Everyone Wants a Piece of Private Credit

May 30, 2024

In 2024, fundraising for private market strategies has become more challenging compared to previous years due to the slow pace of realizations from private equity, venture capital and growth equity funds as well as the total amount of capital raised over the past few years by general partners (GPs). However, the private credit market has experienced significant demand from institutional investors as well as retail and high-net-worth individuals.

Private credit has been around for a while but recently experienced a surge in demand as investors seek attractive returns beyond traditional investment opportunities. The asset class offers various strategies with differing risk/reward profiles, including direct lending, mezzanine debt, real estate credit, stressed and distressed credit, venture lending and special situations funds. Each of these strategies targets different types of borrowers and aims to deliver various types of returns based on the borrowers’ underlying risk profile and where the security is positioned in the capital structure.

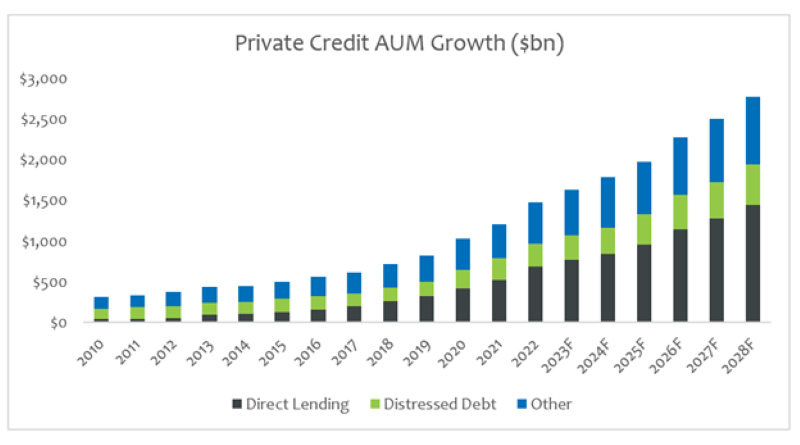

According to Pitchbook Data, Inc., the private credit market is currently valued at approximately $1.5 trillion,1 including $500 billion in dry powder. The actual size of the private credit market is a topic of debate among investors, especially considering the significant amount of capital allocated to the space over the past 18 months. Additionally, with the various strategies that fall under the "private credit” umbrella, the total addressable market could exceed $2-3 trillion of capital today.

Why has private credit become more attractive on a relative basis over the past two years? First, banks have retrenched across various areas of the market due to regulation as well as changes in risk management, leaving a significant segment of the market underserved by lenders, such as corporate lending and real estate. Second, many private credit funds price their loans at the secured overnight financing rate (SOFR) plus a spread, and as the Federal Reserve has slowly raised interest rates over the past few years, the total return on these loans has increased to ~10%+, even higher if private credit investors are lending to borrowers that are more risky or the security is positioned lower in the capital structure (with fewer covenants). Third, many of these loans are relatively short duration, which historically has generated mid-to-high single-digit returns from an internal rate of return (IRR) perspective. Given the higher pricing environment today, alongside the short duration of the loans, modeled returns continue to move up. As part of the loan structuring, some private credit investors also receive equity warrants which are accretive to overall returns should the company continue to perform well. Finally, given the number of businesses in the market today that are in need of bespoke or unique private credit solutions that banks are unable to provide, the opportunity set has grown significantly compared to five years ago.

A number of investors wonder if these returns are sustainable. If rates continue to stay high and banks refrain from lending to various areas of the market, there is ample opportunity for private credit investors to charge higher pricing for their loans as access to capital is still constrained. In addition, as most of these loans are floating rate, higher rates coincide with higher pricing on the loans being made to these borrowers.

Furthermore, one concern among investors is the default rate that the private side of the market may see versus the public side in high yield levered loans.2 A number of issuers have migrated from the broadly syndicated market to the private side given the lack of access to capital and more unique structuring private credit lenders can provide. Given the amount of capital flowing to private credit, there will certainly be defaults in some parts of the market where non-sophisticated lenders exist, but it seems like we are still 12 to 18 months away from that dynamic materializing.

Key Takeaway

Among a difficult fundraising environment for a number of private market strategies, private credit demand has remained strong as investors look for higher yields and opportunities outside of traditional investment strategies. The precise size of the market today is debated by investors but there’s no question the total addressable market is growing at a rapid pace. Returns for the asset class today are as attractive as they’ve ever been; however, the amount of capital flowing to the space does concern quite a few investors. As more capital is allocated to the space and competition increases, pricing should start to move back toward historical averages. Default rates today remain relatively low; however, given the risk profile of the types of borrowers in search of private credit solutions that number could increase over the next year and a half. In conclusion, private credit continues to be a bright spot in private market fundraising as yields remain high and investors continue to seek out alternative investment strategies while prudently managing allocations across their portfolios.

Sources:

1PitchBook Data Inc. – Will more banks join the private credit fray in 2024?; 1/16/24

2Bloomberg – Ex-Apollo Partner Sees Cracks Emerging in Private-Credit Boom; 5/22/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.