The Increased Importance of Asset Ownership

May 9, 2024

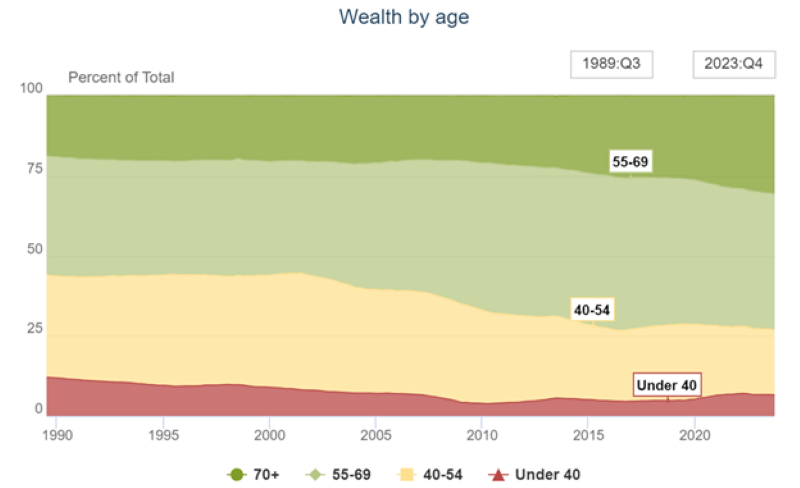

In today’s Chart of the Week, we delve into the dynamics of household wealth distribution across different age demographics. The chart reveals a notable trend: the 70+ age group has significantly increased its share of total wealth within the population. Between 1989 and 2008, this group's share remained stable at 20%. However, by 2023, it had surged to 30.5%, representing a substantial portion of an expanding pool of wealth. Conversely, younger age cohorts have experienced a decline in their wealth share. The 40-54 age group, for instance, saw their share dwindle from a stable 32% before 2008 to 20% by 2023. Similarly, those under 40 witnessed a decrease from 12% of total wealth in 1989 to 7% in 2023.

Various factors contribute to this phenomenon, including the relatively lower starting point for the 70+ age group, demographic shifts and the impact of programs like Medicare for retirees. However, an imperative reason lies in asset ownership. The 70+ age group has high ownership rates of assets such as real estate and stocks, facilitating faster wealth accumulation compared to other age cohorts, who typically possess fewer assets. Consequently, the latter group missed out on significant wealth growth during periods of favorable financial asset and housing market conditions.

Over the past two decades, household wealth in the U.S. has experienced remarkable growth. Between 1989 and 2023, it expanded at an annual rate of approximately 6%.1 Notably, from 2009 to 2023, this growth rate accelerated to 6.8% annually,2 spurred by the Federal Reserve's aggressive use of monetary policy to bolster consumption through the "wealth effect." In contrast, income growth has lagged behind, with median and average incomes increasing by approximately 3.4% and 2.8% per year,3 respectively, over the same periods.

This disparity between wealth and income growth is evident in the ratio of average household wealth to average household income, which ballooned from six in 1989 to 11 in 2023.4

What implications does this trend hold for investments and the economy? Businesses catering to the baby boomer generation are poised to benefit from robust demand. The baby boomer generation, holding a staggering $76 trillion in wealth,5 exerts significant purchasing power. Increased spending on travel and dining, exemplified by the booming cruise industry, underscores this trend. For instance, Oceania Cruise's announcement of a 2024 around-the-world voyage sold out within 30 minutes,6 indicating strong demand. Those unable to secure tickets for extended voyages are reluctantly opting for shorter alternatives.

As wealth continues to grow, income derived from assets will play an increasingly pivotal role in supporting consumption, particularly among retirees. Consequently, traditional indicators such as labor market conditions may lose their predictive power for consumption and inflation trends. The fluctuations of asset prices could wield greater influence on the economy than interest rate adjustments.

Key Takeaway

Asset ownership has emerged as a primary driver of household wealth over the past two decades. The rapid accumulation of wealth among the baby boomer generation signals robust demand for businesses catering to this demographic, whose spending relies heavily on accumulated wealth rather than labor income. As a result, future economic indicators and monetary policy considerations may need to adapt to this evolving landscape.

Sources:

1-4Federal Reserve Bank of St. Louis; as of May 2024

5Yahoo! Finance – You can thank the baby boomers for the stunning strength of the US economy; 4/9/24

6Oceania Cruises – Press Releases; 3/7/22

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.