Artificial Intelligence’s Insatiable Thirst for Power

October 23, 2025

Over the past few years, artificial intelligence (AI) has been the most discussed and opined on topics in recent memory. It seems like there is a new large language model, AI company or use case for AI almost daily and the amount of capital chasing the opportunity set is unprecedented.

Just this year, OpenAI has signed almost $1 trillion worth of deals with large technology companies as part of its mission to become the go-to player in the ecosystem, as seen below:1

- $300 billion agreement with Oracle for computer infrastructure over the course of five years2

- $22 billion deal with CoreWeave for use of its data centers3

- Undisclosed partnership with Broadcom to develop and deploy 10 gigawatts (GW) of custom AI accelerators to scale AI infrastructure4

- $100 billion investment from Nvidia, which a large portion will likely be used for leasing Nvidia graphics processing unites (GPU)5

- Undisclosed partnership with Advanced Micro Devices (AMD) to deploy 6 GW of AMD GPUs on a multi-year, multi-generation agreement; OpenAI will receive a warrant for up to 160 million shares of AMD common stock, vesting over time6

The goal of these various agreements is to build out the infrastructure required to operate AI and machine learning technologies at scale. However, there are some shortcomings, as AI requires a significant amount of power and compute capacity in order to satisfy the extensive demand.

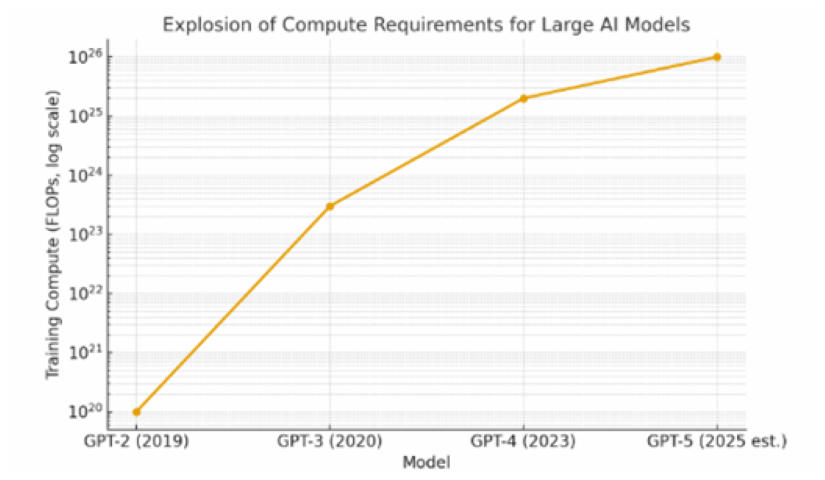

For the purpose of this exercise, I asked ChatGPT to construct a simple chart that shows how compute requirements have grown from the early large language models (GPT-2 in 2019) to the most modern version (GPT-5 in 2025).* It’s easy to see that training compute has grown exponentially in just a few years, and we should expect that to continue over the near-to-medium term.

The estimate and computing cost required to generate the chart above was about 15 watts for 0.5 seconds, or 7.5 joules (J). Converting J to kilowatt (kW) hours, 7.5 J divided by 3.6 million J per kW hour, at an estimated electricity cost of $0.15 per kWh, equates to a fraction of a cent, roughly $0.00000031.

As compute requirements continue to expand, the need and availability of power will be extremely important. Investors, researchers, utilities and even the government are keeping a close eye on AI’s power demands.

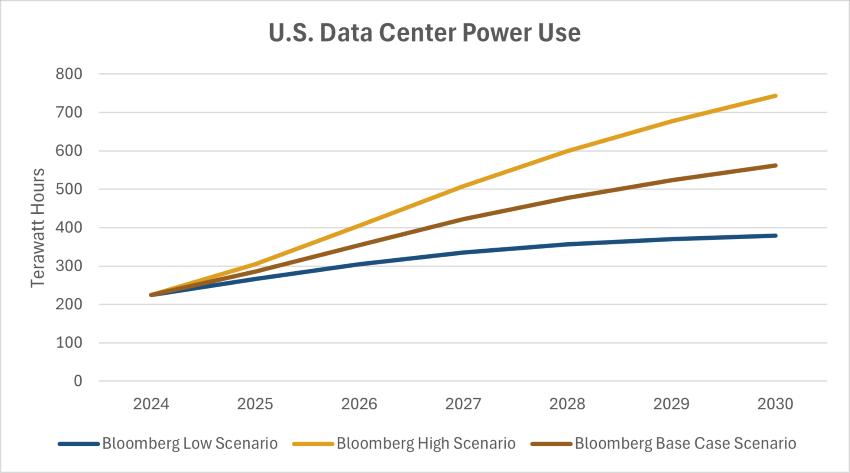

According to Bloomberg, U.S. data center power demand will more than double by 2028, favoring fast-to-deploy solar, storage and gas with AI-driven consumption expected to increase 1 to 5 billion cubic feet a day by 2030.7 In addition, Northern Virginia and Dallas, two of the U.S. primary data-center hubs, could see significant increases in power requirements thanks to the demand for AI and machine learning.8

Furthermore, this phenomenon is only expected to continue, as hyperscalers Amazon, Microsoft, Google, Meta, Oracle and Apple will spend more than $2 trillion on data center capital expenditures (capex) over the next five years,9 and as seen in today’s Chart of the Week, power use from data centers is expected to grow to roughly 380 to 750 terawatt hours by 2030. This will require significant data center capacity, which has been slow to build out but starting to ramp up.

The U.S. added roughly 5 GW of new data center capacity in 2024 and of the projects currently under construction, another 10 to 15 GW of new power demand could come online in 2026.10 Overall, consensus 2026 capex figures for the hyperscalers have been revised upwards about 46% since January, indicating continued investment in data center capacity.11

As one would probably assume, this massive build-out and demand for electricity has not gone without some challenges. About two-thirds of the power consumed in the U.S. runs off of a state or regional grid, where the system operator manages the trading and allocation of energy.12

These costs are ultimately passed onto households and businesses on their utility bills, and can affect customers who live within a 60-90 minute drive of where some of these larger data centers are located. For instance, according to Bloomberg, in some geographies located close to data center locations, a single month of electricity now costs as much as 267% more than it did five years ago.13 In addition, U.S. electricity bills are expected to rise the most in three years this winter thanks primarily to higher retail power prices due to data center demand. The average residential consumer is expected to spend $1,130 on electricity bills in 2025.14

Key Takeaway

AI will be one of the most important technologies of our lifetime, and the demand for AI and the power it requires is reshaping the world as we know it. Trillions of dollars are being deployed into the ecosystem, across both public and private markets, as companies seek to take advantage of one of the most influential technological developments ever.

However, the demand for compute and AI do have negative consequences, which will play out over time. I expect the demand for AI will continue to grow and there will be a lot of money made over the next few years across both incumbent parties as well as new entrants who will find a way to effectively differentiate themselves. We are living through one of the most rapidly evolving technological advancements to ever exist and it will be very interesting to see what the world looks like over the next three to five years.

Sources:

1-5CNBC – A guide to the $1 trillion-worth of AI deals between OpenAI, Nvidia and others; 10/15/25

6OpenAI – AMD and OpenAI announce strategic partnership to deploy 6 gigawatts of AMD GPUs; 10/6/25

7-11Bloomberg

12,13Bloomberg – Bloomberg: AI Data Centers Are Sending Power Bills Soaring; 9/29/25

14Bloomberg – Bloomberg: US Electricity Bills Seen Rising Most In Three Years This Winter; 10/15/25

*This chart was generated using ChatGPT, based on publicly available data sources. While efforts were made to ensure accuracy and relevance, the visualization may contain approximations or interpretations inherent to automated processing. The data used is subject to change and may not reflect the most current information available. Users are encouraged to consult original sources for verification and to use this chart as a supplementary reference only.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.