Private Equity Secondaries Continue to Demand Attention from Institutional Investors

January 22, 2026

The lack of liquidity in private equity (PE) portfolios over the past 12-18 months has been well documented. There have been several contributing factors, including the 2024 presidential election, tariff concerns, interest rate uncertainty, wide bid-ask spreads between buyers and sellers and limited demand for businesses not considered to be “A” assets or companies lacking an artificial intelligence (AI) story. While sponsors, venture capitalists and other private-market investors look to return capital to investors in 2026, the secondaries market has continued to grow, offering limited partners (LPs) a “secondary” avenue for liquidity.

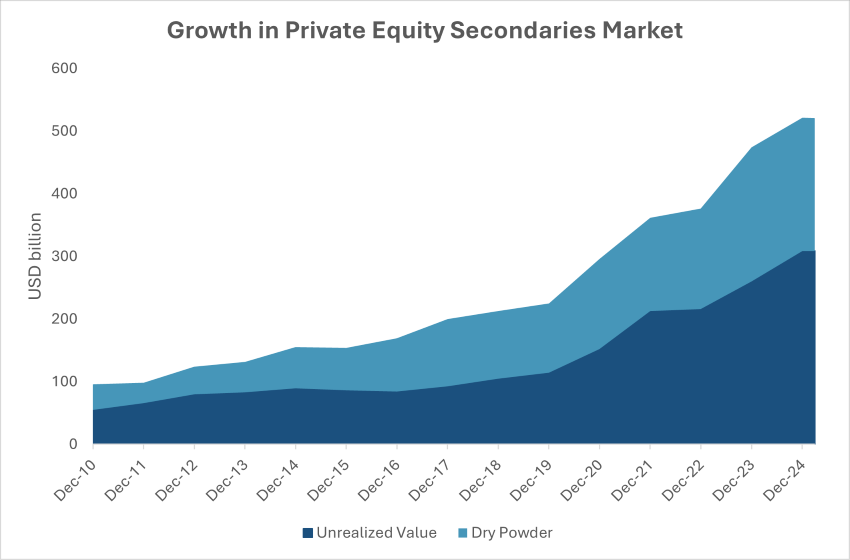

As seen in today’s Chart of the Week, the secondaries market has grown significantly, from roughly $100 billion in assets under management (AUM) in 2010 to over $500 billion at the end of 2024 (data available up until March 2025).1 Why are secondaries receiving so much attention, and how is this newer asset class attractive to investors? There are a few reasons, including maturity and broader knowledge of the strategy, flexibility, a shorter path to liquidity and reduced J-curve effects, access to seasoned assets, as well as relatively consistent performance.2

First, secondaries began to take shape more institutionally around the year 2000.3 Given the asset class’s maturity and positive attributes, more allocators are realizing the potential benefits a secondaries strategy can provide to a diversified portfolio. This dynamic is demonstrated above as secondaries’ share of private equity AUM has nearly tripled since 2000, with momentum accelerating further since the pandemic.4

Second, the flexibility with which secondaries investors can structure their investments to maximize the discount at entry, the period during which the portfolio is funded and the assets they ultimately want to purchase contribute to the strategy’s appeal. Investors can also purchase preferred equity tranches, tender offers and hybrid strip sales, blending primary and secondary capital.5

Third, given secondaries investors are typically purchasing portfolios that are mostly invested, LPs gain access to seasoned assets that are through the majority of the “value creation” period and closer to a liquidity event. Some secondaries investors also frontload their funds through LP-led transactions, thereby reducing or limiting the J-curve and returning capital to investors more quickly. This attribute of the strategy can also help allocators forecast cash flows and budget more effectively, leading to increased appetite for the strategy.

Fourth, secondaries funds may provide relatively consistent performance due to accelerated distributions, insights into the underlying assets of the portfolios, knowledge of the underlying general partners or fund investors, as well as diversification across fund vintages, sectors and geographies. While a secondaries fund may not provide the upside that an early-stage venture capital fund might, the band of outcomes for secondaries performance is much tighter. For some allocators, they may be more appropriate for their investment program or strategy.

Finally, secondaries funds can only purchase portfolios when sellers are available. As mentioned earlier, given the lack of liquidity across the broader PE market, many LPs have been looking to generate cash and, as a means of doing so quickly, have turned to the secondary market. Secondaries offer a faster route to liquidity, provide certainty of closing and efficient pricing. Sellers of assets will normally have to sell their holdings at a discount, which varies depending on the type of strategies the LP is invested in, but given the need for cash, this is sometimes necessary.

Key Takeaway

The lack of exits across the broader PE market has created challenges for some allocators and LPs that need cash. Many are now turning to the secondary market to sell what LPs consider non-core holdings or other assets that may not be critical to their go-forward investment strategy. This has been a boon to secondary capital raising and to the asset class's broader popularity.

Given the attributes of secondaries mentioned above, as well as the ongoing liquidity needs of investors, I expect secondaries to remain a popular avenue for allocators looking to right-size their portfolios. For secondaries fund investors, I expect performance to continue to be attractive with regard to a diversified portfolio, as secondaries funds, with a mix of LP-led and general partner-led transactions, provide earlier distributions and upside in single asset transactions, leading to overall attractive risk/reward scenarios.

Sources:

1Preqin

2-5CVC Capital Partners – Secondaries in the Spotlight; 11/26/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.