Solid 2025 Returns

January 8, 2026

Global equity and fixed-income assets broadly had a very strong year.1 U.S. equities finished near all-time highs, and credit products also set record spread levels during 2025.2 In the spring, tariffs caused significant market volatility, but it was short lived as concerns regarding the long-term impact quickly waned. In the second half of the year, attention shifted to additional rate cuts from the Federal Reserve (Fed) and artificial intelligence (AI) fueling strong economic growth.3 Meanwhile, markets began to anticipate the Trump administration’s Fed chair nominee. While the nominee is likely to favor lower rates, concerns surrounding Federal Open Market Committee independence linger.

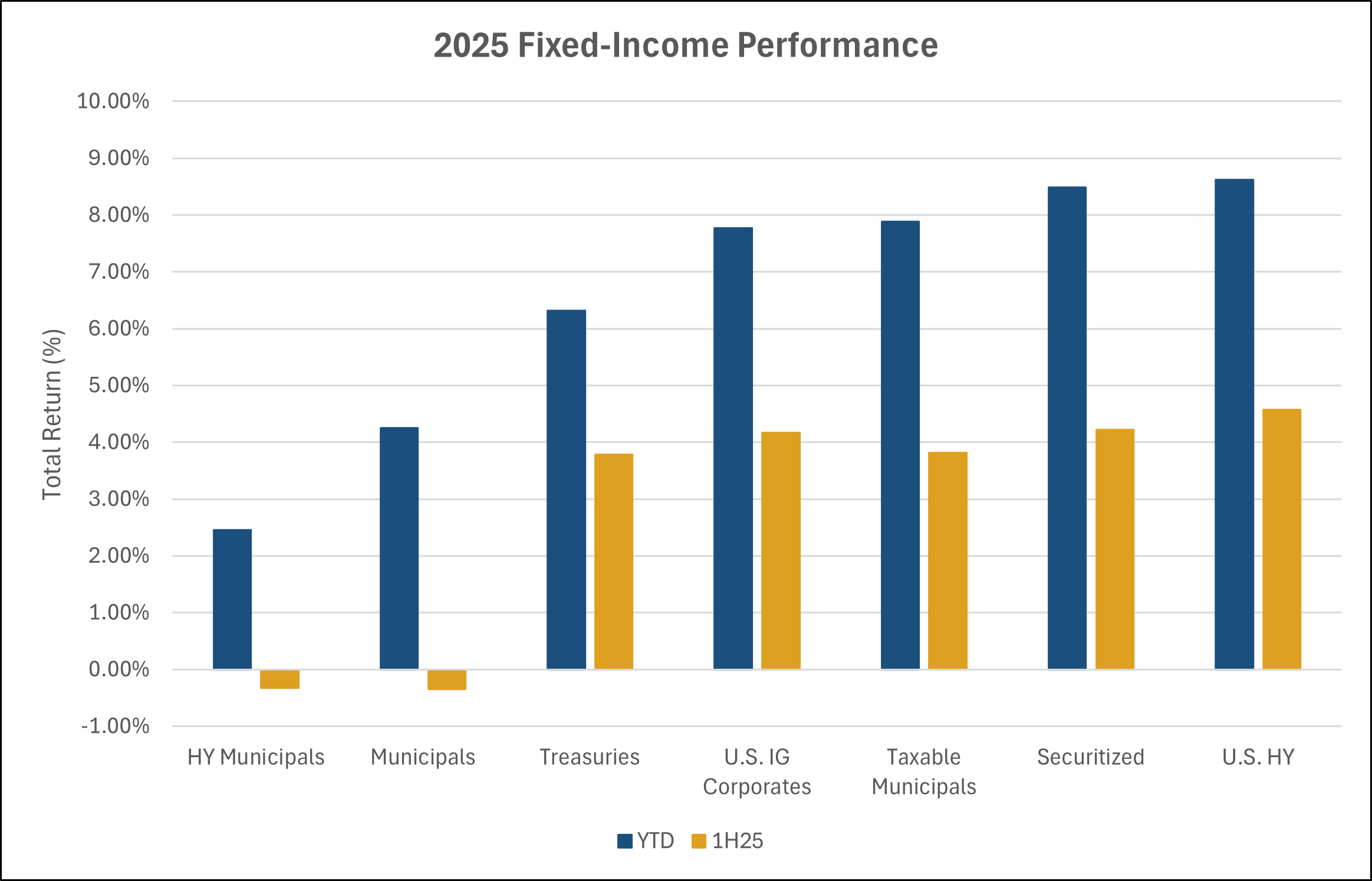

Today’s Chart of the Week highlights the 2025 performance of select fixed-income indices. All the products posted solid returns, though tax-exempt municipals lagged due largely to a slower start in the first half of the year.4 Exempt bond valuations started the year at very rich levels, with 10-year ratios at 67%.5 The exempt market was slower to recover from the Liberation Day volatility than most other markets. Elevated supply and concerns about retail demand amid a tax-friendly Trump administration also contributed to the slower rebound. Taxable municipals performed in line with other taxable sectors.6

Corporate credit—across both investment-grade (IG) and high yield (HY)— delivered solid returns.7 IG fundamentals remain on stable footing, with median gross leverage holding in the 2.25-2.4x context for more than four years.8 In HY, earnings were generally healthy, though performance appears to be diverging across ratings.9 Fundamentals strengthened for BB/B names, while lower-quality borrowers faced more challenges.

Capital expenditure (capex) expectations going forward continue to grow, driven by technology and hyperscalers. In the third quarter of 2025, capex spending hit a record of $312 billion, with one-third of the total coming from five hyperscalers (Amazon, Google, Meta, Microsoft and Oracle).10 This spending is expected to persist, with tech and hyperscaler capex growth forecast at 32% in 2026 compared to 7% for non-financial, non-tech companies.11 Ahead of this spending, their balance sheets remain strong, with the average gross leverage for the five hyperscalers below 1x, and excluding Oracle, the median rating is AA-.12

Key Takeaway

Investment performance in 2025 was strong, with both municipal and corporate credit on stable footing going into 2026. With a new Fed chair expected and the current committee already appearing to have an easing bias, solid economic growth expectations seem warranted. Mergers and acquisitions activity is likely to accelerate along with capex, as we seek to fully develop AI’s capabilities. The challenge for both municipal and corporate credit markets is the current state of valuations. Municipal ratios are tight, as are corporate credit spreads, making credit selection a key driver for 2026.

Sources:

1,2,4-7Bloomberg

3Bureau of Economic Analysis – Gross Domestic Product, 3rd Quarter 2025 (Initial Estimate); 12/23/25

8-12Morgan Stanley

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.