IPO Market Shows Signs of Life…But Will it Last?

October 12, 2023

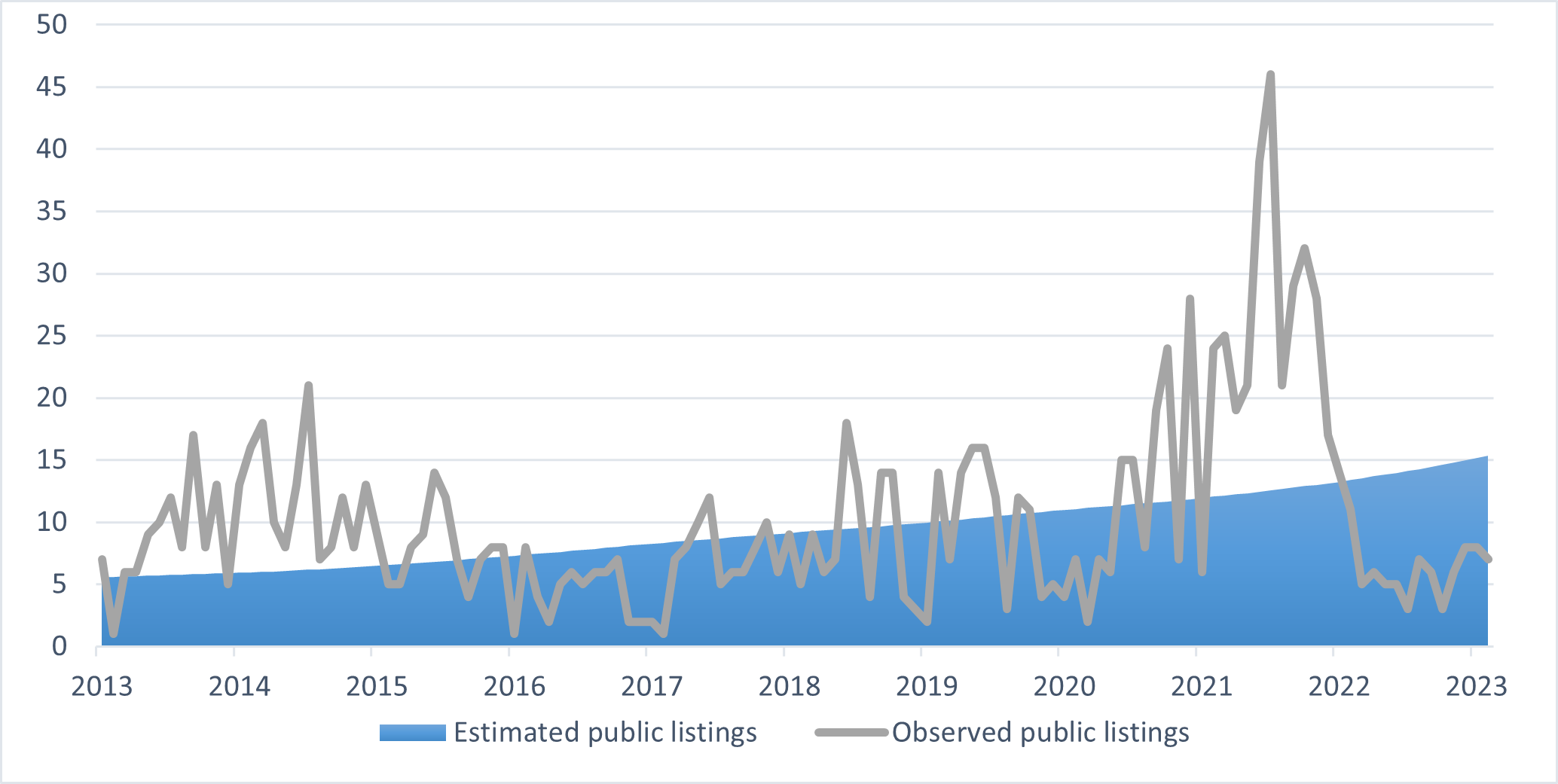

After a meteoric rise in new listings from the start of the pandemic through the end of 2021, the initial public offering (IPO) market has come to a screeching halt. As seen in today’s Chart of the Week, it has been almost 18 months since observed IPOs outpaced estimated IPOs. Further, the number of companies estimated to be in the IPO backlog has skyrocketed to a record 200 as of June 30, according to PitchBook.

While venture-backed companies benefited from a financial boost in 2020 and 2021, many are burning through cash and forced to find ways to cut costs and boost revenue in order to increase their runway. Additionally, founders have employed several strategies to improve their liquidity, such as diluting their equity stake, adding more structure to deal terms (e.g. 2-3x liquidation preference) or taking bridge financing. While down rounds are typically viewed as a last resort for companies needing capital, they have become increasingly common and have reached a four-year high, according to PitchBook.

Many nontraditional investors have pulled back from participating in growth-stage deals in light of the heightened illiquidity and valuation risk associated with such investments. As a result, venture capitalists have been more selective and only deploying capital to the highest-quality companies that demonstrate robust growth momentum and strong fundamentals.

Amidst these challenges, the third quarter brought a glimmer of optimism for an IPO reopening as 26 companies made their public debut, raising a combined $7.7 billion per Renaissance Capital, an IPO investment advisory firm. This figure matches the entire amount of proceeds raised in 2022, even though the number of deals didn't increase compared to prior quarters. British semiconductor Arm Holdings contributed $4.9 billion, making it the largest tech IPO since 2019. Grocery delivery service Instacart and marketing software enterprise Klaviyo were two other high-profile companies that used the opportunity to go public in September.

Out of the gate, all three stocks surged above their respective IPO price, but the momentum didn’t last. Share prices for all three have since fallen from their peak, although Klaviyo and Arm Holdings still trade slightly above their IPO price at this time. However, the retreats were not entirely company-specific as the broader equity indices have experienced declines in recent weeks. Meanwhile, investors continue to grapple with the possibility of more rate hikes in the face of sticky inflation, an uncertain economic outlook and the residual effects of bank failures, notably Silicon Valley Bank.

A wide bid-ask spread between investors and founders has impaired deal volume dramatically over the past 18 months, particularly in late-stage venture. For example, Instacart's public offering priced its stock at a $10 billion valuation — a stark contrast to the $39 billion valuation it received from a funding round led by Sequoia Capital and Andreesen Horowitz in early 2021. Nevertheless, the recent IPOs offer guidance to a venture ecosystem in desperate need of some balance on pricing in order for deals to be completed.

Key Takeaway

Even though a small window may have opened, I suspect that many pre-IPO candidates will take a wait-and-see approach. Many headwinds remain, primarily driven by an uncertain economic environment. The market is starting to recognize that higher rates may still be required and/or may remain elevated for longer than originally expected to rein in inflation.

In the meantime, the venture ecosystem will closely watch the performance of Arm Holdings, Instacart and Klaviyo to gauge optimal IPO timing. Many companies are reaching a tipping point and will undoubtedly need a path forward in the coming months and years. Dozens are likely to pursue the IPO path, but I would not be surprised if the pace of acquisitions by strategic and financial buyers picks up as startups at the end of their venture cycle have no choice but to seek additional funding or accelerate their exit plan.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.