Big Tech’s Recent Dominance in the Stock Market

April 6, 2023

Last week marked the end of an eventful first quarter of 2023. Even after two regional bank failures and the rescue of a global investment bank, the S&P 500 Index finished the quarter up 7.03%. On a sector basis, technology was the biggest outperformer as it ended the quarter up 21.49%. This sector includes massive technology companies that are doing almost all of the heavy lifting in regard to the positive gains for the S&P 500 Index. In particular, AAPL, MSFT, NVDA, TSLA, META, AMZN and GOOGL accounted for 88% of the 7.03% gain in the index. A drawback of this index is that it gives higher weights to companies with more market capitalization. Thus, the performance of a capitalization-weighted index often comes down to the performance of a few companies. The first quarter provided a perfect example of this, as a handful of big tech rallies swayed the direction of the S&P 500 Index. The tech-heavy Nasdaq Composite, which finished the quarter up 17.67%, demonstrated this trend as well.

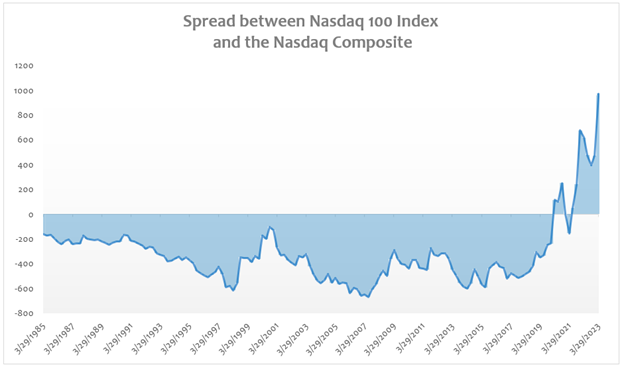

This week’s chart emphasizes how this rally has been entirely driven by big tech companies. The spread between the Nasdaq 100 Index and the Nasdaq Composite is the widest in history. The Nasdaq 100 Index (the 100 largest companies by market capitalization that are listed on the Nasdaq stock exchange) has outperformed and outpaced the broader Nasdaq Composite by roughly 960 points. The extreme influence of big tech helps explain why the index was up despite a banking crisis, higher interest rates and widespread uncertainty about what lies ahead.

Drilling down into the technology sector’s strength, these gains have been driven solely by multiple expansion. Tech forward price-to-earnings is +25% year-to-date, while tech’s 2023 earnings-per-share growth forecast has been cut from -2% to -8% year-over-year.

It will be interesting to see how long this tech rally lasts, as it was a technical shift and would need to be supported at some point by positive fundamental news in order to be sustained. This has been a notable reversal after a tough 2022 for tech stocks, as investors previously sought out less-risky investments amid the Federal Reserve’s interest-rate-hike campaign.

Key Takeaway

The first quarter highlighted how significant an impact a few big tech companies can have on an index. Their dominance year-to-date has the ability to overshadow other industries and potentially mask weakness underneath.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.