The End of (U.S. Stock Market) Exceptionalism?

May 1, 2025

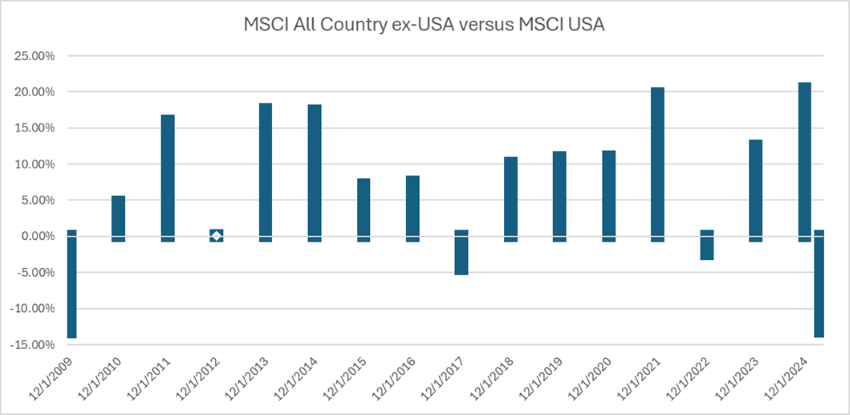

The introduction of the Trump administration’s tariffs and trade policy sent shockwaves through global markets as the intent is to shift global trade dynamics. Is the relative performance between U.S. stocks and global stocks ex-U.S resulting in another stunning shift from what we have experienced over the past few decades of U.S. stock market dominance to a new market paradigm?

The stock market performance thus far in 2025 begs the question: Is this the end of U.S. stock market exceptionalism? For a time, it seemed as if America was the only place to invest as U.S. growth company results surged past nearly every ex-U.S. company. A few months ago, the concern was that the markets had become too concentrated in the Magnificent Seven.

However, in 2025, the Trump administration appears to be intent on shaking up the underpinnings of what worked from a market perspective for the past few decades. Furthermore, the administration has adopted a firm and sometimes confrontational approach toward trading partners. Its punitive reciprocal tariffs are punishing many companies, but some believe none more than U.S. businesses, at least in the short term. Management teams are operating in a “fog of tariffs,” not knowing what the actual tariff rate is or will be. As a result, capital decisions are being delayed as we all await the next tariff headline.

Key Takeaway

The markets dislike uncertainty. Earnings reports are usually followed by forward guidance, which helps investors discern a company’s outlook from a sales and profitability standpoint. Given the recent trade policy proposals, more and more companies are pulling guidance due to not knowing how their businesses will perform in an environment where the rules are changing daily. The longer this uncertainty continues, the more the markets could be exposed to volatility and poor outcomes.

So, how do we invest in this type of market? The key in my opinion, as always, is to seek a margin of safety — solid balance sheets, stable operating margins through a full cycle and previously volatile times and great management teams. Through bottom-up research, we can attempt to uncover those companies that might not be as exposed to or might even benefit from an environment where U.S. tariffs prevail. We must also keep an open mind and prepare for contrarian investments in companies that have performed poorly. If the tariff news improves, there may be some value created for those names as well.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.