Animal Spirits Start To Percolate in Financial Markets

January 11, 2024

The final two months of 2023 marked a sharp reversal in risk sentiment with virtually every financial asset class rallying materially. The prospect for not only the end of further rate hikes but the likelihood of multiple cuts in 2024 caused 2-year and 10-year Treasuries to drop approximately 90 basis points (bps) and 110 bps respectively from the mid-October peak to the end of the year.1 If the inflation trajectory is sustained and interest rate volatility is diminished, the stage is set for more stability and certainty, which are prerequisites for corporations to plan and execute external growth opportunities. These conditions are also critical to allow buyers and sellers to coalesce around valuations for deals to be completed. The current outlook for a slower growth environment, coupled with more visibility surrounding margins, free cash flow, debt financing costs, etc., should allow for increased CEO confidence and a rebound in mergers and acquisitions (M&A).

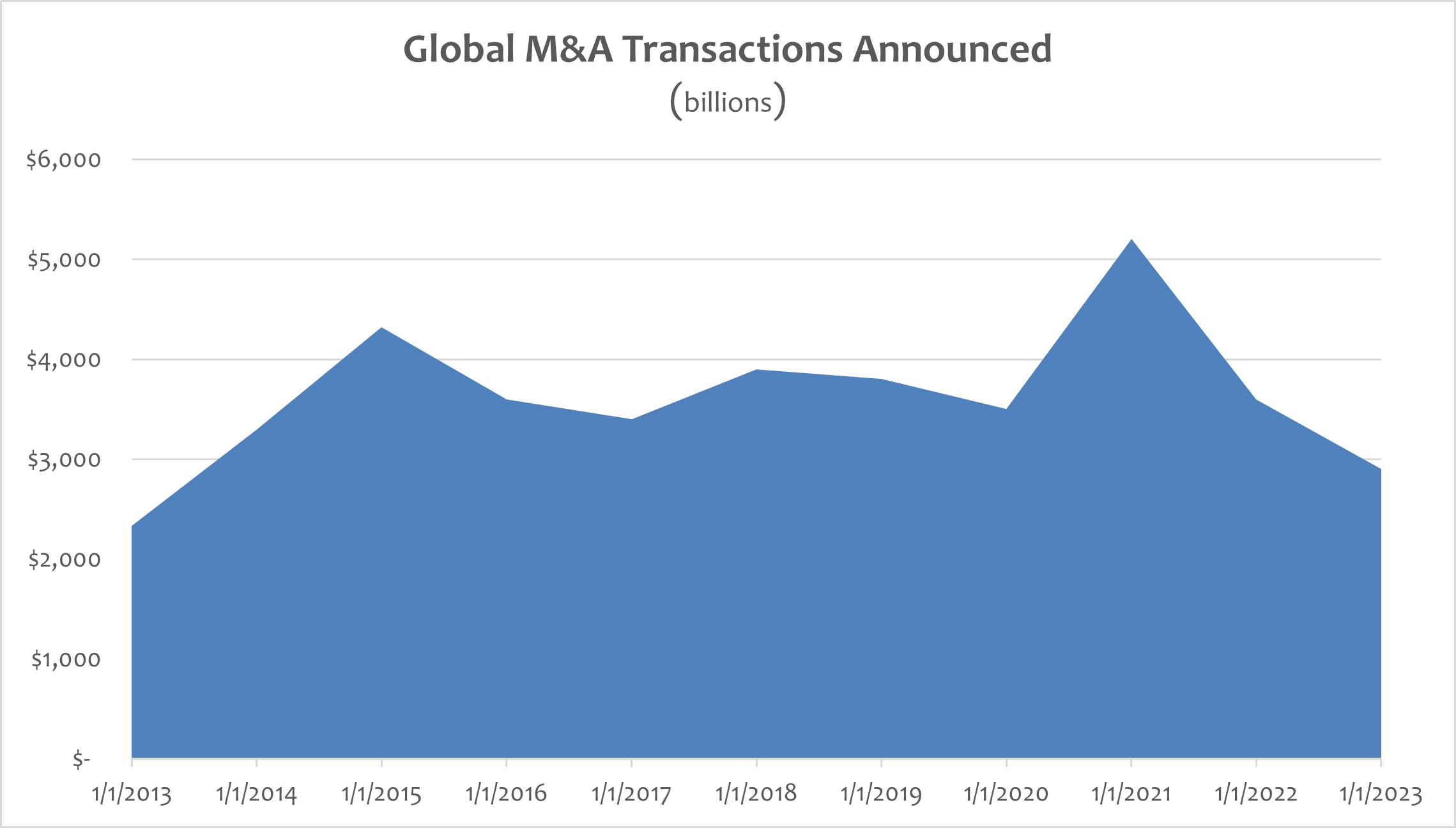

Today’s Chart of the Week highlights the decline in announced global M&A transactions over the past two years, with 2023 levels the lowest since 2013. The rapid rise in inflation and interest rates paused M&A activity as companies focused more internally. While the lagged effect of materially higher interest rates is still being debated in the market, deal-making was an immediate casualty. Numerous risks weighed on sentiment, including the regional bank crisis that occurred last March, a troubled commercial real estate sector, the declining prospects for a China-led growth rebound and a prolonged inventory destocking across many sectors. These issues remain, but when viewed through 3% inflation and a more dovish Federal Reserve (Fed) lens, appear much more manageable.

Key Takeaway

I believe lower interest rate volatility and the Fed delivering on some degree of rate cuts in 2024 are more important for risk markets than the absolute level of long-term interest rates at this point. Corporations have proven to be very resilient, and many will likely be able to manage effectively with Treasury rates returning to long-term historical levels. M&A is off to a good start this year, with a few big deals announced in the energy and healthcare sectors leading the way — I expect much more to come.

Source:

1U.S. Department of the Treasury – Daily Treasury Par Yield Curve Rates; January 2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.