Agency Mortgage-Backed Securities Market Gets a Fixer Upper

November 30, 2023

Following the Global Financial Crisis (GFC), valuations for the almost $9 trillion agency mortgage-backed securities (MBS) market have been subject to the demand of two major buyers — the Federal Reserve (Fed) and U.S. banks — who, combined, currently hold approximately two-thirds of the market. The Fed purchased MBS through four rounds of quantitative easing, with the most recent starting in March 2020, in response to the economic disruptions brought on by the COVID-19 pandemic. Banks traditionally invest a portion of their deposits in MBS to earn net interest margin (NIM), the spread between what they earn from holding MBS and what they pay on deposits. Bank demand for MBS increased in 2020 in response to elevated customer deposits and the Fed holding rates at zero.

In 2022, the Fed ended quantitative easing in March and started reducing the size of its MBS holdings in June through passive runoff. The Fed also began raising its policy rate to combat inflation, increasing it from the target range of 0.00-0.25% in March 2022 to 5.25-5.50% in July 2023. As interest rates rose and the yield curve inverted, bank demand for MBS declined. Yield curve inversion — when short-term interest rates are higher than longer-term rates — reduces net interest margin due to the short-term nature of bank liabilities (deposits) relative to the longer-term nature of its assets, such as MBS.

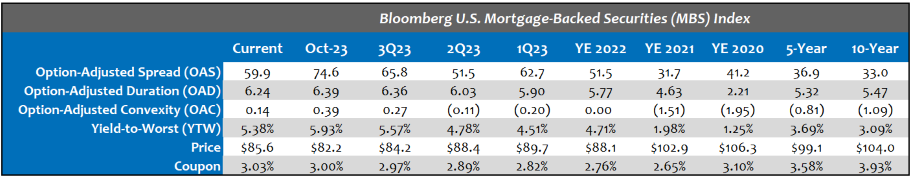

Today’s Chart of the Week shows valuations for MBS as measured by Bloomberg’s MBS Index. With the two dominant buyers pulling back from the market, money managers are stepping in to buy MBS at more attractive valuations. For money managers, the relative value proposition of MBS compared to other high-quality asset classes has improved substantially. Investors are being compensated more than before for taking on the convexity risk1 embedded in MBS. Although the par ($100) priced current coupon mortgage is approximately 6.00%, the majority of outstanding MBS carries a lower coupon and trades at substantially discounted dollar prices, which mitigates convexity risk.

Key Takeaway

2023 marks the first year since the GFC where banks and the Fed have both reduced their MBS holdings. Money manager demand for MBS should continue driving valuations for MBS relative to other sectors as we enter 2024. While the Fed is expected to continue passive balance sheet runoff of its MBS holdings next year, the Fed’s next move regarding interest rates will influence whether or not bank demand for MBS picks back up.

Note:

1Convexity risk in MBS comes from the option given to mortgagors to pay off their mortgage early. When interest rates fall, mortgages are generally paid off at a faster pace and refinanced at lower rates, which decreases the duration of MBS. The opposite generally occurs when interest rates rise.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.