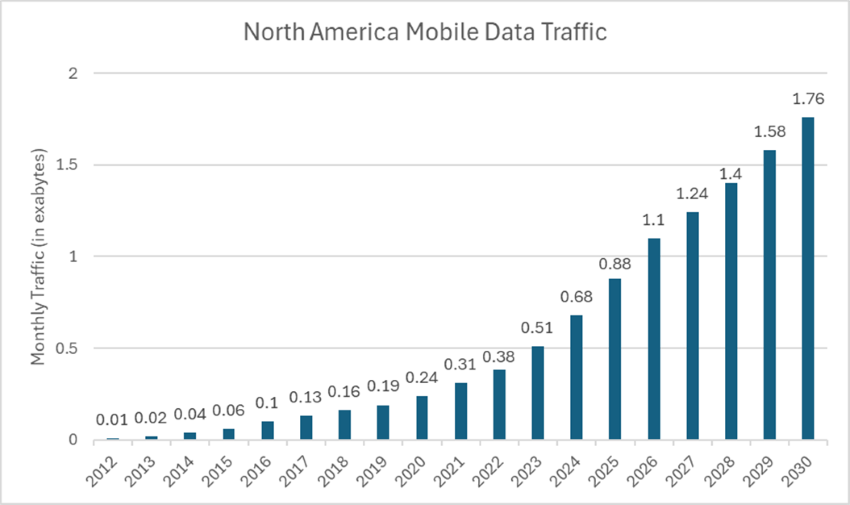

Mobile Data Traffic is Primed to Double by 2030

December 18, 2025

Since the arrival of smartphones, North America's appetite for mobile data has increased dramatically, and the proliferation of data-intensive applications and video streaming continues to drive robust and sustained growth. As highlighted in today’s Chart of the Week, monthly traffic has grown from a mere 0.01 exabytes (EB) in 2012 to over 0.88 EB today, representing more than an 80-fold expansion in just over a decade.1 While growth has moderated from the pace of the 2010s, monthly data traffic across the continent is still expected to double to 1.76 EB by 2030.2

Behind this surge lies a fundamental shift in how people consume digital content and conduct daily life through mobile devices. Video streaming remains a dominant contributor to mobile bandwidth usage, with streaming platforms continuously raising quality standards through 4K and emerging 8K formats. Social media platforms have evolved from text-based interactions to video-first experiences, with short-form video content becoming a dominant mode of engagement.

Meanwhile, the rise of remote work and hybrid workplace models has transformed smartphones and tablets into essential business tools, driving sustained increases in video conferencing, cloud storage access and collaborative application usage. The gaming industry's mobile revolution further accelerates data demands, with increasingly sophisticated titles requiring constant server connections and real-time multiplayer functionality. Additionally, the Internet of Things (IoT) is expanding beyond traditional devices, with smartphones serving as control hubs for smart homes, connected vehicles, wearable health devices and an expanding ecosystem of connected sensors and appliances.

The infrastructure implications of this growth are profound and multifaceted. The ongoing rollout of 5G has increased the need for more tower infrastructure and new equipment as carriers densify networks to reduce latency. Small cell deployment has emerged as a critical enabler, especially in high-density urban areas, such as transit hubs, stadiums, university campuses and business districts, where macro towers alone cannot meet capacity and latency demands. Distributed antenna systems (DAS), which utilize a network of spatially separated antenna nodes connected to a common source to provide wireless coverage within buildings, tunnels and other challenging environments, have become critical for venues such as airports, convention centers and large office complexes where traditional outdoor cell towers cannot adequately penetrate.

Satellite technology is emerging as a complementary layer in this infrastructure evolution, particularly for addressing coverage gaps in remote and underserved areas where deploying terrestrial infrastructure is economically challenging. Partnerships between telecommunications operators and satellite providers, such as collaborations with Starlink and Globalstar, are bringing emergency communications, rural connectivity and backup disaster-recovery capabilities to mobile networks. While satellites are unlikely to replace terrestrial infrastructure for high-capacity urban and suburban markets, they provide crucial connectivity for rural areas, maritime operations, emergency response scenarios and locations where traditional network deployment faces geographical or economic constraints.

Key Takeaway

North American mobile data traffic is on track to double by 2030, driven by the growth of video streaming, the persistence of hybrid work, the evolution of mobile gaming and the rapid expansion of IoT devices. Meeting this demand will require a broad-based buildout across towers, small cells, DAS, fiber backhaul and satellite networks. As data consumption continues its relentless upward trend, the scale and complexity of required investment reinforces digital infrastructure’s role as the essential backbone of modern connectivity.

Sources:

1,2Statista

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.