New CLO Issuance Continues to Slow

August 10, 2023

Continuing the downtrend in collateralized loan obligation (CLO) issuance since 2021, year-to-date CLO issuance stands at $64.2 billion as of August 3, which is 26% lower than this time last year. CLOs are created by issuing rated debt tranches from AAA down to BB or B which finance the CLO equity tranche. While CLO debt tranches are paid a spread on top of a floating-rate index, CLO equity returns are driven by two factors. First, CLO equity holders earn the spread between what the CLO earns on its underlying leveraged loans (assets) less the weighted average cost of debt financing. This is known as the CLO equity arbitrage. Second, the CLO equity holders own a leveraged exposure to the performance of the CLO’s underlying assets.

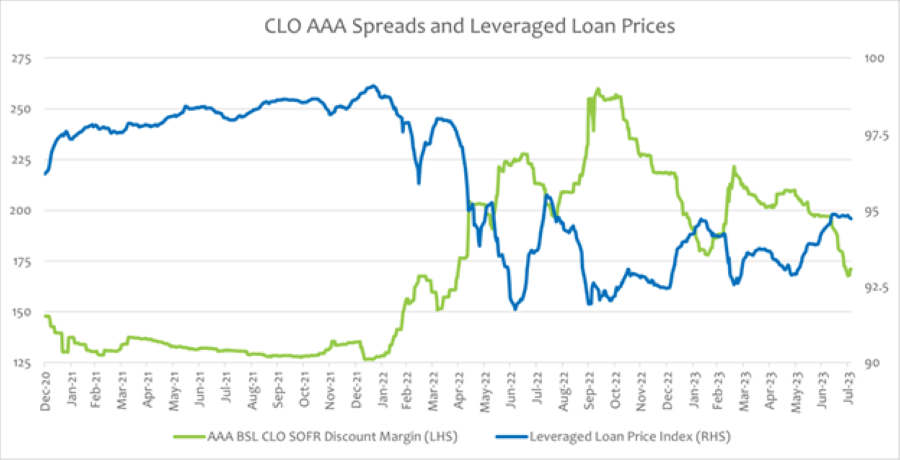

Today’s Chart of the Week shows two major factors behind CLO new issuance: AAA CLO debt spreads and leveraged loan prices. The AAA debt spread represents approximately 60% of the financing cost to the CLO equity; the higher the spread paid to AAA debt holders the lower the return to CLO equity holders. Leveraged loan prices also play a major role because any gains (or losses) the CLO manager makes trading the CLO’s assets directly impact the return of the CLO equity.

2021 witnessed record CLO issuance as tight debt spreads, low interest rates and a benign environment for leveraged loans produced attractive risk-adjusted returns for CLO equity. CLO issuance remained strong at the start of 2022; however, rising interest rates and increased market volatility throughout the year began to weigh on new CLO creation. 2023 has proven even more challenging for CLO issuance. Investors who typically invest in CLO equity are now finding equity-like returns with the BB-rated tranches. Yields on BB-rated CLO debt are approaching the mid-teens and investors expecting leveraged loan defaults to rise may opt for the credit enhancement found on BBs.

Key Takeaway

The CLO primary and secondary markets function in a way as a balancing act between spreads found in secondary and new issue. For example, as demand for CLO debt increases in secondary and spreads tighten, spreads in new issue will follow suit, making new CLO creation more attractive for issuers. This year, the primary CLO market has yet to respond in the typical fashion given the recent strength in secondary spreads, including AAA CLO spreads at the tightest level in more than a year. However, continued strength in secondary CLO valuations is likely to finally get the new issue machine churning again.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.