AI Revolution: A Look Into the Future

March 16, 2023

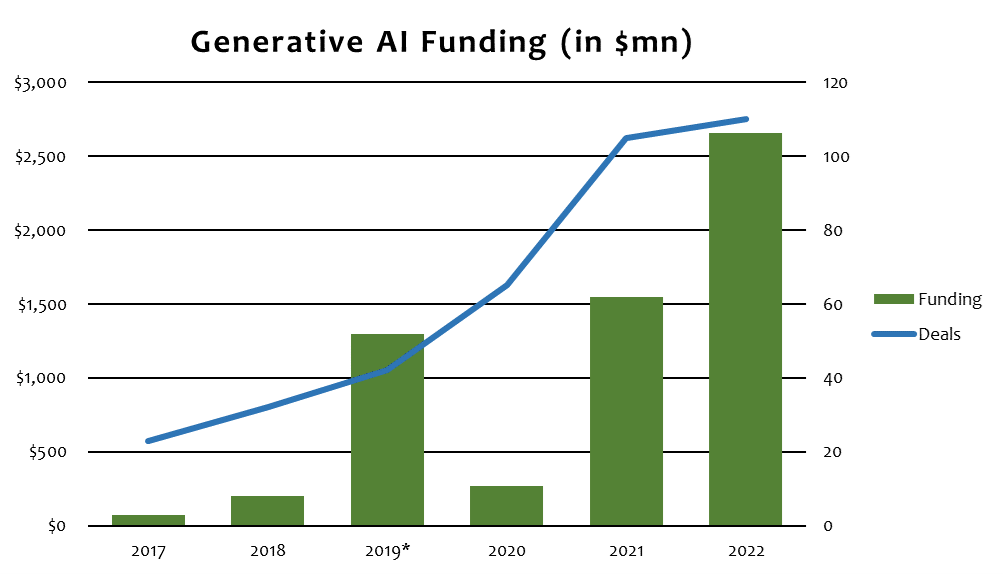

The recent growth of generative artificial intelligence (AI) has been explosive, with funding coming from many of the world’s largest venture capital (VC) firms, including Insight Partners, Kleiner Perkins, Sequoia, Andreessen Horowitz and Lightspeed. As illustrated in this week’s chart, the amount of funding for generative AI companies has skyrocketed from just $70 million in 2017 to over $2.5 billion in 2022.1

Generative AI is a branch of artificial intelligence that uses algorithms to create new content, whether it’s text, images or audio. The process involves feeding a vast dataset into a machine-learning model that learns from the data’s patterns and generates novel content. As the model obtains additional data, it can refine and enhance its output.

There are many types of generative AI, including language models, image generators and music generators. Language models are among the most common, and used for purposes such as language translation, chat-bots and writing news articles. AI-based image generators, such as RunwayML, are used to create new images or modify existing ones; while music generators, like Amper Music, allow users to leverage AI to create custom music for video games, movies and podcasts.

In addition to these more well-known applications, there are a number of emerging use cases for generative AI in industries such as agriculture, education, pharmaceuticals and material sciences. For example, generative AI can be used to speed up drug discovery by generating new drug compounds that are optimized for specific diseases. Generative AI is also being used to develop new crop varieties. Researchers are using machine-learning algorithms to analyze genetic data from different plants in order to identify combinations of genes that are likely to produce desirable traits, such as drought resistance or improved yield.

Currently, six generative AI companies have attained “unicorn” status, including OpenAI, Jasper, Stability AI, Hugging Face, Lightricks and Glean. In venture capital vernacular, a unicorn is a privately held startup that has a valuation exceeding $1 billion. OpenAI, which recently received funding from Microsoft, is unquestionably the most well-known on this list, with a current valuation of over $20 billion. OpenAI has been in the spotlight following the release of its AI chatbot, ChatGPT, at the end of last year. In partnership with OpenAI, Microsoft launched a new version of its search engine, Bing, powered by the technology that underpins ChatGPT.

Numerous other leading technology companies, such as Google, Nvidia, Facebook and Adobe, have their own generative AI under development. For instance, Google is soon expected to release an AI engine called Bard, although the launch has been postponed following a fumbled announcement.

Despite the potential of generative AI, a number of concerns have been cited as it has grown in popularity. For one, the models are only as good as their inputs, which can result in inaccurate or outdated results. There are also concerns about the potential misuse of generative AI, such as the creation of fake news or the manipulation of public opinion. Some machine-learning approaches can be used to generate synthetic media, such as images, videos and audio, that can be difficult to distinguish from real media.

There is also the risk that generative AI could be used to generate personal data or even create convincing forgeries of sensitive information, which could have serious implications for privacy and security. AI raises a range of legal and ethical issues as well, such as ownership and copyright of generated content, and the potential for generative AI to infringe on the rights of individuals and groups.

One of the most commonly held concerns is that the technology could lead to job displacement, as machines become increasingly capable of performing tasks that were previously in the domain of humans. However, proponents of generative AI argue that it can complement human workers rather than replace them, allowing them to focus on more creative or complex tasks. Some also point out that generative AI can be used to democratize access to creative tools and enable more people to participate in creative industries.

Perhaps the most alarming reports are those concerning AI systems that exhibit emotions and pose a threat to their users. In one instance, Bing was recently found to be capable of generating threatening and violent content when prompted with certain inputs.2

Key Takeaway

Generative AI has been getting a lot of attention, and rightfully so. AI has the potential to impact a wide array of fields from agriculture to health care and everything in between. Its benefits include increased productivity and efficiency, the creation of personalized content, and creative output that can lead to new discoveries and innovation.

With that said, generative AI is still a nascent industry. Among the 250-plus generative AI companies that CB Insights has identified, 33% have yet to raise any outside equity funding and 51% are still at the Series A stage or earlier.3 The growth of generative AI has also surfaced real risks, some of which are downright scary and need to be addressed to ensure that generative AI is used safely and does not get abused, especially in the hands of malicious actors. Regulation is certainly forthcoming. We’re a while away from truly realizing its impact on the world but it’s certainly got many people excited, including me!

Sources:

Source1: CBInsights- The state of generative AI in 7 charts; 1/25/23

Source 2: Time- The New AI-Powered Bing Is Threatening Users. That’s No Laughing Matter; 2/17/23

Source 3: CBInsights- The state of generative AI in 7 charts; 1/25/23

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.