Spooky Spending Keeps Markets Sweet

October 30, 2025

Spooky season is here, and as consumers have prepared for Halloween tomorrow, they have likely noticed an increase in the cost of candy, decorations and costumes. Halloween has become more expensive this year, with candy and costumes increasing by 10.8% and 11.0%, respectively.1,2 However, despite the frighteningly high costs, consumers continue to spend. According to the National Retail Federation, Halloween spending is expected to reach a record $13.1 billion in 2025, with 73% planning to celebrate the holiday this year.3

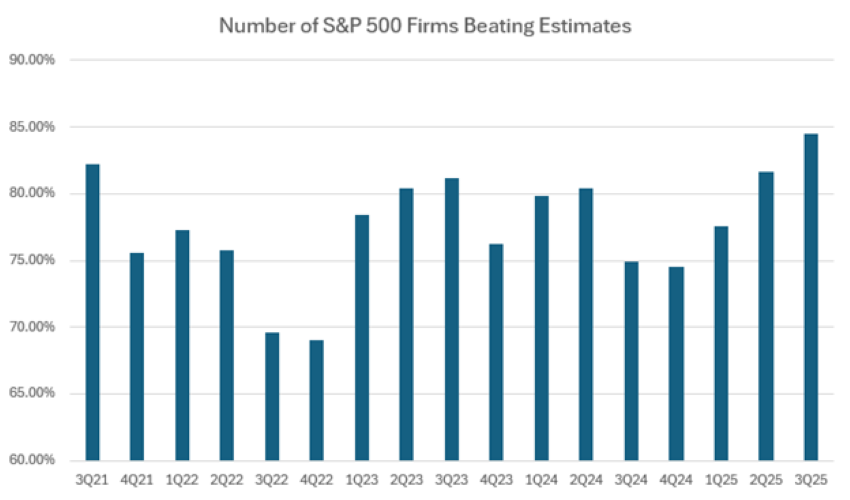

These few Halloween statistics reflect a trend that extends to the broader economy as well. Consumers continue to spend despite tariffs and inflation, especially on services, travel and discretionary goods. Retail sales activity remains strong, with the most recent U.S. consumer spending report in August showing an increase in spending that was higher than expected.4 This stronger-than-expected spending and demand is flowing through to corporate earnings. Today’s Chart of the Week shows that as of last week, approximately 85% of S&P 500 Index firms that have reported third-quarter earnings so far have surpassed profit estimates, which is the highest since 2021.5 These record-breaking corporate earnings are providing support to markets, as the S&P 500 Index is reaching new highs and credit spreads are hovering near all-time lows.6 The U.S Corporate Aggregate Index is at a spread of 76 basis points, showing that bond investors are not being compensated much compared to government bonds of the same maturity.7

Key Takeaway

Continued strong corporate earnings are easing investor concerns regarding the economy, providing support to markets. As we enter the thick of earnings season, I expect corporate earnings to continue exceeding expectations. The tricky part for an investor is finding value amid these strong earnings, as credit spreads continue to be tight, to determine if the reward for taking unusual risks is worthwhile.

Sources:

1CNN – Why Halloween candy is getting more expensive and less chocolate-y; 10/27/25

2CBS News – Halloween costume prices are rising. Here's how one man uses thrifting to help families in need; 10/18/25

3National Retail Federation – NRF Consumer Survey Finds Halloween Spending to Reach Record $13.1 Billion; 9/18/25

4Reuters – Solid US consumer spending in August underscores economy's resilience; 9/26/25

5Bloomberg – Early US Earnings Point to Best Corporate Results in Four Years; 10/22/25

6,7Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.