The Most Wonderful Time of the Year

December 14, 2023

The holiday season can be the most wonderful time of the year for many. It can entail much- needed time off, meaningful time with family and friends and perhaps even a vacation. Time is finite, and making the most of it is paramount. I know my children are excited for the holidays and the quality time with family. It’s amazing to see this time of year through their eyes as they experience the magic in the air. December/January may also be considered the most wonderful time of the year for financial markets. When it comes to financial markets, this time may bring the so-called “Santa Claus rally” or “January effect” — both considered to be opportune times to be invested in the market.

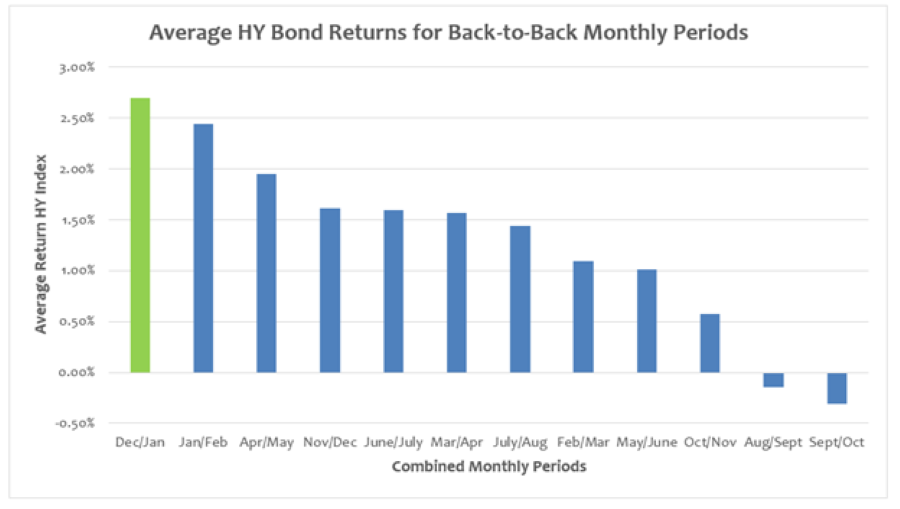

As we approach the close of the year, it is a time to reflect but also to look ahead. First, let’s reflect on the past year from a financial markets perspective. While it has certainly had its share of uncertainty and volatility, it is proving to generate some quite remarkable returns. The S&P 500 Index is up approximately 20.0%, investment-grade corporate bonds are up almost 6.0%, the U.S. Aggregate Bond Index is up over 3.0% and the U.S. High Yield Index is up over 10.0%! But we are not done yet— we are just now entering what has historically been one of the strongest times for U.S. high-yield bond returns.

The U.S. high-yield bond market has had a terrific year, but perhaps the best has yet to come. As seen in today’s Chart of the Week, December and January have historically had the strongest back-to-back monthly returns for high-yield bonds. According to research from J.P. Morgan that looks back over the last 37 years, December and January exhibit positive returns over 80% of the time. The research noted that during the last two weeks of December and the first two weeks of January, high-yield bonds returned 1.97% on average, more than three times a typical 30-day stretch. During the holiday season, companies often take a break from issuing high-yield bonds. The supply and demand imbalance may be one factor leading to stronger seasonal returns. Bonds continue to pay their coupons, while fund managers continue to reinvest that cash flow.

Key Takeaway

Throughout 2023, high yield has been a great place to invest; although, some months have definitely been stronger than others. November was one of the strongest months on record with returns of more than 4.5% for the J.P. Morgan Domestic High Yield Index. Was any of this potential December/January rally pulled forward into November? Maybe, but the seasonal technical and strong momentum for risk assets continue to be at work. I like the odds of staying invested in high yield this holiday season. I also like the odds we will get to hear Andy Williams sing, “It’s the most wonderful time of the year.”

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.