A Market Full of Divergences

February 8, 2024

Much has been written about the amazing gains posted by the S&P 500 Index recently and, of course, the Magnificent Seven stocks that are fueling record gains. As a capitalization-weighted index, the largest capitalization stocks play an outsized role in terms of performance attribution. The larger the market caps of these companies become, the greater their impact on the moves of the index. The mega-cap technology names have certainly performed fundamentally well in terms of sales and earnings growth which has given them a more sustainable boost over the past few years. On the flip side of the equity market, the great majority of stocks are not performing nearly as well. For example, dividend yield stocks, as measured by the iShares Select Dividend ETF Index, gained a meager 1.16% in 2023, while the S&P 500 Index gained 26.29% — a truly staggering difference in returns.1

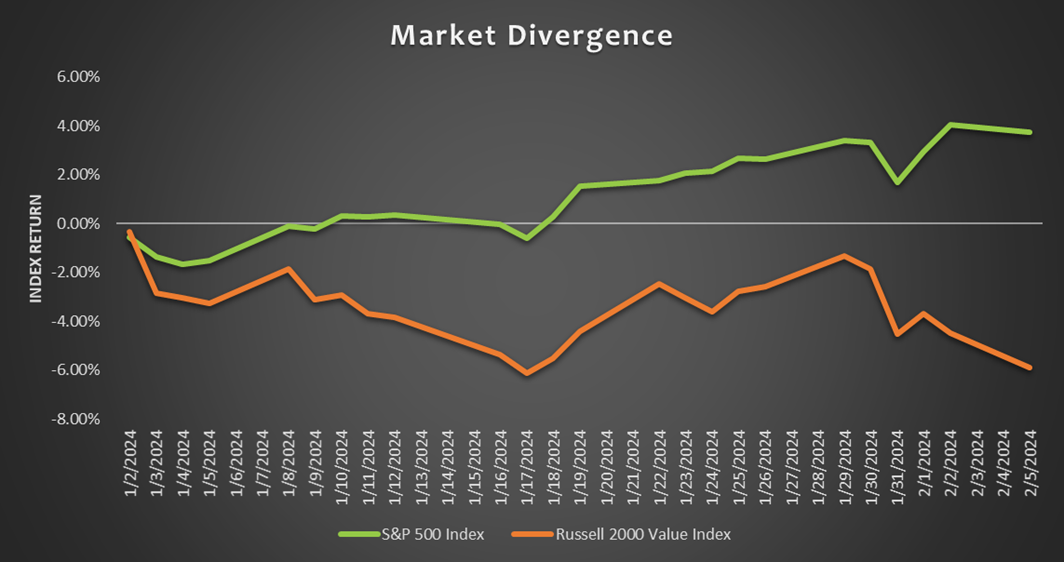

2024 is also starting no differently than last year in terms of eye-catching divergences. As seen in today’s Chart of the Week, the S&P 500 Index has continued its strong performance through the first five weeks of the year with a gain of roughly 3.7%. Meanwhile, another index I track closely, the Russell 2000 Value Index, has fallen by roughly 5.9%. This performance gap of 962 basis points in such a short period of time is remarkable and provides a better idea of how the average and smaller-sized companies are performing — at least in terms of how the market is treating them, if not fundamentally.

As investors, we recognize these divergent market periods can take time to resolve. The good news is we have experienced these periods before. Value investors, in particular, have taken it on the chin relative to growth investors the past few years just as they did a few decades ago. However, I believe this widening gap in performance is presenting opportunities to buy really solid companies at very cheap prices.

Key Takeaway

As dividend yield and all-capitalization investors, small cap and dividend yield stock performance gaps may lead our balanced income strategy to underperform the major indexes over shorter term periods. From a long-term perspective, I believe that these types of wide gaps in performance across the market-cap spectrum can provide some incredible opportunities for investment. As the saying goes, “Price is what you pay, value is what you get.” As long as our assessment of the inherent value of the underlying business is accurate and we pay a price for the stock that is discounted by the market, we can add to the portfolio’s total return as this value is appropriately recognized. This could take some time — in some cases, it could take years. But as a bottom-up stock picker with a long-term view, this approach tends to work very well over longer periods of time. To be able to endure near-term losses and be patient enough to wait is definitely not easy. May even look pretty foolish at times. Nonetheless, being anchored on solid investment tenets — companies with great balance sheets, solid fundamentals and operated by good management teams — can pay long-term “dividends” for years to come.

Source:

1Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.