Secured Debt Gains Ground in the High-Yield Landscape

June 26, 2025

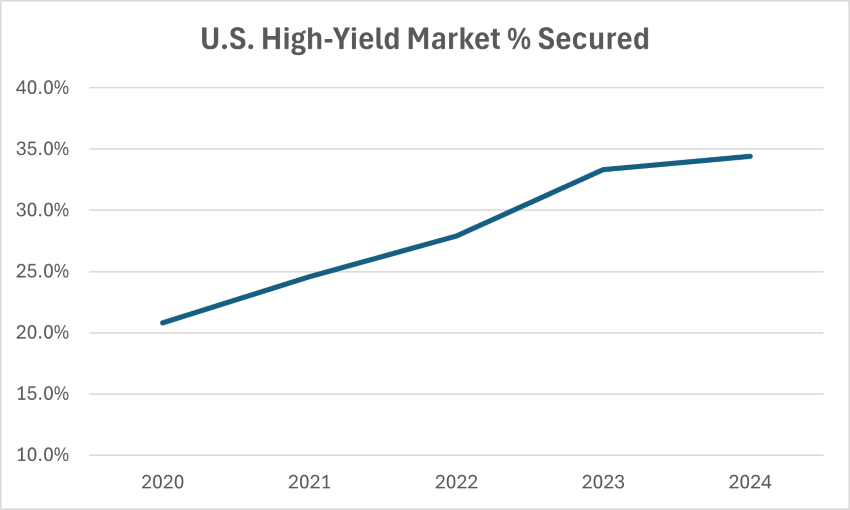

If, like me, you have been wondering why it seems as if more high-yield bond deals are secured than they historically have been, it is more than perception — it’s reality. The issuance of senior secured bonds has spiked recently. Over the past five years, the percentage of the U.S. high-yield bond market that is secured has increased from approximately 20% to nearly 35%.

Secured bonds have assets pledged to lenders as collateral. These assets can be physical in nature, such as a building or inventory, or they can be a pledge of the equity of the business. The collateral provides additional protection to creditors over that of unsecured bonds in the event the issuer defaults on the debt. Secured lenders also benefit from a priority claim over unsecured lenders in the event of a default. As a result, secured notes generally have a higher recovery rate than unsecured notes.1 According to S&P Global, the mean recovery rate for senior secured bonds from 1987 to 2023 was 58.1%, comparing favorably to the recovery rate of 44.8% for unsecured bonds during the same period.2

While there are several factors contributing to the dramatic increase in the percentage of bonds issued that are secured, the technical backdrop may be the driving force. Higher interest rates have increased the cost of borrowing money over the past few years, especially for riskier credits. One way to mitigate the higher cost of borrowing is to offer secured debt versus unsecured debt. Secured debt is often less expensive to issue due to its enhanced protections. Borrowers tend to look to the loan market to issue secured debt; however, current market conditions have made it cheaper to issue debt in the high-yield market.

Key Takeaway

So, where do we go from here? As the yield curve “normalizes” as it has in 2025, and potential rate cuts approach, which would reduce the overall cost of borrowing, one might expect to see a reduction in the percentage of high-yield bond deals that are secured. However, that has not occurred yet. In fact, of the ten companies that priced high-yield bonds during the holiday-shortened week from June 16 to June 20, seven offered secured bonds, while only three issued unsecured bonds.3 While we may begin to observe a decline in the preponderance of secured bonds over the next 6-12 months, it remains to be seen whether the market will return to a more modest level of secured high-yield debt that existed prior to the recent expansion.

Sources:

1,2S&P Global - Default, Transition, and Recovery: U.S. Recovery Study: Loan Recoveries Persist Below Their Trend; 12/15/23

3Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.