From Power to Pressure: GPs Beginning to Discount their Management Fees

February 12, 2026

By the late 1970s and early 1980s, the 2% management fee had become the standard for private equity funds because it was, quite simply, what early firms needed to cover their operating costs. In the early years of private equity, funds were relatively small, and 2% provided enough revenue to support investment teams, travel, deal-related expenses, office space and basic infrastructure. Once the 2% norm solidified, it became self‑reinforcing: general partners (GP) who attempted to charge more faced limited partner (LP) pushback, while those who charged significantly less risked signaling underinvestment or weakness in their platform.

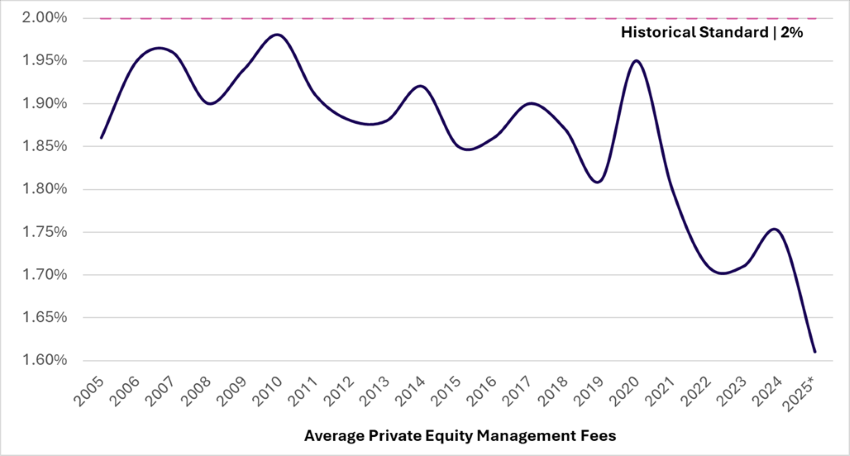

Until 2010, average management fees hovered just below that long‑held 2% standard, with only modest year‑to‑year movement.1 This stability reflected a seller’s market. Top-performing GPs offered a scarce, high‑performing product relative to public equity alternatives, and LPs were willing to pay for access. Between 2010 and 2015, management fees began a slow, but steady decline.2 Over the last decade, however, the rate of decline has accelerated—interrupted briefly in 2020, when robust fundraising allowed managers to adhere more closely to legacy terms.3 Since that time, the downward trend has continued, with average management fees falling to 1.61% by the end of June 2025, marking the lowest point in the dataset and a clear break below the traditional headline rate.4

Several forces have converged to push fees lower. First, private equity’s net outperformance relative to public equity has narrowed, increasing LP fee sensitivity and willingness to push for fee reductions. Second, the fundraising environment has become more challenging: exits have slowed, distributions have fallen and many LPs are overallocated to private equity—prompting many GPs to lower headline fees and offer discounts in order to secure commitments. Third, capital has concentrated at the top, with a growing share of commitments flowing to mega‑funds. These fund companies can spread fixed costs over a much larger asset base, enabling them to accept lower headline rates while still growing fee dollars.

For LPs, the declining fee trend is a visible sign that negotiating leverage has shifted back in their favor—a reversal from the historically GP‑friendly environment. Lower ongoing fees reduce the level of net outperformance required to justify private equity’s illiquidity and complexity relative to lower-cost public‑market strategies. For GPs, the implications are more nuanced. Large managers may benefit from the optics of reduced fees, while still increasing absolute fee revenue thanks to larger fund sizes. Smaller, emerging and mid‑market firms, on the other hand, face the opposite reality: margin pressure that may demand clearer differentiation through strategy focus, consistency of outperformance or enhanced co‑investment opportunities, rather than simple price competition.

Key Takeaways

The long, steady drift downward in management fees is less an endpoint than an inflection point—evidence of a market evolving toward more transparent, competitive pricing. Access alone is no longer sufficient to command premium economics. Going forward, managers will need to better justify their fees.

Sources:

1-4Preqin

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.