Why Have Interest Rates and Equities Responded Differently to Banking Stress?

April 20, 2023

Last month, two U.S. banks failed: Silicon Valley Bank (SVB) and Signature Bank. Additionally, a 166-year-old Swiss bank was compelled by regulators to be absorbed by UBS, another large Swiss bank. Because bank failures can be catalysts of economic recessions, investors are aware of the potential peril they bring to financial markets. This is exactly what we have witnessed in the interest rate market.

From two days before the SVB bank failure (March 8) to last Friday (April 14), the 2-year U.S. Treasury rate decreased by almost 1%. This reflects that investors were increasingly pricing in the probability of interest rate cuts by the Federal Reserve (Fed) in the near future in response to a possible economic downturn.

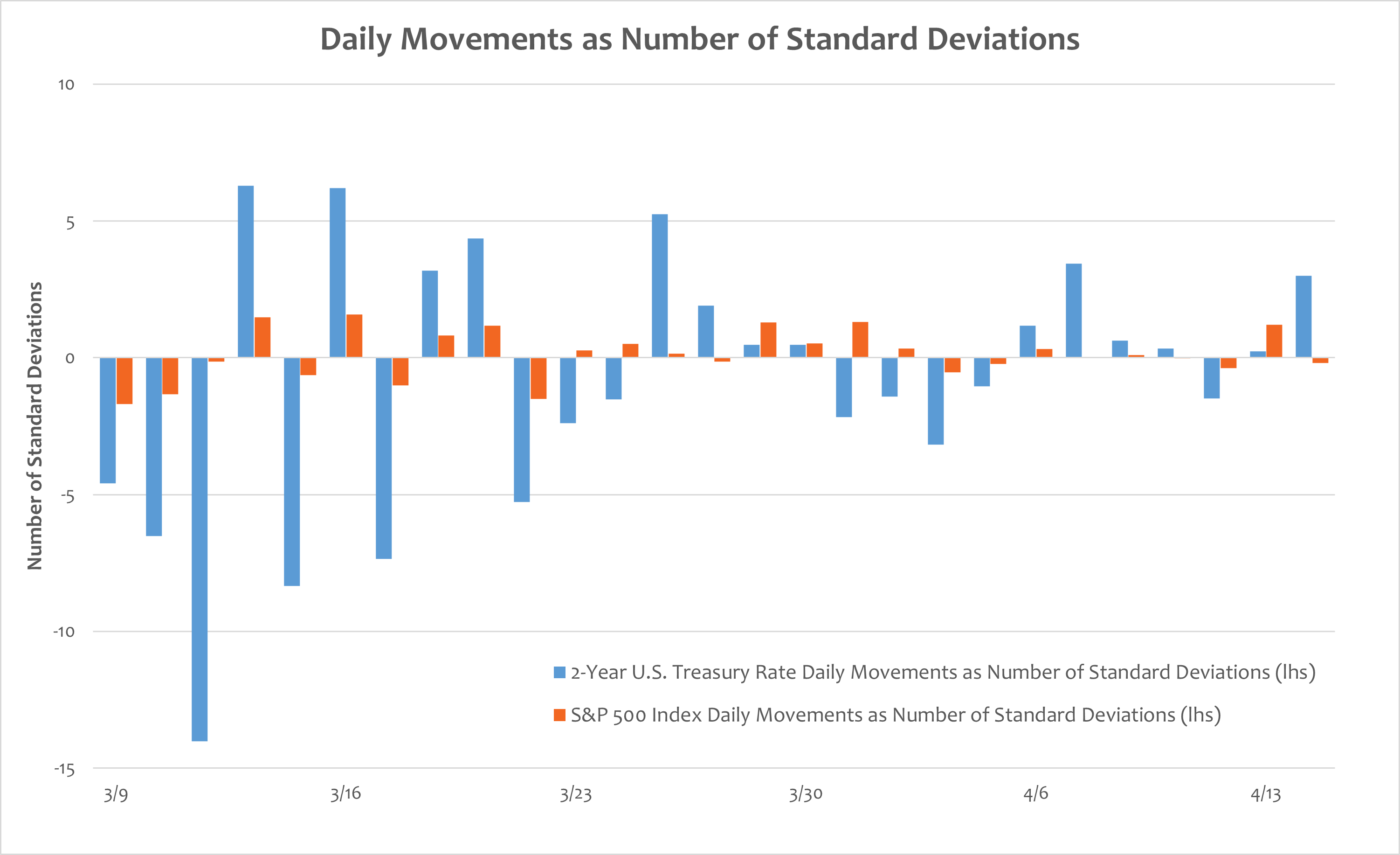

As seen in today’s Chart of the Week, the interest rate market has experienced some massive movements compared to historical standards. On March 13, the 2-year U.S. Treasury rate moved 14 standard deviations based on the last 10 years of measurements. However, if one looks at the equity market, the S&P 500 Index has rallied by 3.6% for the same period. There was not a single day that the index movement exceeded 2 standard deviations. It feels like equity investors have mostly dismissed the banking stress, but have they really?

The answer is no. First, equity investor sentiment is bearish. This can be observed through multiple data points. Commodity Futures Trading Commission data shows that the speculative S&P 500 futures position is near a historical short. Meanwhile, money market fund assets are at a historical high. These numbers had already been flashing bearish signs before the banking stress. This might partially explain why the equity market did not sell off, since investors had very light positions. Money market fund assets were also propelled higher by bank deposit outflows.

Second, we see a story of divergence when looking under the surface of the equity market. Investors have been rotating from cyclical, small-size, weak-balance-sheet stocks into growth, defensive and strong-balance-sheet stocks. For that period between March 8 and April 14, the Nasdaq-100 Index, representing large-cap growth stocks, returned 7.1%. Meanwhile, the Russell 2000 Index, composed of small-cap stocks, returned -5.2%. That level of divergence is staggering for a period of little more than a month, and it seems that investors were trying to precisely measure the impact of the banking crisis on individual companies.

The concerns are that banks will tighten lending standards going forward and bank credits will become more costly to obtain. However, companies can also borrow from the capital market by issuing debt securities. The nonfinancial corporate bond market is more than twice the size of the total commercial and industrial (C&I) loans issued by banks. Also, according to Goldman Sachs, about 50% of the C&I loans were issued by large banks.1 Since the banking stress has been largely confined to small and midsize banks, large companies that can borrow from large banks and the capital market will feel less pressure.

Additionally, the Fed has acknowledged that the tightening of credit can substitute for policy hikes. Lower interest rates may benefit growth stocks due to their longer durations. It is the small-cap and weak-balance-sheet stocks that will be most impacted by the tightening of bank lending standards, because of their limited access to either large banks or the capital market.

Lastly, it’s worth pointing out the different investor base of the interest rate and equity markets. Interest rate market investors are mostly institutional. They are more likely to have synchronized opinions due to having similar knowledge, receiving similar information and pursuing similar goals. On the other hand, the equity investor base is much more diversified. Retail investors have been gaining influence in the market, and their opinions and motivations for investing can be more varied and less predictable.

Key Takeaway

Since the onset of the banking stress, the interest rate and equity markets have seemed to behave inconsistently. The interest rate market is more about pricing overall economic growth and inflation. Meanwhile, the equity market offers investors ways to express more granular views, enabling them to take the unevenly distributed impact of banking stress into consideration. But if we tune in closer, the two markets are actually both hinting toward cautious investor sentiment.

1Goldman Sachs — Stress among small banks is likely to slow the US economy; 3/16/2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.