Unraveling the Resilience and Future Prospects of the US Consumer

June 29, 2023

You may recall from your Economics 101 course that Gross Domestic Product (GDP) = Personal Consumption + Business Investment + Government Spending + Net Exports. GDP is the market value of all goods and services produced by a country over a specific time period and is often used to measure a country’s economic health. In light of many economists and prominent investors continuing to call for a recession, today’s Chart of the Week will investigate how debt and other factors have been supporting the largest component of GDP — personal consumption — which has accounted for an average of 67.6% of GDP every year since 2000.1

At first glance, the U.S. consumer seems to be holding up fairly well. According to the Bureau of Economic Analysis (BEA), consumer spending increased 0.8% in April, after two months of marginal 0.1% increases. Spending on goods rebounded 1.1% after two months of declines, and services outlays rose 0.7% in April.2

Notably, consumer spending on services, which makes up more than two-thirds of spending, has been particularly resilient this year, driven by strong demand for travel and restaurants. Consumers have benefited from falling fuel prices over the past year. According to the U.S. Department of Commerce, Americans spent 20% less at gas stations in May compared to the prior year.3

However, a number of factors have contributed to the strength of the consumer. Perhaps most obvious has been the labor market. Personal income has displayed consistent growth, labor force participation has improved and employers have sustained their hiring momentum by adding nearly 1.6 million jobs within the first five months of this year. The unemployment rate still sits near record lows at 3.7%, marginally up from the 3.4% low touched in January 2023, but still well below the historical average of 5.7%.4

Additionally, homeowners — who constitute two-thirds of Americans — have witnessed their home equity soar as home prices skyrocketed during the pandemic. This development can contribute to a positive wealth effect, whereby individuals tend to spend more freely and confidently due to the perceived increase in their overall wealth.

Furthermore, many Americans who refinanced their mortgage before the run up in rates have benefited from improved cash flow through reduced payments or enhanced liquidity by tapping into their home equity. Although these effects, specifically the wealth effect, are challenging to quantify precisely, they have undoubtedly bolstered consumer spending.

However, this benefit has dissipated since mid-2022 as mortgage rates have skyrocketed and affordability has declined. To put it into context, the Mortgage Bankers Association’s Purchase Applications Payment Index, which measures new monthly mortgage payments relative to the median income, increased approximately 40% from the start of 2022 through April 2023.5

In all likelihood, the biggest contributor to the strength of the consumer has been the tremendous amount of excess savings built up during the pandemic — primarily due to government stimulus payments, reduced spending and relief measures such as expanded unemployment benefits and suspension of student debt payments. According to Apollo Global Management, American households amassed $2.3 trillion in excess savings through the summer of 2021, but have since been depleting those reserves down to the current level of $1.2 trillion.6

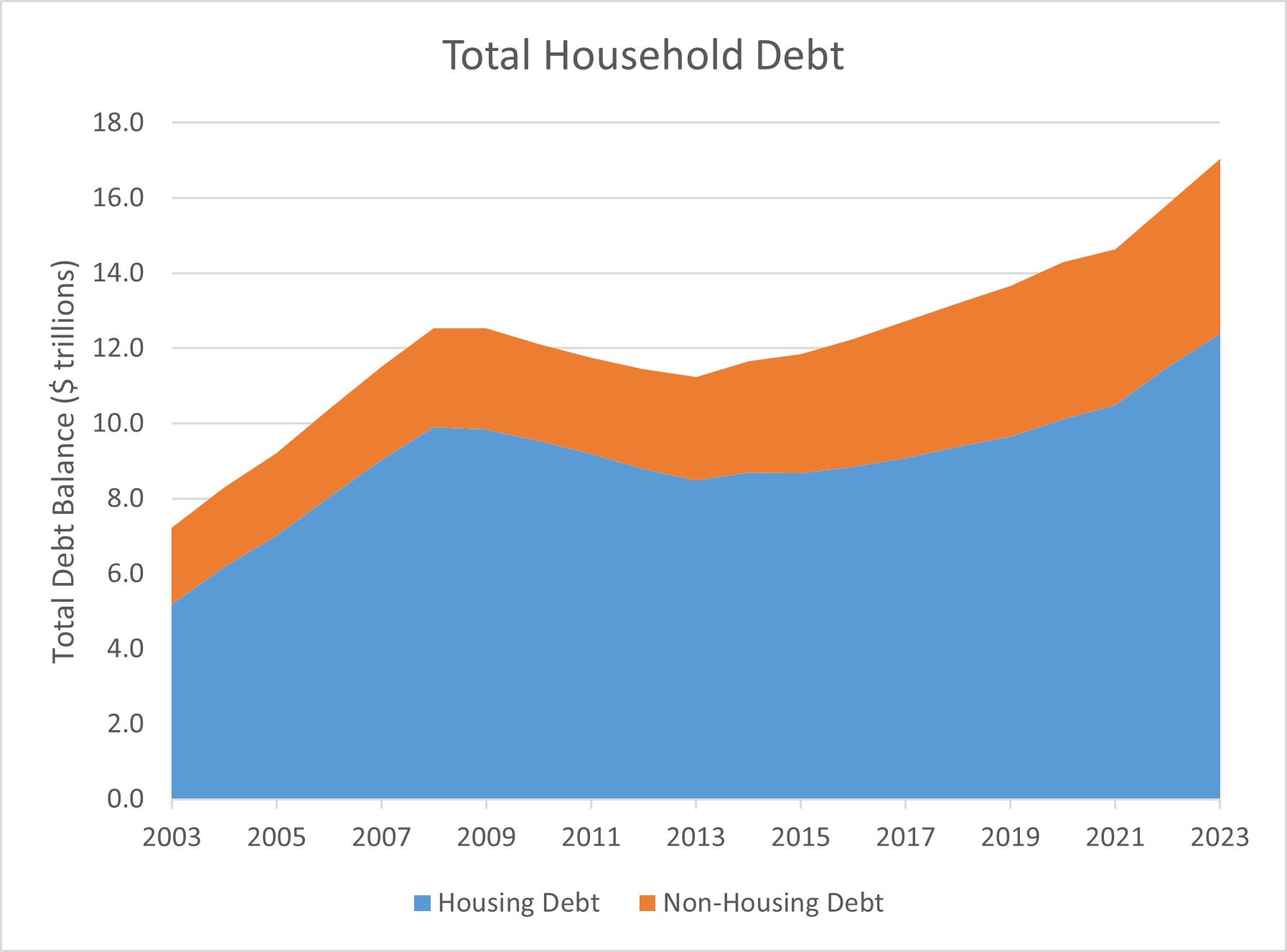

Along with substantial savings, households have also continued to accumulate debt. As depicted in this week’s chart, total household debt now exceeds $17 trillion and has increased at its fastest rate in the last two years since the run up to the great financial crisis of 2007-08. The largest increase on a percentage basis has been credit card debt, which amounts to just under $1 billion as of March 31, an increase of 28% from two years prior.7

Although the Federal Reserve (Fed) paused rate hikes at its recent meeting in June, interest rates are the highest they’ve been since 2007 and the Fed signaled that future rate increases are likely needed in an effort to bring down inflation. The Fed’s preferred inflation gauge, core personal consumption expenditures, which excludes volatile food and energy prices, unexpectedly rose in April and was up 4.7% over the past year — still well above the Fed’s 2% target.8

Student debt, which is the largest non-housing component of household debt, recently surpassed $1.75 trillion. At the time of this writing, borrowers still await the Supreme Court’s ruling on President Biden’s plan to forgive up to $20,000 in student debt. Absent a favorable ruling, interest will begin accruing again in September and payments are set to resume in October for over 40 million Americans. As a result of the relief measures implemented over the past three years, the average borrower saved approximately $15,000 in student loan payments. However, with an average estimated monthly payment of $350, student debt represents a $14-billion-per-month headwind to the consumer.9

A further look under the hood starts to reveal some credit deterioration too. For example, revolving consumer credit outstanding as a percentage of disposable income has ticked up since 2021 and is currently at 6.3%, slightly below pre-pandemic levels. Similarly, household debt payments as a percentage of disposable income have risen to 9.8%, consistent with the levels seen throughout the 2010s. Auto and credit card loan delinquencies are also rising quickly, albeit off a low base, but any further increase would put delinquencies above pre-pandemic levels.10

One leading indicator closely watched by the market is the Michigan Consumer Sentiment Index, which is a monthly survey of how consumers feel about the economy, personal finances and business conditions. The preliminary reading for June is 63.9, up 8% from the May reading and 28% from its all-time low of 50.0 in June 2022. Although the index has recovered from its lows, it is still well below the 75-100 range seen throughout the 2010s.11

Similarly, The Conference Board releases its Consumer Confidence Survey® results each month. A component of this, the Expectations Index — which is based on consumers’ short-term outlook for income, business and labor market conditions — decreased slightly to 71.5 in May. The index has remained below 80, the level associated with a recession in the next year, since early 2022.12

Key Takeaway

In response to the economic and social impact of the pandemic, U.S. authorities implemented a number of fiscal and monetary relief measures, including stimulus packages, zero-interest-rate policy and a pausing of student debt payments. These actions allowed households to build up exceptional cash savings.

Many homeowners also took the opportunity to lock in record-low interest rates on their mortgages, which boosted home prices and improved their cash flow and savings. Falling fuel prices have also freed up some cash to spend elsewhere. Since the economy reopened, consumer spending has been driven by pent-up demand, while being sustained by excess savings and debt.

Looking ahead, it will be interesting to see how consumers adjust as their excess savings dry up, particularly now that student loan repayments are resuming and housing affordability is materially worse than it was last year. Inflation remains well above the Fed’s target, which also means consumers are potentially looking at even higher interest rates on their debt, or at least an environment of higher for longer.

It’ll also be crucial to watch the job market for any signs of further weakness. The favorable conditions that have supported the consumer are transitioning into challenging headwinds. If and when the economy dips into a recession may very well hinge on the U.S. consumer.

Sources:

1FRED Economic Data St. Louis Fed – Shares of gross domestic product: Personal consumption expenditures; 5/25/2023

2Bureau of Economic Analysis (BEA) – Personal Income and Outlays, April 2023; 5/26/2023

3U.S. Department of Commerce – Advance Monthly Sales for Retail and Food Services; 6/15/2023

4United States Department of Labor – U.S. Bureau of Labor Statistics; as of 6/2/2023

5Mortgage Bankers Association – Mortgage Application Payments; 5/25/2023

6Apollo Global Management – Excess Savings Still Elevated; 6/5/2023

7Federal Reserve Bank of New York – Household Debt and Credit Reports; released May 2023

8FRED Economic Data St. Louis Fed – Personal Consumption Expenditures for April; 5/26/2023

9Education Data Initiative – Student Loan Debt Statistics; 4/1/2023

10J.P. Morgan Asset Management – Guide to the Markets; as of 5/31/2023

11University of Michigan – Surveys of Consumers: Preliminary Results for June 2023; as of 6/28/2023

12The Conference Board – US Consumer Confidence Improved Substantially in June; 6/27/2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.