Hot Summer for High-Yield Bond Issuance

August 14, 2025

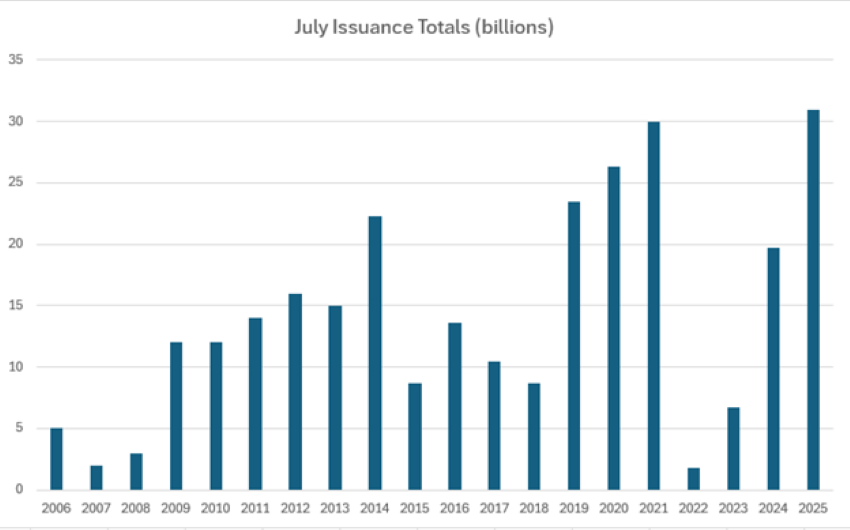

July was especially busy for high-yield (HY) corporate credit investors in the primary market. We saw a huge wave of new bond issuance as HY rated companies took advantage of the wide-open debt capital markets. Companies came to market to meet strong investor appetite for corporate bonds. This is a stark rebound from where the market was earlier in the year around “Liberation Day.” At that time, overwhelming uncertainty essentially froze the debt capital markets, and investors were less likely to lend to companies, not knowing what company profits may look like in a few months. Now that those headlines are behind us and the impact of tariffs is likely less severe, there has been a strong rebound in the primary market. As displayed in today’s Chart of the Week, this dynamic has led to the busiest July for junk bond issuance over the past two decades, with over $31 billion of new issuance.1

Strong supply is continuing into August alongside robust corporate earnings and the expectation of rate cuts this year. This supply has driven HY bond spreads to near-historic lows, relative to the past 25 years,2 making it harder to find good value in such a booming market. As a result, investors have dipped lower into credit quality to achieve yield. In July, lower quality CCC-rated bonds were the best performing asset class in HY as BB, B and CCC issues returned 0.20%, 0.32% and 1.47%, respectively.3 Finding cheap HY bonds has been a challenge, creating a haves and have-nots scenario. Good, higher-quality credit has been trading exceptionally tight, while the have-nots are trading much wider.

Key Takeaway

Appetite for yield, tight spreads and strong demand for new paper pulled borrowers into the market this summer. HY rated companies took advantage of the debt capital market to sell more than $31 billion in July. June was also a busy month, pricing more than $37 billion, which was the busiest since September 2021.4 With August off to a strong start as well, we’re experiencing a hot issuance market.

Sources:

1-4Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.