Credit Downgrades Are Poised to Reshape the Bond Market

May 15, 2025

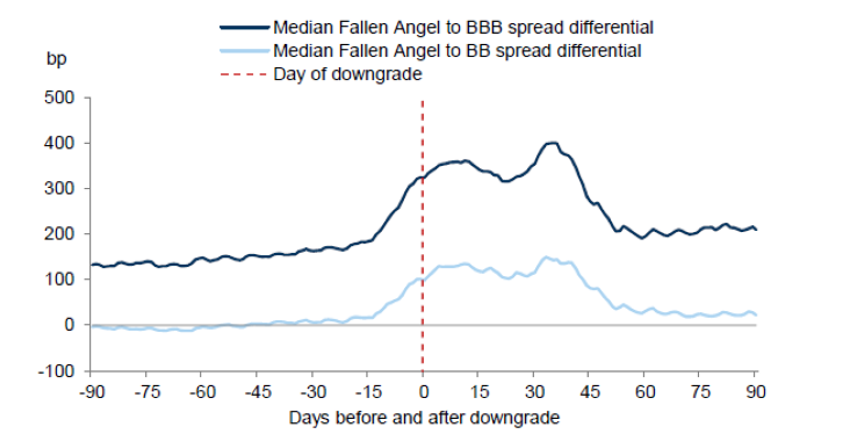

Corporate bonds are rated by credit agencies to assess the creditworthiness of the issuing company and their ability to repay debt. These agencies assign credit ratings — AAA, AA, A, BBB, BB, B, CCC, CC or C — that investors utilize to evaluate the risk of lending money. Investors may sometimes dismiss these ratings as the agencies are often slow-moving, requiring multiple quarters of earnings and commentary before changing a company's credit rating. However, the impact of ratings on bond performance remains notable, particularly when upgraded to investment-grade status or downgraded to high-yield status. These are known as rising stars (BB to BBB for example) and fallen angels (BBB to BB for example). Typically, fallen angel spreads tend to widen in the weeks preceding the downgrade but begin retracing their underperformance shortly after.1 Therefore, when a bond is downgraded from investment-grade to high-yield status (BBB to BB for example), there may be an opportunity to outperform.

This phenomenon is the result of investment-grade investors being forced to sell these fallen angel bonds as their strategies may not permit high yield securities. Typically, this type of selling occurs in a short window, overwhelming the demand in the smaller high-yield market, which causes disproportionate spread widening and price declines around the downgrade month. However, this dynamic often reverts once trading activity normalizes as high-yield investors are now able to buy the former investment-grade bond, benefiting from the temporary price dislocation.

Today’s Chart of the Week theme is especially relevant as fallen angels are expected to exceed rising stars in 2025.2 Barclays is forecasting a range of $40 billion to $60 billion of investment-grade bonds to be downgraded in 2025 compared to $6 billion through November 4, 2024.3 Most recently, Whirlpool was downgraded to high yield as the appliance maker experienced weak demand and a slower housing market that affected earnings. Due to weakened credit metrics and earnings, Ford, Boeing, Paramount and Warner Bros. are other investment-grade companies at risk of downgrade. If these companies are downgraded, expect large inflows in the high-yield market.

Key Takeaway

Increased downgrades from investment-grade to high yield would lead to growth within the high-yield market. With expectations for increased fallen angel activity in 2025, there may be some opportunities ahead to take advantage of these scenarios.

Sources:

1Goldman Sachs Economic Research; 7/2/2024

2J.P.Morgan; as of 4/25/2025

3Bloomberg – Credit Markets Face Risk of a $60 Billion Wave of Fallen Angels; 11/4/2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.