Market Breadth

February 15, 2024

As many of us recall, 2023 was an extraordinary year for the stock market, with the S&P 500 Index returning roughly 26% and the Nasdaq Composite returning slightly over 45% to investors. In a more normal market environment, many market participants might think this performance was broad-based and there were a number of opportunities to generate alpha across individual stocks, sectors and factors. However, that was not the case. The performance of both the S&P 500 Index and the Nasdaq Composite can be primarily attributed to the performance of the Magnificent Seven stocks — Apple, Amazon, Alphabet (Google), Meta, Microsoft, Nvidia and Tesla.

Looking back to this time last year, the equal weighted Magnificent Seven Index was outperforming the S&P 500 Index by approximately 2,300 basis points (bps),1 an astounding margin. This performance continued throughout the year as the Magnificent Seven stocks moved up and to the right. Furthermore, what is harder to believe is the number of stocks in the S&P 500 Index that actually underperformed the index in 2023 — 72% — a record for this century.2 Moreover, market breadth, also known as the ratio of the number of advancing stocks to declining stocks, has become extremely narrow, and this phenomenon has continued into 2024.

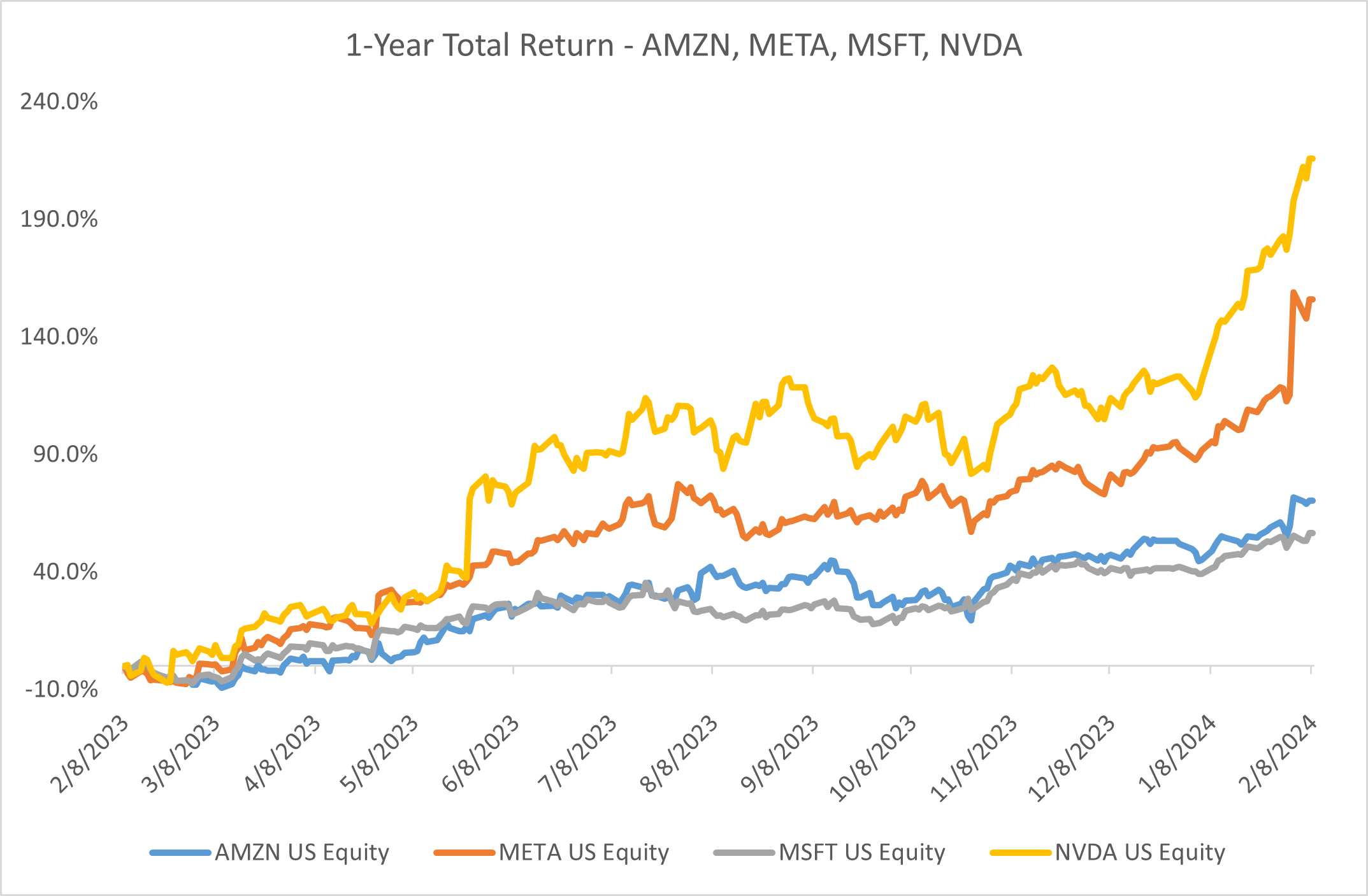

This year, the Magnificent Seven stocks have outperformed the broader market by roughly 5%, still a healthy margin given we are only six weeks into 2024. However, the leadership within this group of stocks, which can be seen in the chart above, has become more concentrated. Through the first month and a half of 2024, Amazon, Meta, Microsoft and Nvidia have contributed to nearly 75% of the total return for the S&P 500 Index, more than double the contributions from these four stocks in 2023.3

These companies have benefited from the tailwinds of artificial intelligence (AI) and the technology’s wide-ranging implications. Amazon, Microsoft and Meta have all invested billions of dollars of capital expenditures into AI features and software, hoping to make their products easier to use, more efficient and ultimately more profitable. Nvidia, meanwhile, designs and develops the chips that these companies use to build and run their software, and has been one of the largest beneficiaries of the AI boom over the past year and a half.

When thinking about the performance of these stocks, one has to wonder whether the valuations of these businesses are justifiable. Are these companies performing well or are investors buying these names purely based on what is hot right now? I’ll give one recent example to show just how well these companies are executing.

Meta, run by entrepreneur Mark Zuckerberg, reported earnings on February 1, 2024. The stock, which bottomed on November 3, 2022, is up roughly 344% since that date.4 Simultaneously, Meta’s price-to-earnings (P/E) ratio expanded from 8.5x (11/3/22) to 22.0x (2/1/24) just before the company reported earnings on February 1, implying the market was expecting an impressive print.5 Needless to say, Meta surpassed expectations with its fourth quarter results, but the more impressive story was the guidance for the first quarter of 2024, which surprised materially to the upside.

In terms of Q4 2023 results, Meta beat revenue expectations by 3%, operating margins expanded to 41% beating estimates by ~150 bps and earnings per share of $5.33 beat Wall Street estimates by roughly 6%. If that wasn’t surprising enough, Meta guided to $34.5 billion to $37.0 billion of revenue in Q1 2024, or 25% growth at the midpoint, where Wall Street was looking for growth of approximately 17%.6 Furthermore, the company is seeing copious amounts of demand for its products and services and the company’s investments in AI appear to be paying off as daily active users grew 6%, the most in eight quarters.7

This is just one example of a stock in the Magnificent Seven that is outperforming the majority of the market. Ultimately, investors have to wonder whether these stocks can continue to run given how rich the valuations have become. Recently, New York University Professor Aswath Damodaran, also known as the “Dean of Valuation,” mentioned that the valuations of the Magnificent Seven are ”richly priced,” but only one is ”priced to insanity,”8 and that company is Nvidia — which currently trades at a P/E ratio of roughly 90.2x. Can these stocks continue to outperform? We will have to wait and see.

Takeaway

Overall, the breadth of the market has become extremely narrow, with Amazon, Meta, Microsoft and Nvidia contributing to the majority of the returns for the S&P 500 Index in 2024 thus far. Will the market see a reset like we did in 2022? It’s impossible to predict. The companies that demand extremely high valuations continue to exceed expectations and guide higher, resulting in more buyers flocking to these stocks. In the meantime, other areas of the market have become extremely cheap, and prudent investors like us need to continue to search for investments that present good risk/reward, fair valuations and opportunities to generate outsized returns.

Sources:

1,3MarketWatch – 'Magnificent 7' acting more like 'Magnificent 4' in early 2024; 2/6/24

2Apollo; Feb. 2024

4,5Bloomberg

6TMT Breakout – TMTB: META post-call thoughts; 2/1/24

7Bloomberg Research: Meta User, Engagement Lift Shows AI Paying Off; Feb. 2024

8CNC – All of the 'Mag 7' stocks look overpriced, says NYU's Aswath Damodaran; 2/6/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.