From TINA to TARA

November 16, 2023

TINA, which stands for “there is no alternative” is frequently quoted by investors suggesting that only equities can generate decent returns. From the Global Financial Crisis to the COVID-19 pandemic, interest rates were subdued. Thus, fixed-income assets have experienced anemic yields. Interest rates have increased steadily since the pandemic, giving rise to the acronym TARA — which means “there are reasonable alternatives.”

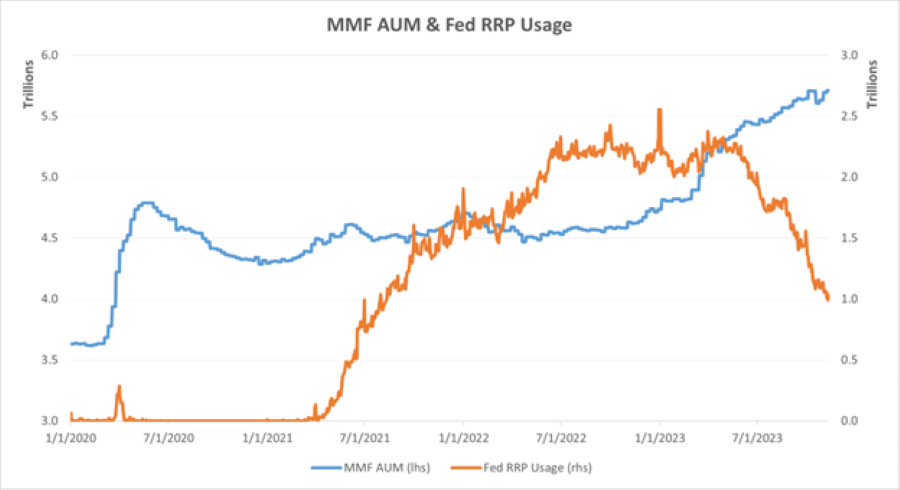

Reasonable might be an understatement. Currently, nearly risk-free cash yields are above 5%, investment-grade corporate bond yields are above 6%, mortgage-backed security yields are close to 6% and high-yield bonds are yielding approximately 9%. Throughout my career, the world of income has never looked so good, and investors have noticed. By observing the total U.S. money market fund (MMF) assets under management (AUM), as illustrated in today’s Chart of the Week, total AUM has increased approximately $2 trillion since the beginning of 2020. This year alone, U.S. MMFs have attracted almost $1 trillion.

MMFs typically invest in short-term, practically risk-free assets such as Treasury bills, agency short-term debts, repurchase agreements (repo), etc. MMF inflows clearly indicate that as the Federal Reserve (Fed) hiked interest rates, short-term nearly risk-free assets became a popular choice for investors. Banks have certainly felt the impact. Earlier in the year, banking stress was largely induced by deposits siphoned out of the banking system through MMFs’ usage of the Fed’s reverse repurchase agreement (RRP). Since then, banks have swiftly increased interest rates to keep deposits from fleeing.

However, the investment flow has had a limited impact on riskier assets so far. Credit spreads are benign, and equity valuations are still high. One explanation is the financial system appears to have ample liquidity, as suggested by MMFs’ close to $1 trillion usage of the RRP. Nevertheless, this buffer is being reduced due to the Fed’s quantitative tightening (QT), which has no confirmed end date. As the excess liquidity dries up, investors could start demanding liquidity premium on cash and the pressure would be passed down to riskier assets. I expect credit spreads to widen and equity valuations to be challenged somewhere down the road if the Fed does not stop QT.

Based on equity valuations, to some investors, TINA is not quite out of fashion just yet. The S&P 500 Index is paying investors a roughly 5% earnings yield, which is currently much lower than the yield of investment-grade corporate and high-yield bonds. This makes little sense as equities are much riskier than corporate bonds. There are two plausible explanations. First, equity investors may not expect interest rates to stay higher for longer. In my opinion, this is a dangerous bet as those investors would be up against both the Fed and bond investors. Second, equity investors may expect great earnings growth in the future. Achieving that requires strong economic growth and/or corporate profits representing a larger share of the economy. I believe the latter would not be sustainable and invite strong backslash. For the former, strong economic growth relies on population and/or productivity growth. As strong population growth does not seem very likely, economic growth would depend on fast-improving productivity. This actually echoes the high-flying Magnificent Seven stocks supported by the high hope of the artificial intelligence (AI) theme. Time will tell if their valuations are justified in a high interest-rate environment.

Key Takeaway

An aging population, green transition, defense and AI all require large sums of public and private investment and spending. The resulting competition for capital would be supportive of borrowing costs. It is a distinct possibility that interest rates will be structurally higher for the foreseeable future. In that environment, the playbook for investing and asset allocation would be very different from the last decade. Being agile and always keeping relative value in mind is one way to potentially overcome the recency bias. While TINA is reluctant to leave, TARA has already arrived.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.