Reverse Yankees on the Rise

May 29, 2025

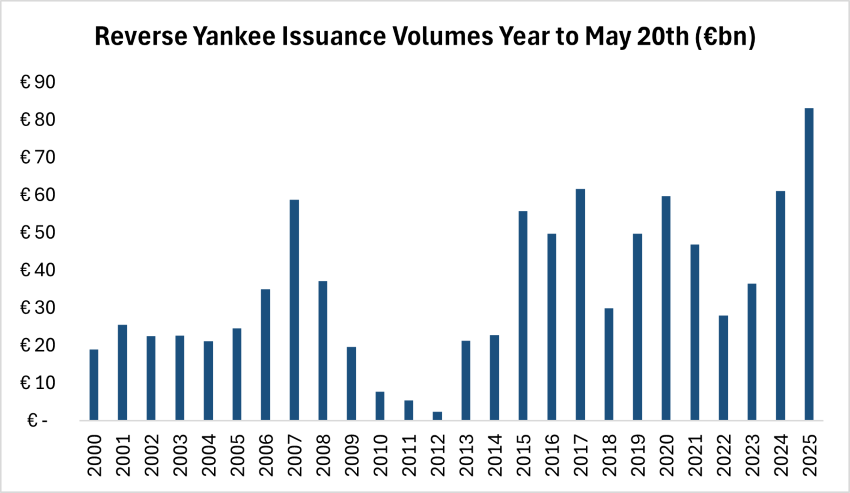

Following uncertainties in the American markets, fueled by tariffs, growing deficits and Moody’s recent credit downgrade of the United States, large U.S. corporations are increasingly turning to the relative stability of European debt markets this year.1 While it is not uncommon for American companies to issue bonds in the European market, reverse Yankee issuance has seen a 35% increase in issuance to over €83 billion compared to this time last year, as companies look to diversify funding away from the U.S. and frontload issuance needs ahead of any further unknown economic turmoil.2 The U.S. credit market was further challenged following a weak result from the May 21, 2025 Treasury auction, pushing 30-year Treasuries up to as high as 5.1%, as investors signaled their concerns over holding long-term U.S. government debt amid the implications of impending U.S. fiscal policy.3

Given the Federal Reserve’s hesitancy to lower interest rates while the European Central Bank cut rates to 2.25% in April,4 borrowing in the European market has become attractive to U.S. companies. During the month of April, the cost of borrowing in the U.S. was approximately 2% higher than in Europe.5 International companies are also able to use euro-denominated issuance as a hedge against currency fluctuations during these periods of rapid changes in exchange rates.

The U.S. credit market has long been a place of stability and confidence for investors, both in the U.S. and the rest of the world. However, as the passing of President Trump’s “One Big Beautiful Bill Act” looms — set to increase the debt ceiling by $4 trillion — treasury yields climb and volatility in the dollar rises, companies are looking elsewhere in the world to find lower cost debt in a steadier environment.6 Aside from the $4 trillion increase to the debt ceiling, the bill is also reportedly set to expand the U.S. government’s deficit by approximately $500-600 billion per year through 2034.7 As companies seek market and political stability elsewhere and the American share of the euro market increases, it is also likely that U.S. political decisions will begin to have greater impacts on the euro bond market than previously.

Key Takeaway

The U.S., once the economic safe harbor of the world, is seeing weakening demand and supply shifting to international markets, with reverse Yankee deals accounting for over 30% of euro issuance this year, more than 10% above normal figures.8 At least for the time being, some companies are seeking more predictable alternatives to the U.S. credit market volatility, as investors push back against the uncertainty of economic and fiscal policy. As always, we remain focused on our disciplined investment process and long-term approach.

Sources:

1-3, 5-7Bloomberg

4,8Financial Times – Reverse Yankee’ deals hit record as US companies flock to euro debt market; 5/14/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.