Excess Returns in IG Corporate Credit

August 31, 2023

As we close out the summer of 2023, investment-grade (IG) corporate credit spreads have been extraordinarily resilient. The Bloomberg IG Corporate Index has traded in a very narrow range for many weeks now with the option-adjusted spread (OAS) at 118 basis points (bps) last Friday. Year-to-date tights were set at the end of July at 112 bps. We now head into the post-Labor Day period, which has historically experienced some of the most volatile markets on the calendar.

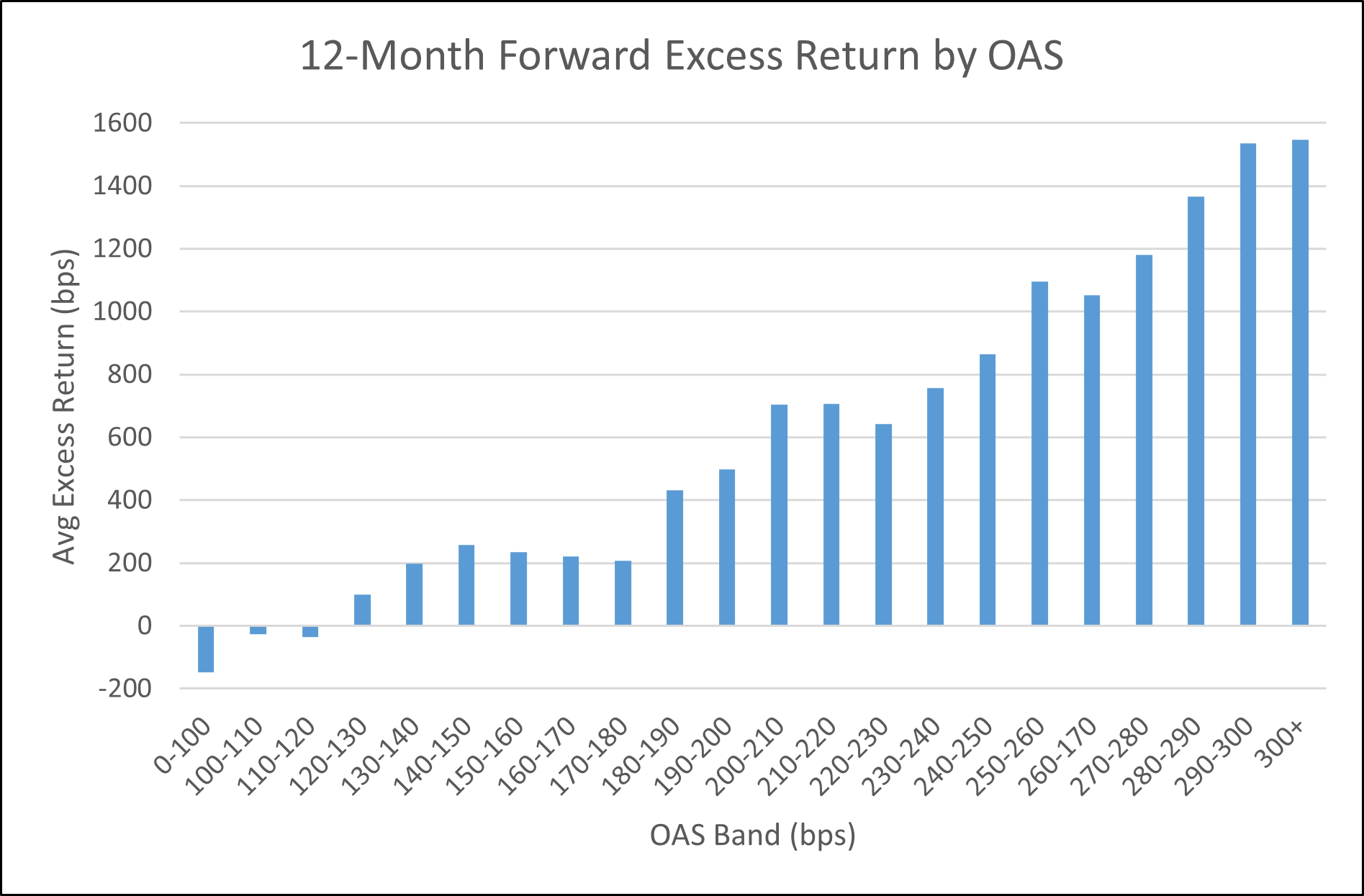

Today’s Chart of the Week shows the average 12-month forward excess returns for IG corporate credit for various OAS starting points. Excess return here represents the outperformance of IG corporate bonds over that of an equivalent duration Treasury security. This picture is somewhat gloomy with the current OAS inside +120 bps. As the chart highlights, with the OAS at 120 or tighter, excess returns have historically been negative for the following 12 months (underperforming Treasuries).

There are other reasons to take a cautious stance on corporate credit as well. The inverted Treasury curve remains. While the 3-month Treasury bill to 10-year Treasury curve is off of its most inverted point of -186 bps in May of this year, it still sits at -124 bps and is at a level never witnessed prior to this inversion. On Friday in Jackson Hole, Federal Reserve (Fed) Chair Jerome Powell reiterated the goal of a 2% inflation target and below-trend growth. He continued, “we are attentive to signs that the economy may not be cooling as expected…Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy."1

To this point, the consumer has been rather resilient; however, cracks appear to be forming. Consumer debts are increasing, savings are falling and delinquencies are increasing. Macy's and Dick’s Sporting Goods have expressed a cautious consumer outlook while Nordstrom has seen delinquencies rise above pre-pandemic levels, which could result in higher credit losses in the months ahead.

Somewhat offsetting these pressures, the move higher in yields has been quite impressive and has led to yield buyers stepping in and limiting any meaningful backup in spreads. The yield on the Bloomberg IG Corporate Index was over 5.75% last Friday. While this is below the 6.125% yield last October, it was last at this level during the Global Financial Crisis. Overseas demand for U.S. corporate credit remains strong as well. According to Citigroup, foreign investor participation relative to total net supply has increased to over 50% this year, stronger than in prior years. Over the 2016-2022 period, foreign demand accounted for 39% of net supply.

Key Takeaway

I expect a fairly volatile post-Labor Day period along with a somewhat active new issue calendar. Although the narrative for a soft landing has gained traction, it should not be confused with a cyclical recovery. The economy is still slowing meaningfully, and the consumer is increasingly feeling pressure. At current valuations, it seems wise to stay up in quality in corporate credit, as forward excess returns from these spread levels have historically been quite disappointing.

Sources:

1Board of Governors of the Federal Reserve System – Inflation: Progress and the Path Ahead; 8/25/23

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.