A Tale of Two Earnings Multiples

September 7, 2023

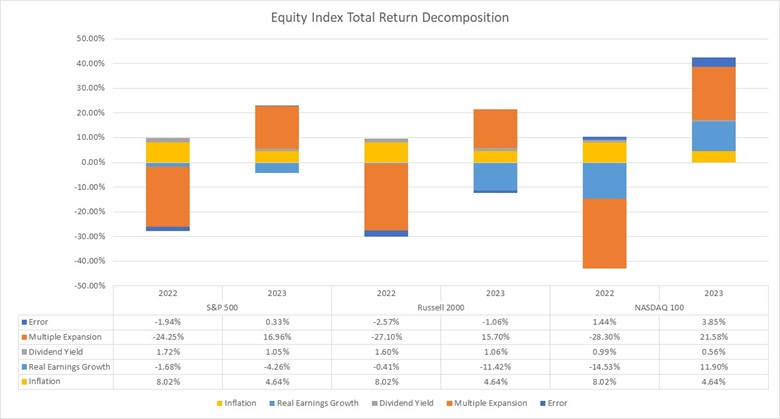

So far, 2023 has been the complete opposite of 2022 across all three major U.S. equity indices; while in 2022 we experienced a sharp selloff in the equity market due to macroeconomic uncertainty and increasingly restrictive Federal Reserve (Fed) policy geared toward fighting inflation, everything has come roaring back in 2023. As of Aug. 31, total returns were 18.72%, 8.93% and 42.53% for the S&P 500 Index, Russell 2000 Index and NASDAQ 100, respectively. In today’s Chart of the Week, I will examine the drivers of equity market returns year-to-date as well as in 2022.

As seen in today’s chart, equity index returns are categorized into five components, highlighting how investors are compensated. The first component is inflation. Since equities are thought of as real assets, investors should be compensated for the rate of inflation present in the economy. In the chart, inflation is represented as the average of year-over-year Consumer Price Index during the period being examined. The next component is real earnings growth, represented by the Bloomberg estimate (BeST) earnings per share, which aggregates sell-side estimates of the next 12 months' earnings expected for the index. To transform this from a nominal number to a real number, the rate of inflation is subtracted from the nominal estimate. Next up, the dividend yield on the index, which has been adjusted to reflect that we are only eight months into 2023. Then followed by any valuation change on the index, which is represented by the BeST price-to-earnings Ratio (P/E). Finally, an error term is included to quantify any items not categorized by the aforementioned components.

On the inflation front, the compensation required to achieve real returns has come down by almost half in 2023. Peak inflation was experienced in the summer of 2022 and has been gradually declining since. While the decrease in inflation has been broad-based from peak, core inflation is proving to be stickier than energy and food inflation. This lends a smaller base to build positive returns; however, also sets a lower bar to clear for achieving positive real returns.

On the earnings growth front, the picture has declined compared to last year for both the S&P 500 and Russell 2000 Indices. Throughout 2022, company earnings showed surprising resilience among S&P 500 and Russell 2000 companies. However, NASDAQ 100 companies saw their earnings estimates decline substantially as higher rates led to increased scrutiny regarding future prospects of high-growth tech companies. Thus far in 2023, the roles have reversed. NASDAQ 100 real earnings are the lone positive contribution in the category among the three indices. This has come on the back of excitement around the future of artificial intelligence (AI), as well as diligent cost-cutting procedures among tech companies. On the other side of the spectrum, the earnings prospects of small-cap companies have contracted by 11.4% so far this year. The smaller companies that compose the Russell 2000 Index are especially sensitive to the increased macroeconomic uncertainty and tightening credit conditions. During the most recent earnings season, retailers began to hint at waning growth amidst an environment that continues to be challenging.

Lastly, multiple expansion/contraction, which has been the real driving force behind equity returns since 2022. It can be seen that in 2022, there was a massive multiple contraction across indices, coinciding with the most aggressive Fed tightening cycle since the 1980s. Both recession fears and exiting a decade’s long zero-interest-rate policy led investors to rethink the multiple of earnings that stocks should trade. In 2023, this has mostly reversed itself. Economic data has been resilient and investors have begun to believe in the Goldilocks soft landing scenario, leading to equity buying as extremely bearish sentiment is abating. Volatility has come down markedly from 2022. This has introduced mechanical flows from quantitative strategies that increase positions in equities as volatility decreases. Additionally, exuberance over AI has fueled loftier valuations.

The question now becomes — is a multiple expansion-driven rally sustainable? Macroeconomic uncertainty has not gone away, inflation still remains above the Fed’s 2% target and rates are projected to stay at current levels through (at least) next summer. Further, current buyers of equity indices are paying a larger valuation premium for real earnings that are lower than what they were last year, with the NASDAQ 100 being an exception.

One way to address the question is to look at a measure of risk premium built into equities. This is based on comparing the earnings yield, which is the inverse of the P/E ratio, to a long-dated Treasury bond to see what the expected pick up is from taking on equity risk. When looking at the S&P 500 Index only, the current BeST P/E ratio is 20.62, while the 10-year Treasury yield is 4.108% — resulting in a current equity risk premium of 0.74%. When looking at a sample from 1991 through 2021, the average equity risk premium was 1.48%, which would suggest that to get back to average the S&P 500 multiple would need to contract to 17.9 given current Treasury yields. As a result, all but 3% of the multiple expansion experienced this year would be erased.

Key Takeaway

Changing multiples has been the main driver of equity returns since 2022. For all but the largest tech companies, current investors in equity indices are investing at a time when they have to pay higher valuations for reduced future earnings estimates. At current yield levels, this multiple expansion has resulted in a shrinking equity risk premium. Without a decrease in long-dated yields, improvement in earnings estimates or both, the sensible move for equity valuations would be to move back down toward the levels experienced at the end of 2022.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.