Tariffs Reshape the Auto Industry in Real Time

May 8, 2025

It’s been roughly one month (although it feels much longer) since the Trump administration unveiled its initial reciprocal tariff policy on Liberation Day, impacting numerous areas of the global economy and spiking volatility across the stock market. One area of the economy that is feeling the effects of tariffs is the automotive sector, particularly with regard to supply and demand, as well as pricing.

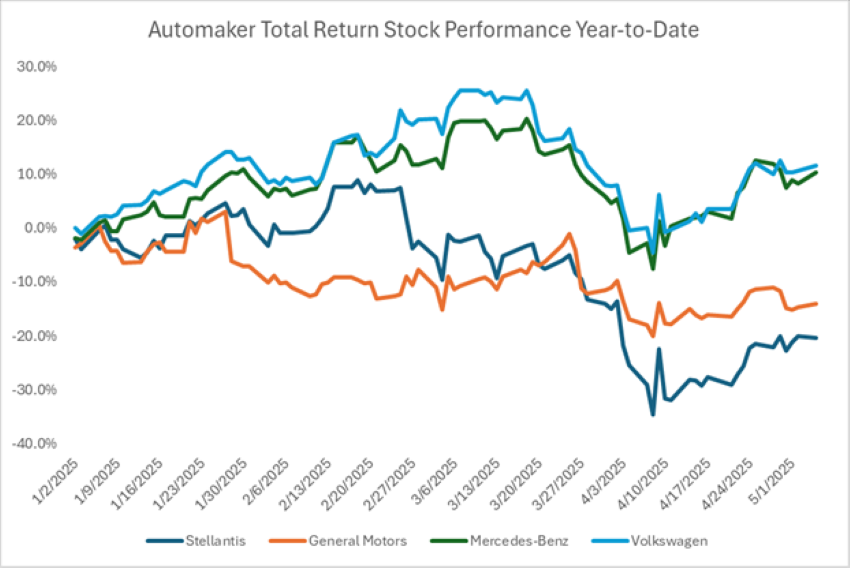

Tariffs have impacted every automaker and original equipment manufacturer (OEM), and dealerships are responding quickly. Showrooms have slashed new-vehicle inventories by 24% compared to this time last year, and dealerships have 61 days’ worth of inventory on hand, the lowest level in nearly two years and down from a 98-day supply in January of 2025.1 Furthermore, General Motors has stated that it will incur $5 billion in additional costs this year, and Stellantis and Mercedes-Benz withdrew their guidance for the year due to the uncertainty of Trump’s tariff policies.2

Some automakers have stated they will absorb the costs and minimally increase prices while others will push pricing through in order to cover the total expenses of tariffs.3 Another knock-on effect of Trump’s tariff policy is that the type of financing available to consumers is slowly going away. The number of 0% loan deals in the U.S. market has fallen to the lowest level since 2019.4 As a result, consumers, if they are able, are flocking to dealerships to get ahead of the price increases as inventory availability starts to wane and financing at higher rates.

Overall, JD Power and Associates estimates that tariffs will reduce U.S. auto sales by approximately 1.1 million units on an annual basis, or roughly 8% year-over-year, while analysts at Black Book expect a 5% increase in transaction prices across the board, estimating 14.9 million vehicle sales this year, down from 16 million in 2024.5 In addition, auto retailer AutoNation, on its most recent earnings call, stated that the pull forward in demand is positive for pricing, but the industry won’t experience the same pricing dynamics as seen during COVID-19.6 Ultimately, premium brands should be able to gain more pricing power than lower-priced alternatives and more effectively protect margins.

The near-to-medium-term outlook for automakers and dealerships remains unclear. Given the moving target on some of the tariffs in place, negotiations between other countries and the White House, as well as tariff deals that could be finalized over the coming weeks, many management teams in the auto sector are in “wait and see” mode. It will be challenging to have much clarity on the outcome; however, one thing is clear: if the uncertainty around tariffs continues, expect higher vehicle prices, limited inventory and volatile supply and demand dynamics in the sector for the balance of the year.

Key Takeaway

The Trump administration’s tariff policies have impacted every sector around the globe, including automotive. Given the current tariffs, many automakers and dealerships are taking drastic action to offset costs as well as cater to consumers, hoping to get in front of higher vehicle prices and limited inventory. Currently, the near-to-medium-term outlook is uncertain, but it will be key to observe how tariff negotiations with other countries continue to develop over the coming weeks, as well as any near-term positive news in the sector.

Sources:

1-5Bloomberg

6AutoNation – Q1 2025 Earnings Call Transcript; 4/25/2025

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.