Markets at Ease…For Now

December 7, 2023

Like a drill sergeant shouting “Ten-Hut” (Attention!), interest rates have certainly caught the attention of market participants over the past few months. While we all know that interest rates play a critical role in valuations across the income investable universe, it has become clear that the dramatic swings in the U.S. 10-year Treasury yield from approximately 4% to 5% and back again have commanded more of an outsized influence than usual.

The income investable universe has undergone quite a massive shift in sentiment from October to November, directly tied to swinging interest rates and fears of overtightening and then the sharpest loosening of financial conditions in decades. As the adage goes, "There are decades where nothing happens; and there are weeks where decades happen." Over the past few weeks, we had decades happen, and it is apparent in many technical indicators.

Based on movements in the U.S. 2-year Treasury yield, the markets have been here twice in the past year in terms of anticipating and betting on a Federal Reserve (Fed) pivot. The market desperately wants the Fed and Chair Jerome Powell to back off from their historic rate hike policy. However, persistently high inflation would not allow the Fed to stop rate increases over the past year — until very recently. The latest deceleration in many inflation readings gives the Fed and investors breathing room and a sigh of relief — “At Ease, soldier!”

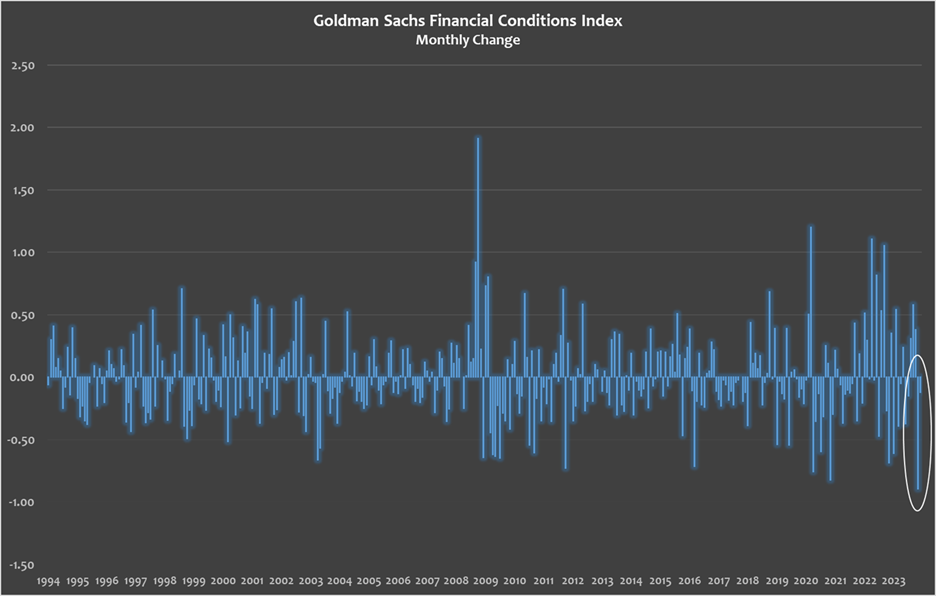

The Goldman Sachs Financial Conditions Index (FCI) is the clearest expression of the massive ease in the market. The FCI is a weighted average of riskless interest rates, the exchange rate, equity valuations and credit spreads, with weights that correspond to the direct impact of each variable on gross domestic product. This index tracks the tightness or easiness of financial conditions across the U.S. economy. As the Fed tightened policy, especially in 2022, you can see higher spikes in the monthly (but not cumulative) readings. As the U.S. 10-year Treasury yield reached 5% in October, financial conditions tightened, sending a shiver throughout the stock and bond markets. However, as inflation readings improved and 10-year yields slipped back to 4.2%, this unleashed the greatest monthly reduction in the FCI in many decades.

Key Takeaway

Looking ahead, as the markets are doing now, the seemingly imminent Fed pivot is likely probable this time, unlike the two head fakes we experienced over the past 12 months. This rate cut expectation is starting to create a massive rotation into many downtrodden income sectors — banks, real estate investment trusts, investment-grade bonds (and high-yield bonds, of course, although they are not really downtrodden after leading many income universe sectors in 2023), stocks of levered companies and just about any interest-rate-sensitive security. Given the low valuations in many of these areas (for example, single-digit price-to-earnings (P/E) bank stocks), this could create a more persistent rally in value stocks and indices heading into 2024. While it is unlikely that the much-publicized performance and valuation gap between value and growth stocks will be closed, it certainly could narrow quite a bit as we saw over the past month.

If you could tell us where rates go from here, we could probably tell you what happens next to the stock market. If inflation has been tamed and rates have peaked and turn lower, this should continue to breathe life into income stocks through higher valuations (which does not tell us what will happen with earnings growth, but we’ll take it from a valuation perspective). Even after the November rally, many bank stocks trade with single-digit P/Es, which may allow for a nice bump up in the intermediate term with a simple change from 8x to 12x, for example. Levered companies with new management teams strategically willing to address their debt and cost structure issues could also see a more sustained benefit. For both groups of income-producing securities — dividend-paying stocks and corporate bonds — the market, in the short term, will not differentiate between the long-term sustainable names from the ones that are structurally flawed. That is our job as investors. The opportunity is there for potential turnarounds and P/E depressed names, as long as rates have truly peaked and growth does not decline from here.

In the meantime, interest rates are clearly in the driver’s seat for the markets — and they certainly have our undivided attention. It will be interesting to see where they lead us, but we will enjoy this time for now as the markets are breathing a little easier.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.