and governance (ESG) concerns are at the forefront of many investors’ minds. Capital expenditures have fallen steadily since 2019. For instance, public companies have historically raised or issued equity for acquisitions and drilling capital. The recent shift in public appetite for oil and gas exposure has led to a lack of new equity issuances and reduced drilling and acquisition activity. At the same time, private capital in the energy sector has also decreased materially. In 2018, there were about 29 energy private equity firms with $1 billion or more for oil and gas investments with a total dry powder of $90 billion. Today, there are approximately five capital providers of that size —and $16 billion of aggregate dry powder for oil and gas investment.

Key Takeaway

The demand for fossil fuels will remain high for some time while the energy transition continues. It’s clear the current supply of oil and gas will not get us close to net zero, so our reliance on fossil fuels will likely continue in order to bridge the transition. The necessary capital investments and resulting supply will likely, and debatably should, happen domestically for a number of reasons. Relative to the other major oil-producing economies, such as Russia and Saudi Arabia, the United States: 1) is geopolitically stable; 2) has a leading production profile for oil, gas and liquefied natural gas (LNG) exports; 3) has a demonstrated track record of lower emissions intensity, environmental safety and human rights; 4) has a strong focus on improving all of the things mentioned above; and 5) needs to take a leadership position if it hopes to achieve energy independence.

Because of the capital scarcity in both public and private markets, the remaining operators have been especially focused on capital discipline and operating efficiencies, rather than the aggressive development and growth that many pursued prior to the COVID-19 downturn. All of these factors come together to create what is a potentially compelling intermediate-term investment opportunity for oil and gas.

Sources:

1United Nations – The United Nations World Population Prospects 2022 Report; as of 2022

2International Energy Agency – Net Zero by 2050: A Roadmap for the Global Energy Sector, revised version; October 2021

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.