Market Complacency and the Search for a Catalyst

June 6, 2024

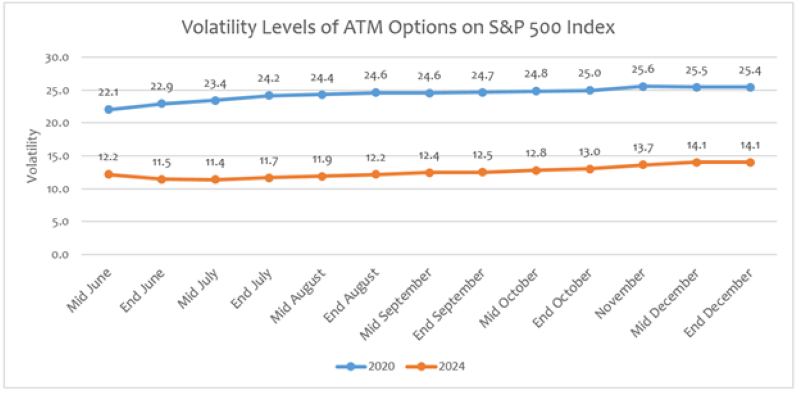

As we approach the summer, one question that is gaining traction: what could spook this market? In today’s Chart of the Week, I assess the level of risk the market is pricing in by examining the term structure of volatility for an at-the-money (ATM) call for the S&P 500 Index. The maturities range from the end of May until December 2024, and I compare these to the levels observed during the same period in 2020.

In financial markets, volatility serves as a critical indicator of investor sentiment and market stability. Recent trends in the term structure of volatility, specifically ATM options, reveal a notable decrease compared to the level observed in 2020. Term structure volatility refers to the pattern of how implied volatility varies across different expiration dates for options. Implied volatility is a metric derived from options prices that reflects the market's expectations of future volatility.

The positive macroeconomic environment is one reason for these lower levels of volatility. Economic indicators increasingly point toward the possibility of a "soft-landing" scenario, with a strong labor market and lower inflation among other factors. This stable economic environment suggests that the market might be underestimating potential risks, as reflected by the lower volatility levels.

The chart tells us two things: first, volatility levels are much lower than in 2020, indicating a significant level of market complacency. Second, in the near term, volatility is subdued, with levels decreasing in mid-June and reaching the same level at the end of August.

So, what could potentially change this sense of complacency? The largest change is anticipated from October to December, which coincides with the election — a possible catalyst. This is evident from the chart, where this year’s election has added more volatility from the end of October to mid-December, when compared to the last election, which did not have such a pronounced effect.

Additionally, another significant risk looms, the potential underperformance of artificial intelligence (AI) technologies. Given the increase in popularity and high expectations in this area, any failure of AI to deliver as anticipated could be a large catalyst for market volatility. This concern is underscored by the fact that 41% of the companies in the S&P 500 Index mentioned AI during their earnings calls throughout the first quarter of 2024.1

Key Takeaway

The current market environment is marked by a notable decrease in volatility levels, reflecting a high degree of complacency. This complacency is largely driven by a positive macroeconomic outlook. However, as we approach the upcoming elections, geopolitical risks are expected to increase, posing a significant potential catalyst for market volatility. Uncertainty surrounding different policies, especially those related to AI development, could significantly impact market dynamics.

With few other known catalysts on the horizon, it will be interesting to observe how these factors influence market sentiment in the coming months.

Source:

1Goldman Sachs – Portfolio Strategy Research; 5/15/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.