Strong Growth Requires Strong Labor Force

August 3, 2023

Last week, the Federal Reserve (Fed) delivered another 25-basis-point interest rate hike following the July Federal Open Market Committee meeting.1 Many people expect it to be the last interest rate hike of this cycle. During the post-meeting press conference, Fed Chair Jerome Powell said “Reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions.”2 It is not news that the labor market is very tight. According to the Bureau of Labor Statistics (BLS), the headline unemployment rate has been hovering around a 50-year historical low since mid-2022.3 In last week’s Conference Board Consumer Confidence Survey, the share of consumers feeling that jobs were “hard-to-get” dropped below 10% — an event that has only occurred twice in the past 20 years.4

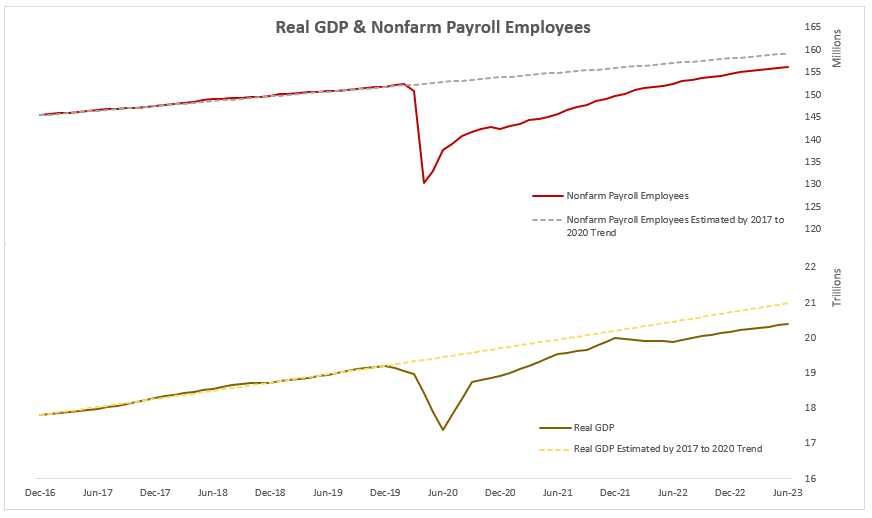

However, if we look at another measure, total nonfarm payroll employees, which is also published by the BLS, it is clearly below the pre-pandemic trend as demonstrated in this week’s chart. As of June 30, 2023, the gap between the survey reading and the pre-pandemic trend is approximately three million wide. If we had three million more workers now, I would imagine a much more balanced labor market. Total job openings, another statistic published by the BLS, would be rebalanced to under seven million, which would be consistent with the pre-pandemic levels. The combination of the low jobless rate and the low number of people working tells us that we have a labor supply shortage.

Roughly half of the three million gap can be attributed to the exceptional employment improvement seen between 2017 and 2020. Admittedly, such a good trend sets a high bar to match. The remaining half is brought by pandemic disruptions. COVID induced early retirement and COVID-related health issues preventing people from working are the two most important factors. The labor force participation rate for ages 25 to 54 is at 83.5%, the highest level since early 2000s.5 However, the labor force participation rate for ages 55+ dipped from the pre-pandemic level of 40% to approximately 38% now.6 The elder cohort of the labor force is more susceptible to the two factors mentioned earlier. Going forward, the prime-age labor force cohort is already fairly saturated, and it is doubtful that we would see normalization of the elder cohort labor supply. Additionally, the aging population is a structural headwind for the labor supply; therefore, I wouldn’t be surprised to see an even tighter labor supply.

What does a tight labor supply mean for economic growth and inflation? As displayed in the bottom half of the chart, gross domestic product (GDP) exhibits a similar pattern to the nonfarm payroll employees. I believe it is fair to say that without the support of a strong labor supply, economic growth would be limited. No matter how willing the government, businesses or consumers are to spend, if there is not enough labor force to produce, real growth would be unsustainable and high inflation could very well be the byproduct. There is evidence that firms competing for labor are lifting wages and feeding inflation. Recent news of contract negotiations, such as at UPS and airline carriers, confirm the high bargaining power of the employees.7,8 The latest Employment Cost Index is increasing at 1% on a quarterly basis, as of June 2023.9 Albeit it has come down from its peak level, it is still higher than the 0.8% level which is consistent with the Fed’s 2% annualized inflation target. With a limited labor supply, it is likely that the current economy has a lower potential output capacity —above which undesired inflation would appear —than pre-pandemic. Just as Fed Chair Jerome Powell mentioned, the Fed has to slow down growth to cool down inflation.

If it becomes increasingly more difficult to find workers, it becomes even more critical to discover ways to work more efficiently with improving technologies. The tech industry’s creativity continues to amaze me. They might just hold the key to strong future economic growth.

Key Takeaway

In the post-pandemic era, below-trend labor supply is constraining economic growth and propping up inflation. The pandemic caused disruption to the labor force that is likely irreversible. The economy’s potential output capacity might have shifted lower due to the bottleneck of labor supply and forcing growth would only cause more inflation. Productivity improvement brought by innovative technologies, such as artificial intelligence, might be a way out and clearly, the stock market is counting on it.

Sources:

1Board of Governors of the Federal Reserve System – Federal Reserve issues FOMC statement; 7/26/2023

2Board of Governors of the Federal Reserve System – Transcript of Chair Powell’s Press Conference July 26, 2023

3FRED Economic Data – Unemployment Rate; as of June 2023

4Industrial Supply – Consumer confidence rises to two-year high; 7/27/2023

5FRED Economic Data – Labor Force Participation Rate - 25-54 Yrs.; as of June 2023

6FRED Economic Data – Labor Force Participation Rate - 55 Yrs. & over; as of June 2023

7Reuters – UPS, union avert strike with planned 5-year deal, more pay; 7/25/2023

8Reuters – United Airlines pilots reach labor agreement, boost pay; 7/17/2023

9U.S. Bureau of Labor Statistics – Employment Cost Index – June 2023; as of June 2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.