Junk Lags as Investors Seek Safety in Quality

November 13, 2025

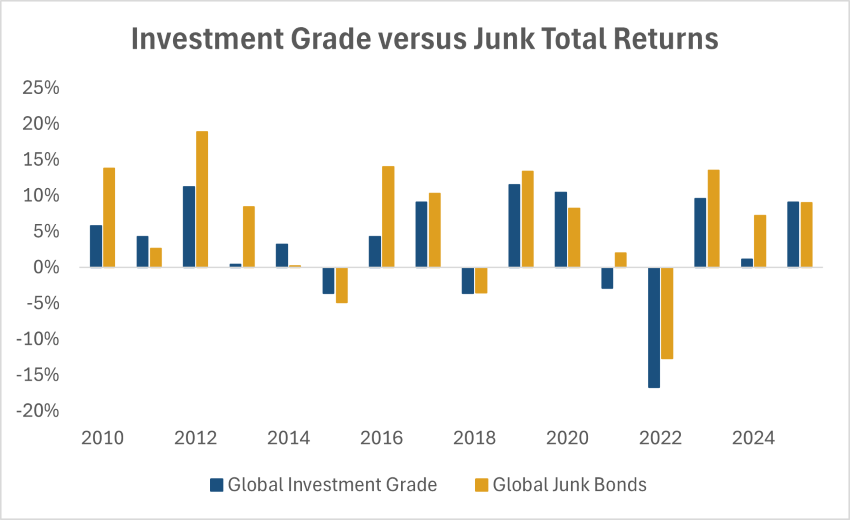

Despite a broad rally across U.S. assets, driven by falling interest rates, ongoing economic resilience and tight credit spreads, risky junk debt has underperformed.1 In the month ended Nov. 6, CCC-rated bonds in the U.S. have dropped nearly 0.8%, underperforming the broader high-yield market as investors increasingly avoid the riskiest debt.2 In terms of spread, CCC debt widened twice as much as that of all high-yield debt — approximately 27 basis points (bps) from Oct. 31 through Nov. 6 — compared with 13 bps on average for the rest of high yield.3

In contrast, the investment-grade (IG) market is on pace to have one of its best return years since 2020, with BBB-rated bonds performing the best.4 If IG continues its current performance, it will mark the first outperformance over high yield since 2020, when investors fled to safer securities amid extreme global uncertainty.5 However, IG spreads have seen some pullback recently, with $75 billion in supply from technology companies in September and October alone to fund increasing artificial intelligence demand.6 While gross issuance is reaching record levels, it is not outpacing maturities in the market, leaving an even stronger demand for debt.7

Investors are not seeing the same type of returns for junk bonds, despite outsized risk.8 Recent bankruptcies in riskier names, such as Tricolor Holdings and First Brands Group, have resulted in millions of dollars in losses at some large banks and funds, making investors more wary.9 Following these two bankruptcies, Jamie Dimon, chief executive officer of JPMorgan Chase, said, “I probably shouldn’t say this, but when you see one cockroach, there are probably more. Everyone should be forewarned on this one.”10 These market disruptions have worried investors, leading many to shy away from lending to the riskiest borrowers. This caution has also extended to the leveraged loan market, with four deals shelved last month and six deals withdrawn between August and September.11 Investors are more comfortable with IG issuers in the event of market and economic turbulence, given that the U.S. government is more likely to provide support, as seen during the pandemic.

Key Takeaway

Amid possible market uncertainty this year, credit investors have remained more cautious, preferring more liquid and higher-quality structures. This has led to IG achieving one of its best performance years since the pandemic-driven flight to quality, offering better returns and less risk than some high-yield offerings, which are experiencing notable underperformance.

Sources:

1,4,5,7,8Bloomberg – Credit Punishes the Brave as Safest Debt Pulls Ahead: Macro View; 11/7/25

2,3,11Bloomberg – Fear Is Coming Back to the Junk Bond Market: Credit Weekly; 11/8/25

6Reuters – Five debt hotspots in the AI data centre boom; 11/5/25

9,10Bloomberg – Dimon’s ‘Cockroach’ Fear Revives Threat of Cracks in Credit; 10/14/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.