The Incredible Growth of US Household Wealth

January 25, 2024

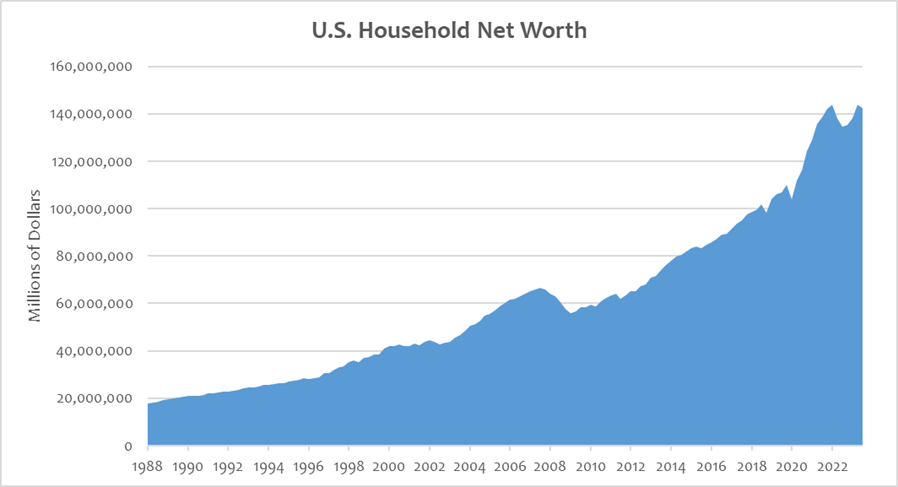

Post-pandemic, investors have been repeatedly surprised by the resilience of the U.S. consumer and economy. Consumers continued to spend, and the economy continued to grow even when the federal funds rate reached the 5.25%-5.50% level — a multi-decade high.1 The stunning growth of household wealth might explain why.

U.S. household wealth reached a high of $66 trillion before the 2008 recession, driven by the housing bubble. Post 2008, the Federal Reserve (Fed) kept monetary policy easy for roughly ten years, dramatically boosting financial assets and the housing market. By the end of 2019, household wealth had grown to $110 trillion — a 67% increase over 10 years. After the pandemic, financial assets and the housing market grew sharply after strong fiscal stimulus and monetary easing. Household wealth reached $142 trillion in September 2023, a 29% increase in less than four years and well above the historical 6% annual increase rate. Median household wealth grew significantly as well.

As household wealth climbed, the wealth effect also increased. According to one analysis conducted by Visa, pre-pandemic consumers spent approximately 9% of new wealth, while post-pandemic consumers spent 34%.2 Where does the increased spending go? The top three categories with increased spending include airlines, hotels and clothing, which is consistent with the elevated spending on travel and service we are witnessing.

There are a few reasons that might explain this increased wealth effect. First, some individuals may spend more after feeling more financially secure. Second, the wealth effect is more pronounced for retirees, and the percentage of retirees among the population has increased from 14% (20 years ago) to 18%.3

The rapid increase in household wealth, combined with the increased wealth effect, will continue to power consumer spending and the economy. Financial markets had a strong fourth quarter last year; therefore, I believe robust consumption will continue or even reaccelerate.

The Fed currently believes monetary policy is restrictive, and the market is pricing in a 138-basis-point rate cut this year.4 Lower inflation and a cooler labor market seem to justify it, but might simply be a mean reversion from the supply chain tightness and overhiring by technology and finance that occurred during the pandemic.

Key Takeaway

U.S. household wealth has increased sharply over the last four years. I believe the strong balance sheet of the consumer will enable resilient consumption even as the federal funds rate remains at 5.25%. With higher household wealth and a more pronounced wealth effect, the stock and housing markets may act as strong leading indicators for consumption and labor market strength.

Sources:

1,4Bloomberg

2,3VISA – The sudden increase in the wealth effect and its impact on spending; June 2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.