Cautious Capital: Private Equity’s Recovery Hits Economic and Political Headwinds

May 22, 2025

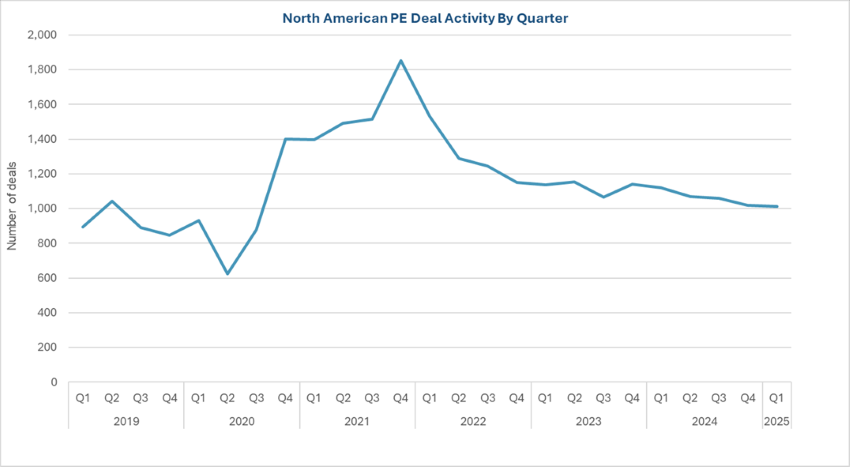

Entering 2025, the private equity (PE) industry was buoyed by strong expectations for a rebound in transaction activity. After a challenging period marked by sluggish dealmaking and exit activity, optimism was fueled by signs of economic stabilization, anticipated interest rate cuts and hopes of a more business-friendly regulatory environment under the new administration. Many industry watchers believed these factors would finally close the persistent gap between buyer and seller expectations, unlocking pent-up deal flow.

However, as the year has progressed, that initial optimism has given way to a renewed sense of uncertainty. Early data from 2025 shows that North American PE deal activity has remained subdued, with deal counts in the first months trailing behind recent years. While the macroeconomic backdrop has improved in some respects — such as easing inflation and stabilizing interest rates — other factors have emerged to cloud the outlook, including unexpected policy shifts and geopolitical volatility.

Economic and political volatility have been significant drivers of this uncertainty. New tariffs and evolving regulatory measures have injected unpredictability into the market, prompting concerns about rising costs, disrupted supply chains and the potential for retaliatory trade measures. These developments have made it difficult for PE firms to confidently price deals and forecast returns, leading many to adopt a more cautious approach despite the abundance of available capital.

Recessionary fears have further dampened transaction momentum. Recent forecasts from major banks have sharply increased the probability of a U.S. recession, citing the impact of tariffs on inflation, consumer spending and gross domestic product (GDP) growth.1 The specter of an economic downturn, combined with sticky interest rates and persistent valuation gaps, has caused some investors to pull back or delay transactions, waiting for greater clarity on the direction of the economy.

In response, PE firms are adapting by exploring creative liquidity solutions to generate returns and manage portfolio risk in a less predictable environment, such as:

- Continuation Funds – A tool utilized by general partners (GPs) that allows them to transfer select portfolio companies into a new vehicle, giving limited partners (LPs) the option to either cash out or re-invest in those companies, providing liquidity for those who opt to cash out and upside potential for those who opt to re-invest.

- Net Asset Value (NAV) Financing – A tool utilized by GPs affording them the ability to bridge liquidity gaps and manage cash flows by borrowing against the value of their portfolio without needing to sell assets.

- Partial Exits/Minority Stake Sales – A tool utilized by GPs to generate some gains and return capital to LPs, while still allowing investors to participate in future portfolio company growth.

- Dividend Recapitalizations – A tool utilized by GPs that involves issuing new debt in specific portfolio companies for the purpose of paying LPs a special dividend.

Many firms are also refocusing on value creation within existing holdings and seeking opportunities in sectors less exposed to macroeconomic headwinds.

Key Takeaway

While the long-term fundamentals of private equity remain intact, the path forward in 2025 will likely be shaped by how quickly economic and political uncertainties can be resolved. For now, the industry is navigating a delicate balance: eager to deploy capital and capture opportunities, but constrained by the realities of a volatile and shifting landscape. Successfully navigating this environment will require agility, strategic foresight and a willingness to adapt as conditions continue to evolve.

Sources:

1Chief Investment Officer – US Recession Fears Reappear in Economic Forecasts; 4/7/2025

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.